New York Car Insurance Requirements: Minimum Coverage and State Laws

Content

New York operates under one of the strictest auto insurance enforcement systems in the country. The state's Department of Motor Vehicles maintains a real-time database tracking every registered vehicle's insurance status, and a single day without coverage can trigger automatic penalties. Whether you're buying your first car, moving from another state, or simply renewing your registration, understanding exactly what New York mandates—and why the minimums might leave you financially exposed—matters more than you think.

What Auto Insurance Does New York Legally Require?

New York law requires three distinct types of coverage before you can legally register and operate a vehicle: liability insurance, Personal Injury Protection (PIP), and uninsured motorist coverage. These aren't optional add-ons; they form the foundation of every policy sold in the state.

Liability insurance pays for injuries and property damage you cause to others in an accident. If you rear-end someone at a stoplight and they need medical care or their car requires repairs, your liability coverage handles those costs up to your policy limits. Without it, you'd pay out of pocket—potentially tens or hundreds of thousands of dollars.

Personal Injury Protection covers your own medical expenses and certain other costs regardless of who caused the crash. New York's no-fault system means your PIP pays first when you're injured, before any liability claims get sorted out. This speeds up payment for medical bills and lost wages without waiting for fault determinations.

Uninsured motorist coverage protects you when someone without insurance (or without enough insurance) injures you. Despite New York's strict enforcement, roughly 6% of drivers still operate without coverage. When one of them causes a serious accident, your uninsured motorist protection becomes the only buffer between you and massive medical bills.

Author: Tara Livingston;

Source: trialstribulations.net

All three coverages must remain active continuously. The moment your policy lapses—even if you're not driving the car—New York's system flags your registration and begins the penalty process.

Understanding NY Liability Limits: Minimum vs. Recommended Coverage

New York's mandatory liability minimums follow the 25/50/10 structure, which translates to specific dollar amounts that define how much your insurer will pay per accident. These numbers appear on every policy's declarations page and determine whether your coverage will actually protect your assets in a serious crash.

Bodily Injury Liability Explained

The first two numbers address injuries to other people. New York requires $25,000 per person and $50,000 per accident in bodily injury liability. If you cause a crash that injures one person, your policy pays up to $25,000 for their medical bills, lost income, pain and suffering, and other damages. If you injure multiple people, the total payout caps at $50,000 regardless of how many victims need compensation.

These limits create real problems in moderate-to-severe accidents. A broken leg with surgery easily exceeds $25,000 once you factor in emergency room care, orthopedic procedures, physical therapy, and lost wages during recovery. Rear-end a vehicle with three passengers, and $50,000 splits among their claims—potentially $16,000 each before you're personally liable for the remainder.

Most insurance professionals recommend 100/300 bodily injury limits ($100,000 per person, $300,000 per accident) as a more realistic baseline. The cost difference between minimum and recommended coverage typically runs $15–$30 monthly, a small price compared to the financial devastation of a lawsuit that exceeds your limits.

Property Damage Liability Explained

The third number—$10,000—covers damage you cause to other people's property, primarily their vehicles but also fences, buildings, or utility poles you might strike. Ten thousand dollars sounds adequate until you realize the average new car price in 2024 hovers around $48,000. Total a late-model SUV or pickup truck, and you'll personally owe the difference between $10,000 and the vehicle's actual value.

Property damage claims also include rental car costs while the other driver's vehicle is being repaired, towing and storage fees, and diminished value claims. A seemingly straightforward accident can balloon beyond $10,000 faster than most drivers expect.

Increasing property damage coverage to $50,000 or $100,000 costs surprisingly little—often $5–$10 monthly—because property claims, while common, rarely reach catastrophic amounts the way injury claims do.

| Coverage Component | New York Minimum | Recommended Amount | What It Covers |

| Bodily Injury (per person) | $25,000 | $100,000–$250,000 | Medical bills, lost wages, pain/suffering for one injured person |

| Bodily Injury (per accident) | $50,000 | $300,000–$500,000 | Total payout for all injured people in a single accident |

| Property Damage | $10,000 | $50,000–$100,000 | Repairs to vehicles, buildings, and other property you damage |

Personal Injury Protection (PIP) Rules in New York

Author: Tara Livingston;

Source: trialstribulations.net

New York's no-fault insurance system centers on PIP, which must provide at least $50,000 in coverage per person. Unlike liability insurance that pays others, PIP pays your own expenses regardless of fault. This creates faster claim resolution and reduces litigation, though it also adds complexity to how policies work.

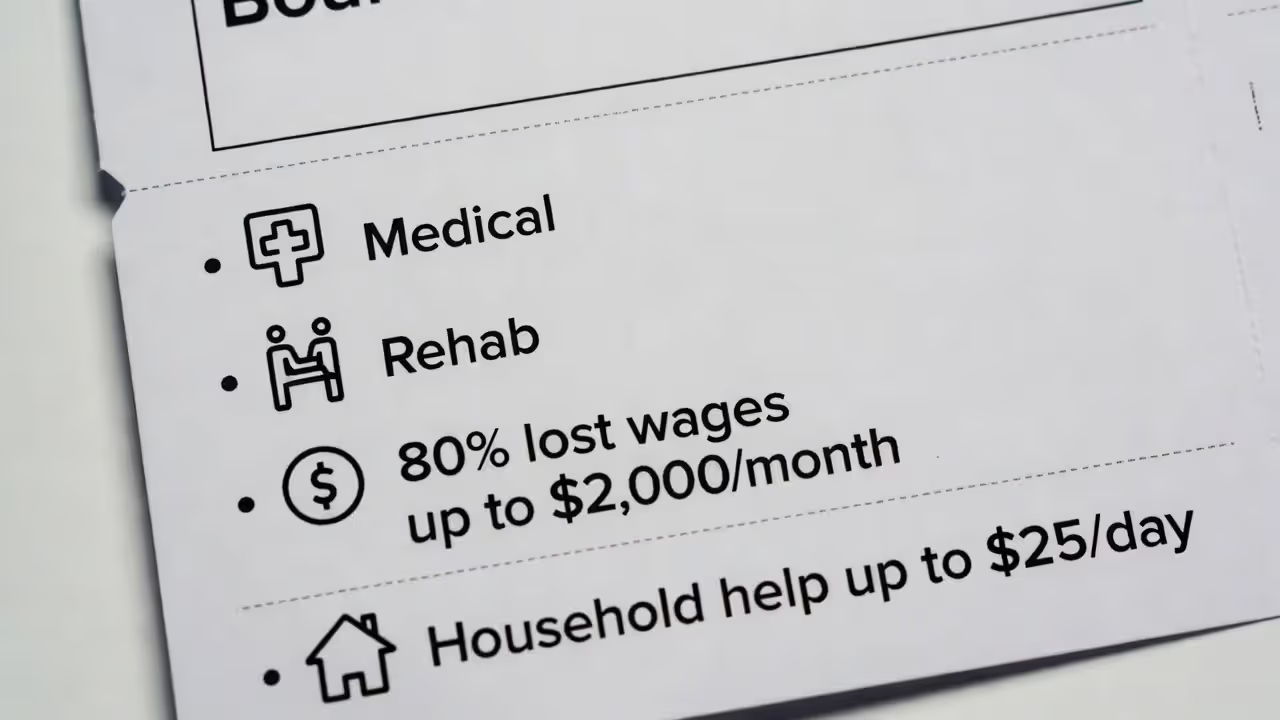

PIP covers medical and rehabilitation expenses for injuries sustained in auto accidents, including hospital stays, surgery, physical therapy, chiropractic care, and necessary medical equipment. It also reimburses 80% of lost earnings up to $2,000 per month for up to three years if your injuries prevent you from working. A lesser-known benefit: PIP includes up to $25 per day for other necessary expenses like hiring help for household tasks you can't perform while recovering.

The coverage extends to you as the named insured, relatives living in your household, passengers in your vehicle, and pedestrians struck by your car. If your teenage son borrows your car and gets injured in a crash he caused, your PIP still pays his medical bills. If you're walking across a parking lot and get hit by someone else's vehicle, that driver's PIP covers you.

New York law requires insurers to offer optional additional PIP (APIP) coverage beyond the $50,000 basic limit. You can purchase this in increments, though most drivers decline it assuming $50,000 will suffice. For serious injuries requiring extended hospitalization or multiple surgeries, that assumption proves wrong. A spinal injury, traumatic brain injury, or multiple fractures can exhaust $50,000 within weeks of treatment.

PIP includes a coordination of benefits provision when you have health insurance. Your auto PIP pays first, then your health insurance covers expenses exceeding the PIP limit. This prevents double payment but also means your health insurance deductible and copays still apply to accident-related treatment once PIP exhausts.

New York’s insurance system is unforgiving when it comes to coverage gaps. With real-time DMV monitoring and automatic penalties, even a short lapse can trigger serious financial and legal consequences. Drivers should treat minimum limits as a starting point — not a safeguard against real-world accident costs.

— Alicia Morgan, New York Auto Insurance Compliance Specialist

How Insurance Connects to Vehicle Registration in NY

New York ties insurance status directly to vehicle registration through the Insurance Information and Enforcement System (IIES), a database that tracks coverage for every registered vehicle in real time. When you register a car, the DMV requires proof of insurance before issuing plates. Your insurer electronically reports your policy information to the state, creating a digital link between your registration and coverage.

The FS-20 form serves as physical proof of insurance. Insurers must provide this form—not just an insurance card—when you purchase or renew a policy. The FS-20 includes your policy number, coverage dates, and vehicle identification number. You'll need it when registering a vehicle, renewing registration, or responding to DMV inquiries about your insurance status.

This system operates continuously, not just at registration time. If your insurance company cancels your policy or you switch insurers with a gap in coverage, they notify the DMV electronically within days. The DMV then sends you a Notice of Pending Registration Suspension, giving you a short window to restore coverage or face automatic suspension.

Many New York drivers mistakenly believe they can drop insurance during winter months when storing a vehicle or after parking a car they're not currently driving. The law disagrees. As long as your vehicle remains registered, insurance must stay active. The only way to legally drop coverage is to surrender your registration and plates to the DMV, a process that requires physically returning the plates or completing a Statement of Transaction form.

When buying a used car from a private seller, the insurance-registration connection creates a specific sequence you must follow. You need insurance before the DMV will transfer registration to your name, but insurers need the vehicle identification number and proof of ownership to issue a policy. Bring the title and bill of sale to your insurance agent first, get the FS-20, then complete the registration transfer at DMV.

Penalties for Driving Without Insurance in New York

Author: Tara Livingston;

Source: trialstribulations.net

New York imposes some of the nation's harshest penalties for operating or owning an uninsured vehicle. The consequences stack quickly, affecting both your wallet and your ability to legally drive.

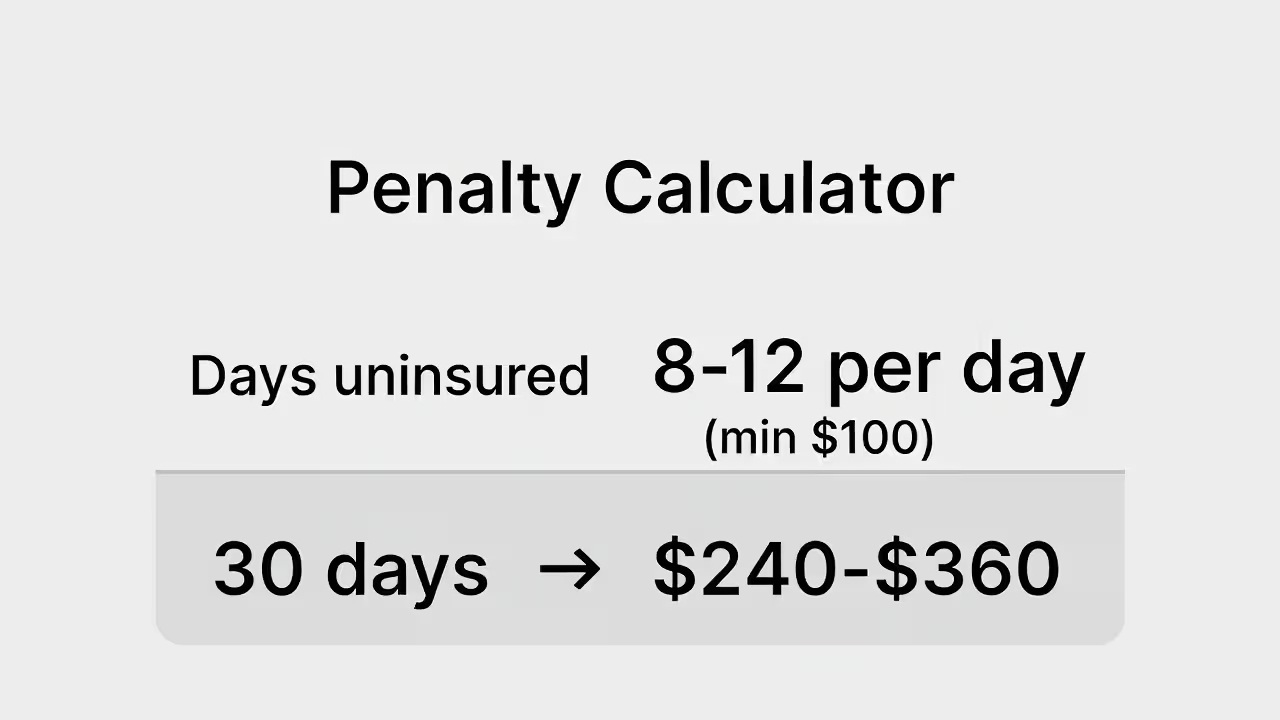

The DMV assesses a civil penalty between $8 and $12 per day for every day your registration remains active without insurance, with a minimum fine of $100. A 30-day lapse costs $240–$360 in civil penalties alone. These penalties arrive by mail as a Notice of Registration Suspension and must be paid before you can restore your registration, even if you've since obtained insurance.

Your driver's license gets suspended automatically once the DMV confirms your vehicle lacked insurance while registered. Restoring your license requires paying a $50 suspension termination fee on top of the per-day civil penalties. You'll also need to file proof of current insurance and may need to pay any outstanding registration fees.

If police catch you driving without insurance, the penalties escalate dramatically. First offense: $150–$1,500 fine plus mandatory $250 annual assessment for three years (the Driver Responsibility Assessment). Second offense within 36 months: $750–$1,500 fine plus another three-year assessment. The court may also suspend your license for up to one year and potentially impound your vehicle.

These criminal penalties apply separately from the DMV's civil penalties, meaning you could pay both the per-day fine for having an uninsured registered vehicle and the criminal fine for driving it. A single lapse can easily cost $2,000–$3,000 once you add civil penalties, criminal fines, suspension fees, and the three-year assessment.

New York doesn't use the SR-22 certificate common in other states, but after certain violations, the DMV may require you to maintain higher liability limits (100/300/50) for three years and have your insurer file periodic proof of continuous coverage. This requirement typically applies to DWI convictions and repeated insurance lapses.

The penalties don't disappear if you move out of state. New York participates in interstate driver's license compacts, meaning your license suspension follows you. Most states won't issue you a new license until you resolve the New York suspension, requiring you to pay all outstanding penalties and fees regardless of where you currently live.

Common Mistakes New York Drivers Make With Coverage

Author: Tara Livingston;

Source: trialstribulations.net

Letting policies lapse accidentally ranks as the most expensive mistake. Many drivers switch insurers to save money but miscalculate the effective dates, creating a one- or two-day gap between policies. That brief lapse triggers the entire penalty structure—civil fines, license suspension, and registration suspension—despite the driver never intending to go uninsured. Always overlap coverage by at least a day when switching insurers, and confirm your old policy doesn't cancel until the new one activates.

Choosing minimum coverage only makes financial sense for drivers with no assets to protect. If you own a home, have retirement savings, or earn a substantial income, the minimum 25/50/10 limits expose you to devastating liability. A serious accident can trigger lawsuits that pierce your policy limits and target your personal assets. The $20–$40 monthly cost to increase coverage to 100/300/50 or higher provides enormous protection relative to the premium difference.

Many drivers misunderstand PIP and assume their health insurance eliminates the need for auto coverage. PIP covers expenses health insurance doesn't, including 80% of lost wages and household help during recovery. More importantly, PIP pays immediately without deductibles or copays for the first $50,000 in covered expenses. Health insurance only becomes relevant after PIP exhausts or for expenses PIP doesn't cover.

Ignoring uninsured motorist protection represents another critical error. New York requires this coverage, but insurers must offer you the option to reject it in writing. Some drivers decline it to save $10–$15 monthly without grasping the risk. When an uninsured driver causes a serious accident, your only recourse is suing them personally—usually futile since uninsured drivers typically lack assets worth pursuing. Your uninsured motorist coverage becomes your own protection against their negligence.

Drivers also frequently forget to update their insurance when circumstances change. Moving to a new address, adding a teenage driver, buying a different vehicle, or changing how you use your car (like starting a food delivery side job) all affect coverage and premiums. Failing to notify your insurer can result in denied claims when the insurer discovers the undisclosed change.

Frequently Asked Questions About NY Car Insurance Requirements

Meeting New York's car insurance requirements means more than just satisfying the legal minimums. The state's mandatory coverage—25/50/10 liability, $50,000 PIP, and uninsured motorist protection—provides a baseline, but that baseline often falls short when serious accidents occur. A single hospitalization can exhaust PIP limits, and a multi-vehicle crash can blow past minimum liability coverage within hours of the incident.

The enforcement system leaves no room for gaps or mistakes. Real-time monitoring means a single day without coverage triggers penalties that compound quickly, potentially costing thousands in fines and fees. The connection between insurance and registration isn't just bureaucratic paperwork; it's an automated system designed to catch lapses immediately and impose consequences that affect your ability to drive legally.

Smart coverage decisions balance legal compliance with real-world risk. Increasing liability limits to 100/300/50 or higher costs relatively little but protects your assets if you cause a serious accident. Adding optional APIP coverage beyond the basic $50,000 PIP provides a safety net for catastrophic injuries. Maintaining uninsured motorist coverage protects you from the roughly 6% of New York drivers who operate illegally without insurance.

The cheapest policy rarely proves the best value when you need it most. Understanding what New York requires—and why those requirements exist—helps you make informed choices that protect both your legal standing and your financial security on the state's roads.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.