Texas registration renewal notice next to a generic insurance card and car keys.

Texas Car Insurance Laws: Requirements, Penalties, and Compliance

Content

Register a vehicle in Texas? You're going to need liability insurance—not tomorrow, not next week, but before you turn the key. The Lone Star State tracks your coverage through real-time databases, catches violators during routine traffic stops, and blocks registration renewals the moment your policy lapses.

Here's what most drivers miss: even a single uninsured day can trigger fines, registration holds, and premium hikes that follow you for years. I've seen people lose their cars to impound lots over $50 in missed premium payments. Others discover—too late—that their "cheap" minimum coverage leaves them personally liable for $100,000 after a serious crash.

Texas operates on a fault system for auto accidents. Whoever causes the wreck pays for the damage through their insurance company. That's why carrying liability coverage isn't some bureaucratic suggestion—it's the law, whether you drive daily or once a month. Your plates connect you to this requirement the moment you complete registration.

Minimum Liability Coverage Required in Texas

You'll hear Texas requires "30/60/25" coverage. Those numbers break down into three separate dollar amounts (in thousands) that your policy must provide:

- $30,000 covering injuries to any one person

- $60,000 covering all injuries in a single accident

- $25,000 covering property you damage

| Coverage Component | Required Minimum | What Your Policy Pays For | Real-World Example |

| Per-person injury | $30,000 | Hospital bills, physical therapy, wage replacement, pain/suffering for one victim | Rear-end collision sends another driver to the ER with whiplash; treatment runs $22,000 across eight weeks |

| Per-accident injury | $60,000 | Combined medical expenses when you injure multiple people | T-bone crash at an intersection injures three occupants needing $55,000 total in care |

| Property damage | $25,000 | Vehicle repairs, fence replacement, building damage, etc. | You plow through a red light and total someone's $18,000 pickup |

That first number—$30,000 per person—sets the maximum any single injured party can claim. Say you cause a wreck that seriously injures one person. Their medical bills, lost work, and pain and suffering add up to $85,000. Your policy pays $30,000. You personally owe $55,000, and they can sue to collect every penny.

The $60,000 per-accident cap creates an even messier situation when multiple people get hurt. Imagine three passengers each sustaining $30,000 in damages. That's $90,000 in claims, but your policy maxes out at $60,000. Someone's going unpaid, and guess who they'll come after? The driver—meaning you.

Property damage seems straightforward until you realize how much vehicles cost now. A base-model family SUV easily hits $40,000. Your $25,000 in coverage pays for about half the replacement. The owner will pursue you for the remaining $15,000, possibly through court if you can't pay immediately.

Here's the kicker: these minimums protect everyone except you. Liability coverage sends money to the people you hurt and whose property you wreck. Your own hospital stay, your own smashed car, your own missed work—none of that gets covered under a minimum liability policy. You'd be shocked how many drivers think "I have insurance" means they're protected, then wind up with $50,000 in medical debt after causing their own accident.

Author: Brandon Whitaker;

Source: trialstribulations.net

How Texas Verifies Insurance: Proof Requirements and TexasSure

Texas runs TexasSure, a statewide electronic system that tracks insurance status for every single registered vehicle. Your insurance company reports directly to this database—when your policy starts, when it renews, when it cancels. County tax offices tap into TexasSure during registration renewals. No active policy showing in the system? Your renewal gets denied on the spot.

Police officers check TexasSure within seconds during traffic stops. You hand over your license; they type your information into their computer; the screen immediately displays whether your vehicle carries current coverage. Forgot your insurance card? The database still confirms you're legal. That said, carry proof anyway—computers crash, systems go offline, and you don't want to argue about technology with a skeptical officer.

Texas accepts several types of proof:

- Physical insurance card your company mailed you

- Digital card displayed through your insurer's mobile app

- Policy declaration showing your coverage dates

- Temporary binder from your agent (usually good for 30-60 days)

Yes, pulling up your insurance app during a traffic stop counts as valid proof. The legislature explicitly legalized electronic verification years ago. Some old-school officers still prefer paper, but state law backs you up completely.

Get pulled over without coverage? The officer writes you a citation on the spot—court date included. First offense fines start around $175, though they climb quickly. If you can't produce another licensed, insured driver to take your vehicle from the scene, the officer may impound it right there. You'll pay towing and storage fees before you ever see it again.

TexasSure runs automatic checks 30-45 days before your registration expires. When the system flags an uninsured vehicle, DPS mails you a warning letter demanding proof of coverage within 10 days. Ignore that letter, and your registration dies. You're now driving illegally even if you race out and buy insurance the next day—you'll need to pay reinstatement fees on top of regular renewal costs to fix it.

Penalties for Driving Without Insurance in Texas

Author: Brandon Whitaker;

Source: trialstribulations.net

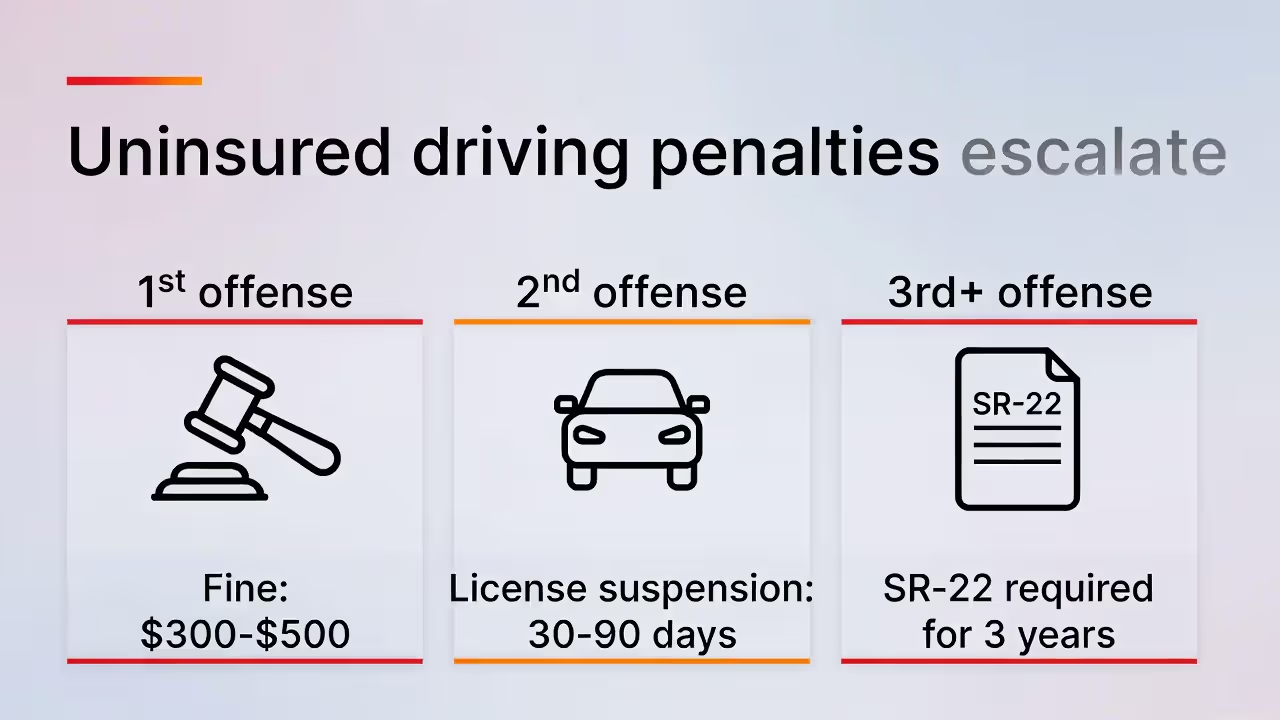

Texas classifies uninsured driving as a misdemeanor criminal offense. The penalties multiply with each violation, creating a cascade of problems that can haunt you for years.

| Violation Count | Fine Amount | What Happens to Your License | Extra Complications |

| First catch | $175–$350 | May suspend until you file proof | Possible impound; court fees add $100–$200 |

| Second catch | $350–$1,000 | Suspended until proof filed; $100 to reinstate | Must carry SR-22 for 24 months; premiums skyrocket |

| Third+ catch | $1,000 or more | Long-term suspension; potential criminal prosecution | Registration cancelled; insurers may refuse coverage |

Your first ticket usually costs $175 to $350 in fines plus court costs. Some judges cut you a break if you buy insurance before your court date and bring proof to the hearing. The fine might get reduced or dismissed, though the violation stays on your record regardless.

DPS suspends your license automatically once they receive notice of your citation. Your driving privileges stay suspended until you file proof of financial responsibility—often requiring an SR-22 certificate—and pay all reinstatement fees. During suspension, getting caught behind the wheel for any reason triggers fresh criminal charges. Even driving to the courthouse to handle your case can land you with a $500 fine and possible jail time.

SR-22 certificates verify you're carrying at least state-minimum coverage. Texas mandates them after specific violations, including uninsured driving convictions. Your insurance company files the SR-22 electronically with DPS. You'll pay a filing fee ($15–$50 typically) and watch your premiums explode. Insurers treat SR-22 drivers as high-risk customers, often doubling or tripling what you paid before. You must maintain uninterrupted coverage for two years. Let your policy lapse even one day, and the clock resets to zero—you start the two-year requirement all over again.

Impoundment happens when officers catch you driving without coverage. Towing charges start at $150–$300. Storage fees accumulate at $20–$50 daily. Let your car sit for two weeks, and you're looking at $500+ before the lot releases your vehicle. You'll need proof of insurance plus cash for all fees before they hand you the keys. Can't scrape together the money within 30 days? The impound lot auctions your car to recover their costs.

Rack up three or more uninsured driving convictions, and Texas may revoke your registration entirely. Your plates get cancelled, making it impossible to legally operate that vehicle until you complete a lengthy reinstatement process—back fees, continuous insurance for a specified period, possibly retaking your driving exam. Some drivers end up selling their cars because the reinstatement requirements become too expensive or complicated.

Texas doesn’t treat insurance lapses as minor paperwork issues — the system is automated, immediate, and unforgiving. Even a brief gap in coverage can trigger fines, license suspension, and long-term premium increases, making continuous compliance one of the smartest financial protections a driver can maintain.

— Robert Gaines, Texas Auto Insurance Compliance Advisor

Your Options When Hit by an Uninsured Driver in Texas

About one in eight Texas drivers runs around without insurance despite it being illegal. When one of them crashes into you, recovering your losses becomes an uphill battle.

Uninsured motorist coverage (UM) kicks in when the at-fault driver carries no insurance at all. Underinsured motorist coverage (UIM) applies when they have coverage, but their limits fall way short of your actual damages. Texas law says insurers must offer you UM and UIM coverage matching your liability limits, but you're allowed to decline it in writing. Lots of drivers reject this protection to save $50–$150 yearly. Then they get T-boned by someone with no insurance and immediately regret that decision.

When you carry UM/UIM coverage, your own insurance company compensates you as though the uninsured driver had proper coverage. You pay your deductible and file a claim for medical bills, lost wages, pain and suffering—everything up to your policy's limits. Your rates typically won't increase because the accident wasn't your fault.

Without UM/UIM coverage, you're stuck with limited, frustrating options:

Sue the at-fault driver in civil court. Win a judgment, then try collecting. Good luck with that. Someone who can't afford $75-a-month insurance probably doesn't have $40,000 in accessible assets. You can garnish wages, file property liens, and pursue other collection methods, but recovery often takes years and yields pennies on the dollar.

Tap your medical payments coverage (MedPay). This optional coverage pays your medical bills regardless of who caused the crash, typically up to $5,000 or $10,000. It won't replace your totaled car or cover lost income, but it keeps medical debt collectors off your back while you figure out next steps.

Apply to the Texas Crime Victims' Compensation Fund. If the uninsured driver fled the scene or committed a crime (like DUI) during the accident, you might qualify for state assistance. Maximum awards rarely exceed $50,000, and the application process drags on for months. Still, it's free money when you have few other options.

Use your health insurance. Your medical plan covers accident injuries, though you'll pay whatever deductibles and copays your policy requires. Health insurers sometimes try to recover their costs through subrogation—going after the at-fault party—but they rarely collect much from uninsured drivers.

Brutal truth time: crashes with uninsured drivers frequently leave victims eating huge costs. A $75,000 injury caused by someone with no insurance might yield only $10,000 after years of legal wrangling. Meanwhile, carrying UM/UIM coverage costs a fraction of that risk.

Beyond the Minimum: Additional Coverage Rules in Texas

Author: Brandon Whitaker;

Source: trialstribulations.net

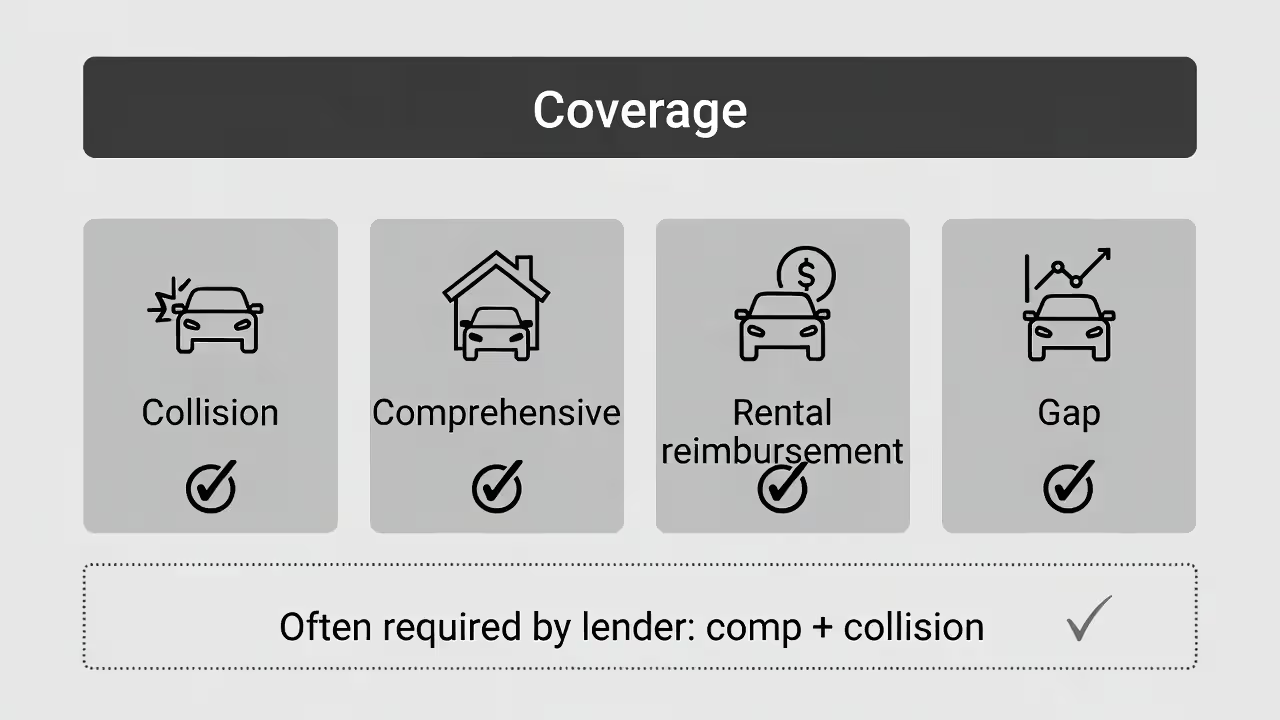

Texas doesn't force you to buy comprehensive coverage, collision coverage, rental reimbursement, or gap insurance. These protections remain optional unless a lienholder requires them in your loan agreement.

Comprehensive coverage handles non-crash damage: theft, vandalism, hail, flooding, fire, hitting a deer. Own your vehicle outright? The state doesn't care whether you buy comprehensive. Financing or leasing? Your lender absolutely requires it—count on that.

Collision coverage fixes or replaces your vehicle after accidents regardless of who caused them. Basic liability policies leave you stranded when you total your own car. Collision costs more than comprehensive because fender-benders happen far more often than car theft or tornado damage.

Rental reimbursement covers rental car costs while your vehicle sits in the shop after a covered incident. Policies typically pay $30–$50 daily up to a maximum number of days (often 30). Skip this coverage, and you're either paying Enterprise out-of-pocket or bumming rides for two weeks.

Gap insurance covers the difference between your car's actual cash value and your remaining loan balance. New cars depreciate fast—you might owe $28,000 on a vehicle worth only $22,000 after you total it. Gap coverage pays that $6,000 difference so you're not making payments on a car sitting in a salvage yard.

Lienholders spell out their coverage requirements in your loan paperwork. Most demand comprehensive and collision with deductibles capped at $500 or $1,000. Many require gap insurance on new vehicles. Fail to maintain these coverages, and the lender will buy "force-placed insurance" on your behalf—outrageously expensive policies they'll charge to your loan, often costing double or triple what you'd pay yourself.

Here's where common sense enters the equation. That 2013 sedan worth $4,000? Paying $900 yearly for comprehensive and collision makes little financial sense. Total the car, and you'll receive roughly $4,000 minus your deductible—barely more than four years of premium payments. Older, paid-off vehicles often justify liability-only coverage. Bank the premium savings toward your next car.

Common Violations and How to Regain Compliance

Author: Brandon Whitaker;

Source: trialstribulations.net

Coverage lapses create instant legal exposure. Texas offers zero grace period—the second your policy cancels, you're breaking the law.

Common reasons policies lapse:

- Missed payment due to insufficient funds

- Credit card expiration or bank account closure

- Insurer cancellation for non-payment

- Switching carriers with gaps between effective dates

- Moving out of state without updating your policy

Insurance companies report cancellations to TexasSure within 48 hours. DPS responds by mailing a notice demanding proof of insurance within 10 days. Blow off that notice, and your registration gets suspended. Those plates become invalid until you file proof and pay reinstatement fees.

Steps to fix a lapse:

- Buy new coverage immediately. Call an agent, go online, do whatever gets you a policy meeting state minimums—today, not next week.

- Request SR-22 filing if DPS requires it. Your insurer submits this electronically, usually within one business day.

- Pay reinstatement fees. First lapse runs $175–$350. Subsequent lapses cost more and may trigger mandatory SR-22 requirements.

- Confirm TexasSure updates. Check the Texas DMV website to verify your vehicle shows active coverage before driving anywhere.

- Maintain continuous coverage for at least two years if you're carrying an SR-22. Any lapse—even one day—resets the entire two-year period and may trigger immediate license suspension.

Registration problems compound insurance violations. Let your registration expire while uninsured, and you face separate penalties for expired plates. Renewing registration requires current insurance proof, so you must fix the insurance problem before handling the registration issue.

Preventing future lapses means setting up autopay and actually monitoring your bank balance. Set calendar reminders two weeks before renewal dates. Many insurers offer mobile apps with push notifications for upcoming due dates—turn those on.

Some drivers game the system by letting coverage lapse between the rare times they drive, thinking they'll save money. This backfires spectacularly. Continuous coverage history affects your rates. Gaps signal irresponsibility to insurers, who respond with premium increases. You'll pay more over time than you saved during lapses. Plus, you're one emergency grocery run away from a citation and possible impoundment.

Frequently Asked Questions About Texas Auto Insurance Laws

Texas car insurance laws protect everyone sharing the road from catastrophic financial losses after serious accidents. The 30/60/25 minimum liability requirement establishes a baseline, though many drivers benefit from higher limits given modern medical costs and vehicle prices. TexasSure's automated tracking eliminates any hope of flying under the radar—the system knows your coverage status before any officer approaches your window.

Non-compliance penalties create a self-reinforcing trap: fines stack up, licenses get suspended, SR-22 requirements kick in, vehicles get impounded, and premium increases haunt you for years. The monthly cost of minimum liability insurance—typically $40–$80—looks like pocket change compared to these cascading consequences. Even if you're the world's safest driver, you can't control the person texting through a red light. Uninsured motorist coverage and higher liability limits shield you from scenarios minimum coverage won't touch.

Regaining compliance after a lapse demands immediate action. Every day you wait multiplies the administrative hassles and financial penalties. Set up automatic payments, track your policy status through your insurer's app, and tackle payment problems before they escalate to cancellations.

Understanding these rules transforms insurance from an annoying legal requirement into a practical financial shield protecting your assets, your license, and your ability to get to work tomorrow. The drivers who navigate this system best aren't necessarily the ones who never mess up—they're the ones who understand exactly what the law demands and maintain continuous compliance without interruption.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.