Michigan auto insurance card and registration on a desk next to a phone showing a claim confirmation.

Michigan No Fault Insurance: How It Works and What Drivers Must Know

Content

Most Americans deal with auto insurance one way—someone causes a crash, that person's insurance pays. Michigan? We've been doing something completely different for over 50 years. Here's what makes driving in Michigan unique: after a collision, you don't chase down the other driver's insurer. Instead, your own policy covers your medical bills, no matter who was texting or ran that red light. Sounds simple, right? It's not—especially after 2019's massive overhaul that gave drivers coverage options for the first time in decades.

How Michigan's No Fault Insurance System Differs From Other States

Picture this: you're rear-ended at a stoplight. In Ohio or Indiana, you'd file a claim against the other driver's insurance and wait while they investigate, verify fault, argue about liability. In Michigan? You call your own insurance company that afternoon, and they start paying your medical bills within days. That's Michigan no fault insurance in action.

This approach cuts out the legal wrestling match that bogs down claims in most states. Your insurer handles your medical expenses, replaces your lost wages (up to 85% for three years), pays for someone to mow your lawn or cook meals if you're laid up, and covers transportation to doctor appointments. The fault question matters for property damage and lawsuits, but not for getting your injuries treated.

Now, about lawsuits—you can't just sue someone for bumping you in a parking lot and claiming whiplash. Michigan law sets a high bar. Legal action against another driver requires one of three things: someone died, someone suffered what the courts call "serious impairment of body function" (think broken bones, torn ligaments, injuries that genuinely disrupt your normal life for a substantial period), or permanent serious disfigurement (significant scarring, burns, or visible deformity). Minor pain and suffering? Not enough. This threshold keeps insurance costs from exploding with lawsuits over every fender bender.

Property damage operates on traditional fault principles. Scratch someone's BMW? Their insurance comes after yours. This hybrid model—no-fault for injuries, fault-based for vehicle damage—creates confusion when drivers assume their own collision coverage handles everything. It doesn't. You'll file two separate claims after most accidents: one with your insurer for medical, one against the other driver's policy for property damage.

For decades, Michigan stood alone requiring lifetime medical coverage with zero dollar limits. Paralyzed in a crash at 25? Your insurance covered round-the-clock care until you turned 90. Traumatic brain injury needing millions in therapy? Covered. This guarantee protected catastrophic injury victims unlike anywhere else in America, but it also pushed Michigan premiums to painful heights—Detroit residents sometimes paid $500 monthly for basic coverage while Ohio neighbors paid $80.

Author: Tara Livingston;

Source: trialstribulations.net

PIP Coverage Options: Understanding Your Choices After the 2019 Reform

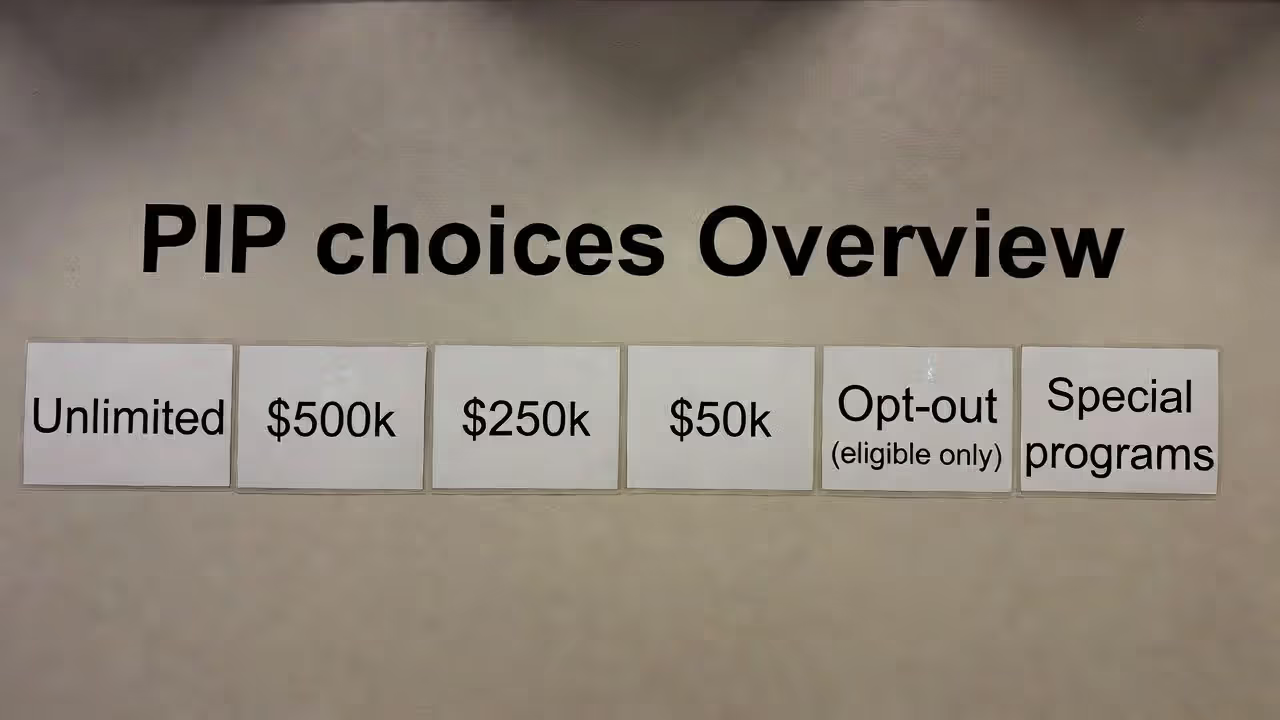

June 2020 changed everything. Michigan went from one mandatory coverage level to six distinct choices. Suddenly, drivers faced decisions most had never considered: How much medical coverage do I actually need?

Unlimited PIP Coverage vs. Limited Options

Unlimited coverage still exists—everything works exactly like before 2019. Catastrophic injury tomorrow? Your insurance keeps paying for medical care, attendant services, rehabilitation, and equipment for the rest of your life. Zero caps. Zero lifetime limits. It's the gold standard for protection but costs significantly more than alternatives.

The limited tiers—$500,000, $250,000, and $50,000—slice your premiums but cap your benefits. Here's what that means in practice: say you suffer severe burns requiring multiple skin grafts, reconstructive surgeries, physical therapy, psychological counseling, and scar treatment. You could hit $250,000 within two years of intensive care. A spinal cord injury? You'll blow through $500,000 before your third anniversary in a wheelchair, especially factoring in home modifications, attendant care, and specialized equipment.

What happens when you max out? You're on your own—well, you and your health insurance if you have it. But here's the problem: health insurance never agreed to replace auto coverage. Your health plan has deductibles (PIP doesn't), copays (PIP doesn't), coverage exclusions (PIP has few), and limited rehabilitation benefits (PIP provides extensive rehab). Plus, health insurance won't replace your wages or pay your nephew to shovel your driveway because you can't lift your arm anymore. PIP does both.

Who Qualifies for PIP Opt-Out

Complete opt-out sounds tempting—why pay for coverage you'll probably never use? Michigan allows it, but the eligibility rules have teeth. First requirement: you need health insurance that explicitly covers auto accident injuries. Some policies exclude them. Second: every licensed driver in your household must qualify and consent to opt out in writing. Your college kid home for summer? They need qualifying health coverage too. Third: your vehicle can't have a lien. Banks and credit unions lending money for your car want PIP protection for their collateral.

Even meeting these requirements, opting out carries risks. Some health insurers have denied claims for auto injuries, arguing no-fault insurance should pay. Legal battles ensued, leaving injured people stuck between two insurers pointing fingers at each other. Court decisions have mostly sided with injured parties, but who wants to litigate while recovering from broken ribs?

Medicare and Medicaid recipients get special treatment—they can choose a $250,000 option at discounted premiums. The logic? Government health programs provide backup coverage, reducing (but not eliminating) the risk of hitting coverage limits. Medicare covers many medical services but often caps rehabilitation therapy visits and rarely covers long-term attendant care that catastrophically injured people need. Medicaid's better for long-term care but comes with its own maze of restrictions.

Coordination of benefits creates its own headaches. You carry health insurance and $100,000 PIP—which pays first after an accident? PIP does. It's primary for auto injuries until exhausted. Then health insurance kicks in. Sounds straightforward until you read your health policy's fine print excluding services PIP would've covered, or discover your health insurer applies different medical necessity standards than your auto insurer used.

What Michigan Reform Laws Changed for Drivers

Author: Tara Livingston;

Source: trialstribulations.net

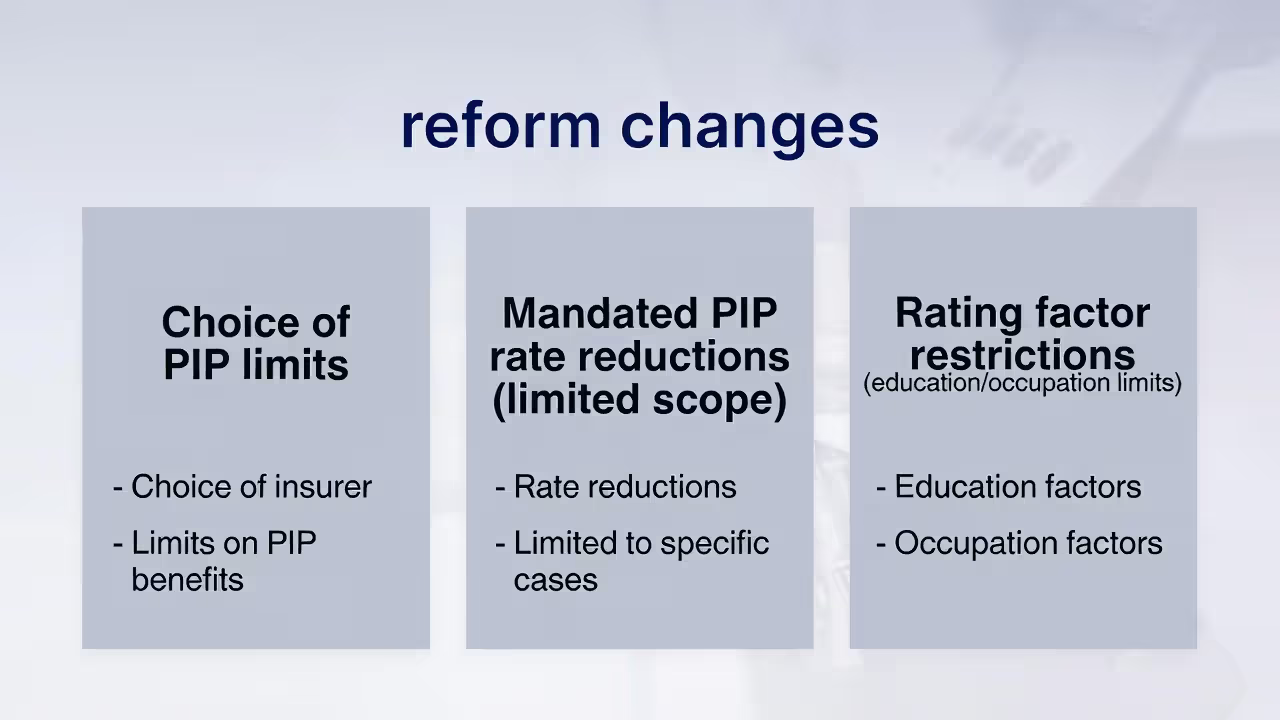

Politicians promised the 2019 reforms would slash premiums while maintaining adequate protection. They delivered half that promise.

Creating coverage options was reform's centerpiece. Before 2019, every Michigan driver—whether they wanted it or not—paid for unlimited lifetime medical coverage. A 22-year-old with excellent health insurance paid the same PIP premium as a 65-year-old with Medicare. The new law introduced choice: keep unlimited and pay full price, or scale back coverage and pocket the savings. This flexibility addressed decades of complaints, particularly from Detroiters paying more for insurance than for their cars.

Insurers faced mandated rate cuts for customers maintaining unlimited coverage—8% initially, with additional reductions following. But here's the catch: those cuts applied only to PIP portions of premiums. Your liability coverage, collision, comprehensive? No mandated decreases there. Since PIP typically represents 40-60% of your total premium, an 8% PIP cut translated to maybe 4% off your total bill. Better than nothing, but not the dramatic relief some expected.

The Michigan Catastrophic Claims Association fee got a complete makeover. Every driver previously paid this fee (it hit $220 per vehicle in 2019) to fund the MCCA—essentially a reinsurer that pays claims exceeding $580,000. The reform tied MCCA fees to coverage selections. Pick unlimited? You pay the full fee. Choose $250,000? Pay a reduced fee. Select $50,000 or opt out? Pay nothing.

That MCCA fee dropped to $100 in 2020, and many drivers celebrated big savings. Then reality set in. The fee climbed to $122 in 2021, $151 by 2024 for unlimited coverage. Why? The MCCA adjusted fees based on investment returns and claim projections. Lower investment earnings meant higher fees. That initial drop created false expectations about long-term savings.

Reforms also tackled rate discrimination. Insurers could no longer use your education level, occupation (with exceptions), or give as much weight to credit scores when calculating premiums. The goal was equity—stop charging teachers more than engineers, or penalizing people with past financial troubles. Insurers still use territory, driving record, vehicle type, and age, giving them plenty of rating variables.

Fee schedules for medical providers sparked intense controversy. The law capped what doctors, hospitals, and rehab facilities could charge auto insurers—typically 200% of Medicare rates for most services. Providers claimed these caps didn't cover their costs, particularly for specialized auto injury care. Some refused to accept no-fault patients. Legal challenges continue, with medical associations arguing the caps violate constitutional protections.

How Your Coverage Choice Impacts Your Premium

Author: Tara Livingston;

Source: trialstribulations.net

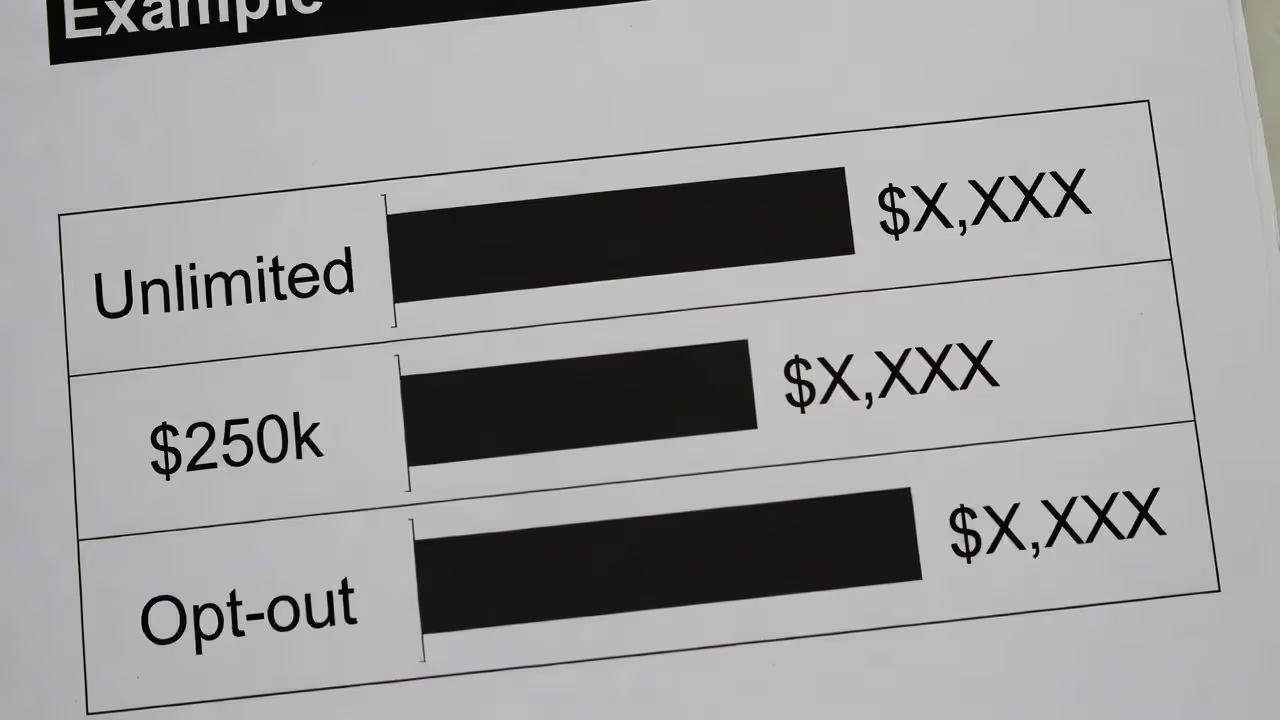

Your PIP selection creates the biggest premium swing you'll see from any single factor. Real-world example: a 35-year-old Detroit driver with a clean record insuring a 2020 Honda Accord might pay $2,800 annually with unlimited PIP. Drop to $250,000 coverage? That same driver might pay $1,750—a $1,050 difference. Switch to opt-out? Could drop to $1,400. Same driver, same car, same record—just different medical coverage.

The MCCA fee explains part of this gap. For 2024, unlimited coverage carries a $151 per vehicle fee. Choose $500,000 coverage, pay $60. Pick $250,000, pay $40. Select $50,000 or opt out, pay zero. That fee appears as a separate line on your policy, though insurers often bundle it into your total premium for payment purposes.

Geography compounds these differences. Detroit ZIP codes have historically been insurance nightmares—accident frequency, theft rates, medical costs, and fraud all run higher than outstate areas. A Kalamazoo driver might pay $1,200 for unlimited coverage while someone in Detroit pays $3,500 for identical protection. When the Kalamazoo driver drops to $100,000 coverage and saves $300, that same coverage reduction saves the Detroit driver $900. The higher your base premium, the more reduction strategies save.

Age and driving record multiply these coverage effects. A 19-year-old male in Grand Rapids with a speeding ticket faces steep premiums regardless—maybe $4,500 with unlimited PIP. That same teenager with $50,000 coverage might pay $2,600. The $1,900 difference represents massive savings for a young driver already stretched thin. But consider the trade-off: young drivers have decades ahead where catastrophic injury could occur, making low coverage especially risky.

Vehicle value plays a smaller role for PIP than collision coverage. Whether you drive a 2015 Civic or a 2024 Tesla, your injury risk remains similar, so PIP costs don't vary dramatically by vehicle. However, expensive cars cost more to repair, pushing up collision and comprehensive portions of your premium regardless of PIP choices. On a luxury vehicle, PIP might represent 35% of your total premium; on an older economy car, PIP might hit 65% of your costs.

Michigan’s no-fault reform shifted real financial risk onto drivers. Choosing lower PIP limits may reduce premiums today, but it also caps lifetime medical protection in a state where catastrophic injuries can cost millions. Understanding that trade-off is essential before selecting anything less than unlimited coverage.

— Andrew Collins, Michigan Auto Insurance Policy Analyst

Stack up the discounts—safe driver, multi-vehicle, bundling with homeowners, good student—and they trim premiums nicely. But they apply after base calculations. Think of PIP coverage as your foundation: choose unlimited, build on an expensive foundation; choose $50,000, build on a cheap one. Discounts then reduce from there.

Comparing Michigan PIP Coverage Levels: Costs and Risks

| Coverage Level | Maximum Benefit | Eligibility Requirements | Estimated Premium Impact | Risk Level |

| Unlimited | Medical expenses, wage replacement, and attendant care continue for life with no dollar cap | Any Michigan driver can select this option | Most expensive choice; includes full MCCA assessment at $151 annually per vehicle | Maximum protection; covers all catastrophic injury scenarios without exposing policyholder to financial gaps |

| $500,000 | Benefits stop once claims reach half a million dollars per person per accident | Available to any driver regardless of health insurance status | Typically 15-25% less expensive compared with unlimited; reduced MCCA fee | Moderate exposure; serious injuries involving extended hospitalization, multiple surgeries, or long-term care can exceed this threshold within 2-4 years |

| $250,000 | Coverage terminates after paying $250,000 per individual injured in a single accident | No restrictions; any driver qualifies | Usually 25-35% cheaper than unlimited; further reduced MCCA assessment | Considerable vulnerability; many significant injuries requiring ongoing rehabilitation or home care will surpass this amount |

| $250,000 (Medicaid) | Quarter-million cap with Medicaid providing secondary coverage layer | Policyholder and all household drivers must maintain active Medicaid enrollment | Approximately 35-45% below unlimited premiums due to government health coverage backup | Moderate risk profile; Medicaid fills some gaps but imposes strict provider networks and service limitations |

| $50,000 | Pays only first $50,000 of medical bills, wage loss, and related expenses | Open to all drivers without qualification requirements | Delivers 35-50% savings versus unlimited; no MCCA fee required | Substantial exposure; even moderately serious injuries frequently generate six-figure costs, leaving policyholder financially responsible for balance |

| Opt-Out | Zero PIP benefits; policyholder relies entirely on health insurance | Must prove qualifying health coverage; every household driver must agree and qualify; vehicle cannot secure a loan | Steepest discount at 45-55% under unlimited; completely eliminates MCCA fee | Maximum financial vulnerability; health insurance denies many services PIP covers, provides no wage loss, excludes attendant care and replacement services |

This comparison exposes the direct trade-off: pay more for protection or save money and gamble. A single parent working retail with two kids can't afford coverage gaps if injured. A retired couple with robust Medicare supplements and adult children faces different math. Your age, family situation, health coverage quality, and financial reserves should drive this decision more than premium cost.

Rules and Requirements Every Michigan Driver Should Follow

Author: Tara Livingston;

Source: trialstribulations.net

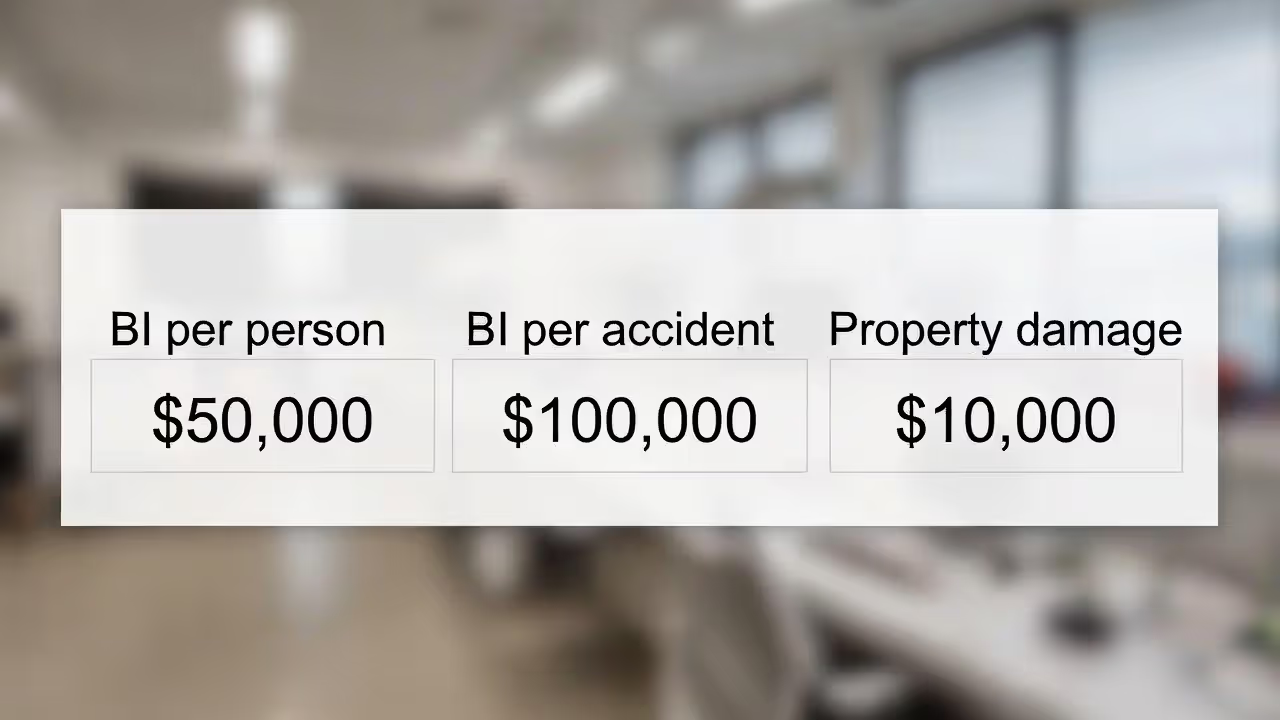

Michigan mandates minimum liability coverage protecting others when you cause accidents. Current minimums: $50,000 for injury to one person, $100,000 if multiple people are hurt, and $10,000 for property damage. These requirements exist separately from PIP, and every driver must carry them regardless of which PIP option they choose.

Keep insurance proof accessible—your vehicle, your phone, wherever works. Police request it during traffic stops, at accident scenes, whenever you're pulled over. Michigan runs electronic verification allowing officers to confirm active coverage instantly through their cruiser computers, but you'll still want backup proof. Screenshot your insurance card or carry paper copies. Getting cited for no proof of insurance costs time and money even when you're actually covered.

Drive uninsured? Brace for consequences. First offense brings fines up to $500, immediate license suspension, and registration suspension for your vehicle. You can't get that license back until you secure insurance and pay $125 in reinstatement fees. Get caught a second time within seven years? Fines double to $1,000, reinstatement fees jump to $250, and the state might immobilize your car. Cause an accident while uninsured? You're personally liable for every dollar of damage and injury costs—lawsuits can garnish wages and seize assets for years.

File claims fast. Michigan gives you exactly one year from the accident date to submit a PIP claim for medical expenses and related benefits. Miss that deadline by even one day? You've forfeited your rights to benefits permanently, even if you're still receiving treatment for injuries discovered later. Property damage claims against other drivers have a three-year statute of limitations, but don't wait—evidence disappears, witnesses forget details, and insurers get suspicious about delayed reporting.

Coordination of benefits rules determine which policy pays when multiple options exist. Riding as a passenger in your friend's car when they crash? Your friend's insurance provides your PIP coverage. Hit by a car while walking across a street? Your own auto insurance covers you even though you weren't in a vehicle. Living with your parents and getting injured in your mom's car? You can claim under any vehicle policy in the household—yours, hers, or your dad's truck policy.

Notify insurers immediately after any accident. Most policies require "prompt" or "timely" notice, courts usually interpret that as days, not weeks. Waiting a month to report a crash? Your insurer might deny the claim arguing delayed reporting hampered their investigation. Take photos at the scene, swap information with other drivers, write down witness names, then call your insurance company that same day. Report even minor accidents—seemingly small impacts can cause injuries that surface days later.

Choose your medical providers freely. Michigan law doesn't require pre-authorization for most treatments, so you can visit whichever doctor or facility makes sense for your injuries. But insurers can dispute whether treatment was reasonable and necessary after the fact, potentially refusing payment for services they consider excessive, experimental, or unrelated to accident injuries. Fee schedules now limit what providers can charge for many services, reducing costs but also creating payment disputes between insurers and medical facilities.

Common Questions About Michigan No Fault Insurance

Michigan no fault insurance remains one of America's most unusual auto insurance systems, combining mandatory personal injury protection with expanded coverage choices introduced just a few years ago. The 2019 reforms transferred risk from insurance companies to drivers who select limited coverage, making your PIP decision more consequential than ever. That choice should reflect your complete financial picture—health insurance quality, emergency savings, family obligations, and stomach for risk—not just which option costs least each month. What works for a single 60-year-old with comprehensive health benefits might be disastrous for a 30-year-old supporting three kids on modest income. Review your coverage annually, especially when major life changes occur (marriage, children, retirement, job changes, health insurance switches), and consult an insurance professional who can model how different injury scenarios would affect you specifically under each coverage tier. Understanding Michigan's framework, recognizing what reforms actually changed versus what stayed the same, and honestly assessing your risk tolerance helps you make informed decisions balancing affordability against protection.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.