Laptop and documents comparing bundled versus separate auto and home insurance costs.

How Much Can You Save with Bundling Quote Savings on Insurance?

Content

Insurance carriers advertise bundle discounts everywhere—billboards promise 25% off, radio spots tout massive savings, and online ads flash percentages that seem too good to pass up. But when you actually sit down to compare your current premiums against a bundled quote, the math often tells a different story.

Understanding what you'll genuinely save requires looking past marketing claims and examining how insurers price multi-policy packages, what eligibility criteria determine your discount tier, and whether your specific situation makes bundling the smart financial move or a costly mistake.

What Insurance Bundling Actually Means for Your Wallet

Bundling means purchasing two or more insurance policies from the same carrier. The most popular combination pairs homeowners (or renters) insurance with auto coverage, though carriers also bundle life, umbrella, motorcycle, boat, and other specialty policies.

When you bundle, the insurer applies a discount to one or both premiums. This isn't charity—it's a calculated business decision. Carriers use sophisticated actuarial models that account for your total premium value, predicted policy duration, and cross-selling opportunities. A customer paying $2,400 annually across two policies costs less to service than two separate customers each paying $1,200, so the insurer shares part of that operational savings.

The discount typically appears as a percentage reduction on each policy, though some carriers apply it only to the auto portion or structure it as a flat dollar amount. State Farm might show a 17% discount on your homeowners premium and 10% on auto, while Progressive could display a single 5% reduction across both. The presentation varies, but what matters is your total annual cost compared to buying policies separately.

Multi policy discounts work by adjusting the base premium after the insurer calculates your individual risk profile. Your driving record, home's age, credit score, and claims history still determine your starting rate. The bundle discount applies afterward, which means two drivers with identical coverage won't necessarily save the same dollar amount—a 20% discount on a $3,000 premium saves $600, while the same percentage on a $1,200 premium saves only $240.

Average Savings by Bundle Type: What the Numbers Really Show

Author: Calvin Prescott;

Source: trialstribulations.net

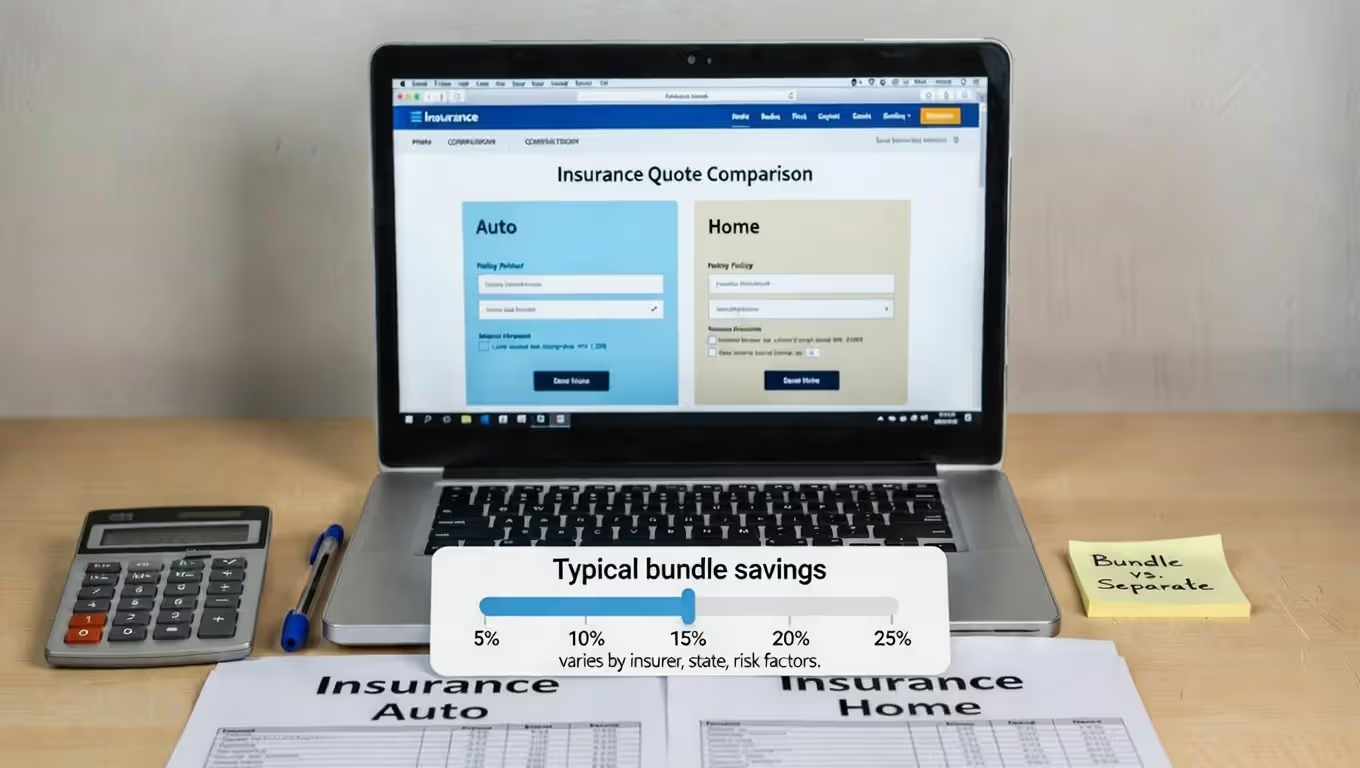

Industry data reveals wide variation in actual savings, with most households seeing reductions between 5% and 25% when they combine policies. The specific amount depends on your insurer, state regulations, coverage levels, and individual risk factors.

Home Auto Bundle Discount Ranges

The home-auto combination generates the most substantial discounts because it represents the highest total premium volume for most households. Carriers compete aggressively for this business, knowing that customers who bundle both policies tend to stay for 6-8 years on average, compared to 3-4 years for single-policy holders.

Typical savings averages fall into these ranges:

- Budget-friendly carriers (Geico, Progressive): 5-15% total savings

- Regional mutuals (State Farm, Nationwide): 15-20% total savings

- Premium carriers (Chubb, AIG Private Client): 10-18% total savings

- Direct-to-consumer (USAA, Amica): 18-25% total savings

These percentages represent combined savings across both policies. A household paying $1,800 for auto and $1,200 for homeowners ($3,000 total) might see annual costs drop to $2,400-$2,700 when bundled, depending on the carrier and their specific risk profile.

Other Common Policy Combinations

Renters-auto bundles typically save 10-15% because the renters premium is smaller (often $150-$300 annually), limiting the total discount value. However, young renters who don't own homes can still save $200-$400 yearly by bundling.

Umbrella policies added to existing home-auto bundles usually trigger an additional 5-8% discount on the underlying policies. Since umbrella coverage itself is inexpensive ($200-$400 for $1-2 million in coverage), the bundle discount can effectively make the extra liability protection free.

Motorcycle, RV, and boat insurance bundled with auto typically save 10-15% on the recreational vehicle policy, with smaller discounts (3-5%) applied to the auto portion.

| Insurer | Home+Auto Discount % | Additional Bundles Available | Minimum Requirements | Geographic Restrictions |

| State Farm | 15-20% | Life, umbrella, boat, motorcycle | Both policies must be active; home must be primary residence | Available in all 50 states |

| Allstate | 10-25% | Renters, condo, motorcycle, RV, life | Varies by state; typically requires full coverage auto | Not available in all states for all products |

| Progressive | 5-15% | Renters, condo, RV, boat, motorcycle | No minimum; discount increases with more policies | Home insurance through partnerships in some states |

| Geico | 5-15% | Renters, condo, motorcycle, umbrella | Auto policy must include comprehensive and collision | Home/renters through third-party partnerships |

| USAA | 10-23% | Renters, valuable items, life, umbrella | Military affiliation required for membership | Available to eligible members nationwide |

| Liberty Mutual | 5-20% | Renters, condo, motorcycle, boat, umbrella | Both policies must be purchased simultaneously for maximum discount | Available in most states |

| Farmers | 10-20% | Renters, condo, life, umbrella, business | Varies by state and policy type | State-specific restrictions apply |

| Nationwide | 15-25% | Renters, condo, motorcycle, boat, umbrella, pet | Must maintain continuous coverage on both policies | Available in most states |

The discount percentages shown represent typical ranges. Your actual savings depend on state regulations, coverage selections, and underwriting factors specific to your situation.

How Insurers Structure Multi Policy Discounts Behind the Scenes

Author: Calvin Prescott;

Source: trialstribulations.net

Insurance companies lose money acquiring new customers. Marketing costs, agent commissions, underwriting expenses, and policy setup typically exceed the first-year profit margin on a single policy. Bundling helps carriers recoup these acquisition costs by increasing customer lifetime value and reducing the probability you'll shop around next renewal.

Insurer incentives for offering bundle discounts include:

Customer retention economics: Data shows bundled customers cancel at half the rate of single-policy holders. When you have two policies with one carrier, switching requires getting quotes, comparing coverage, coordinating effective dates, and managing two transitions instead of one. Most people postpone this hassle, giving insurers predictable revenue streams.

Reduced claim frequency: Policyholders with multiple policies file fewer claims per policy than single-policy customers. Whether this reflects selection bias (more responsible people bundle) or behavioral factors (reluctance to file claims that might affect multiple policies), insurers price this lower risk into their bundle discounts.

Cross-selling efficiency: A customer who bundles home and auto is more likely to add umbrella coverage, life insurance, or specialty policies later. The carrier has already absorbed acquisition costs, so additional policies generate nearly pure profit. The initial bundle discount serves as a loss leader for future sales.

Operational savings: Managing two policies for one household costs marginally more than managing one policy, not twice as much. Shared customer records, consolidated billing, single renewal cycles, and unified claims handling create genuine cost savings that insurers can share through discounts.

State insurance regulations limit how aggressively carriers can discount bundles. Regulators want to ensure that single-policy customers aren't subsidizing bundle discounts through inflated base rates. Most states require insurers to justify bundle discounts with actuarial data showing legitimate cost savings or reduced risk.

Eligibility Requirements That Determine Your Actual Savings

Not everyone qualifies for maximum bundle discounts. Insurers tier their savings based on risk factors and coverage selections that affect their retention calculations and claims exposure.

Coverage Minimums and Policy Restrictions

Author: Calvin Prescott;

Source: trialstribulations.net

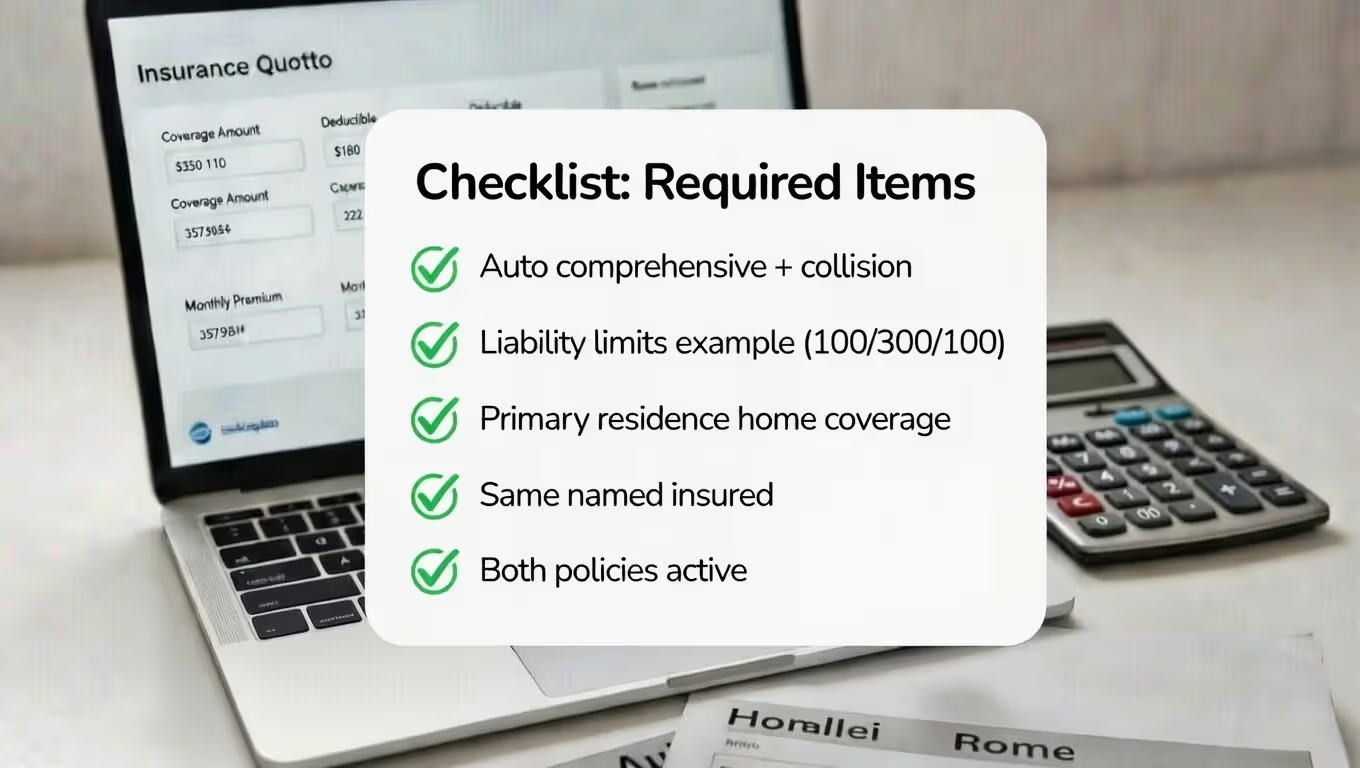

Most carriers require specific coverage levels to unlock full bundle discounts. You'll typically need:

Auto insurance: Comprehensive and collision coverage, not just liability. Minimum liability limits of 100/300/100 (some carriers accept state minimums but offer smaller discounts). Policies with only liability coverage often receive reduced bundle benefits or none at all.

Home insurance: Coverage on your primary residence, not a rental property or second home (though some carriers bundle these at reduced discount rates). Dwelling coverage must meet the lender's requirements if you have a mortgage. Homes with certain high-risk features—older roofs, knob-and-tube wiring, wood-burning stoves—may qualify for smaller discounts or require upgrades.

Policy ownership: Both policies must list the same primary policyholder. Spouses typically qualify for full discounts even if only one person appears on the auto policy, but unmarried partners may face restrictions depending on the carrier and state.

Active policy status: Both policies must remain active simultaneously. If you cancel your auto policy mid-term, your homeowners discount disappears at the next renewal. Some carriers prorate the discount removal; others eliminate it immediately.

Price is what you pay. Value is what you get.

— Warren Buffett

Credit and Claims History Factors

Eligibility rules extend beyond coverage types. Insurers evaluate your overall risk profile when determining bundle discount tiers:

Credit-based insurance scores: Carriers in most states use credit information to predict claim likelihood. Customers with excellent insurance scores (typically 750+) qualify for maximum bundle discounts, while those with scores below 600 may receive minimal savings or face eligibility restrictions. Seven states prohibit or limit credit-based pricing, which can affect bundle discount structures.

Claims history: Multiple at-fault accidents or home claims in the past 3-5 years can reduce your bundle discount tier or disqualify you entirely. One carrier might offer you 10% instead of 20%, while another might decline to bundle your policies altogether. Non-fault accidents and comprehensive claims (theft, weather damage) typically have less impact.

Payment history: Customers with prior cancellations for non-payment, even with different insurers, may receive reduced bundle discounts. Carriers view payment reliability as a retention indicator—if you've lapsed policies before, you're more likely to do it again, reducing their return on the bundle discount investment.

Length of continuous coverage: Gaps in insurance history can lower bundle discount eligibility. Drivers who went uninsured for six months or homeowners who let coverage lapse between selling one house and buying another may qualify only for entry-level discounts until they establish 12-24 months of continuous coverage.

When Bundling Costs You More Than It Saves

Author: Calvin Prescott;

Source: trialstribulations.net

Bundle discounts don't guarantee the lowest total cost. Several scenarios make separate policies the better financial choice:

Competitive standalone pricing: Some carriers offer exceptionally low rates on auto insurance but charge above-market rates for home coverage (or vice versa). Progressive might quote you $900 for auto insurance—$400 less than competitors—but their home insurance (through a partner company) costs $1,600 when standalone quotes from other carriers come in at $1,100. The 10% bundle discount saves you $250, but you're still paying $150 more than buying separately from the cheapest providers.

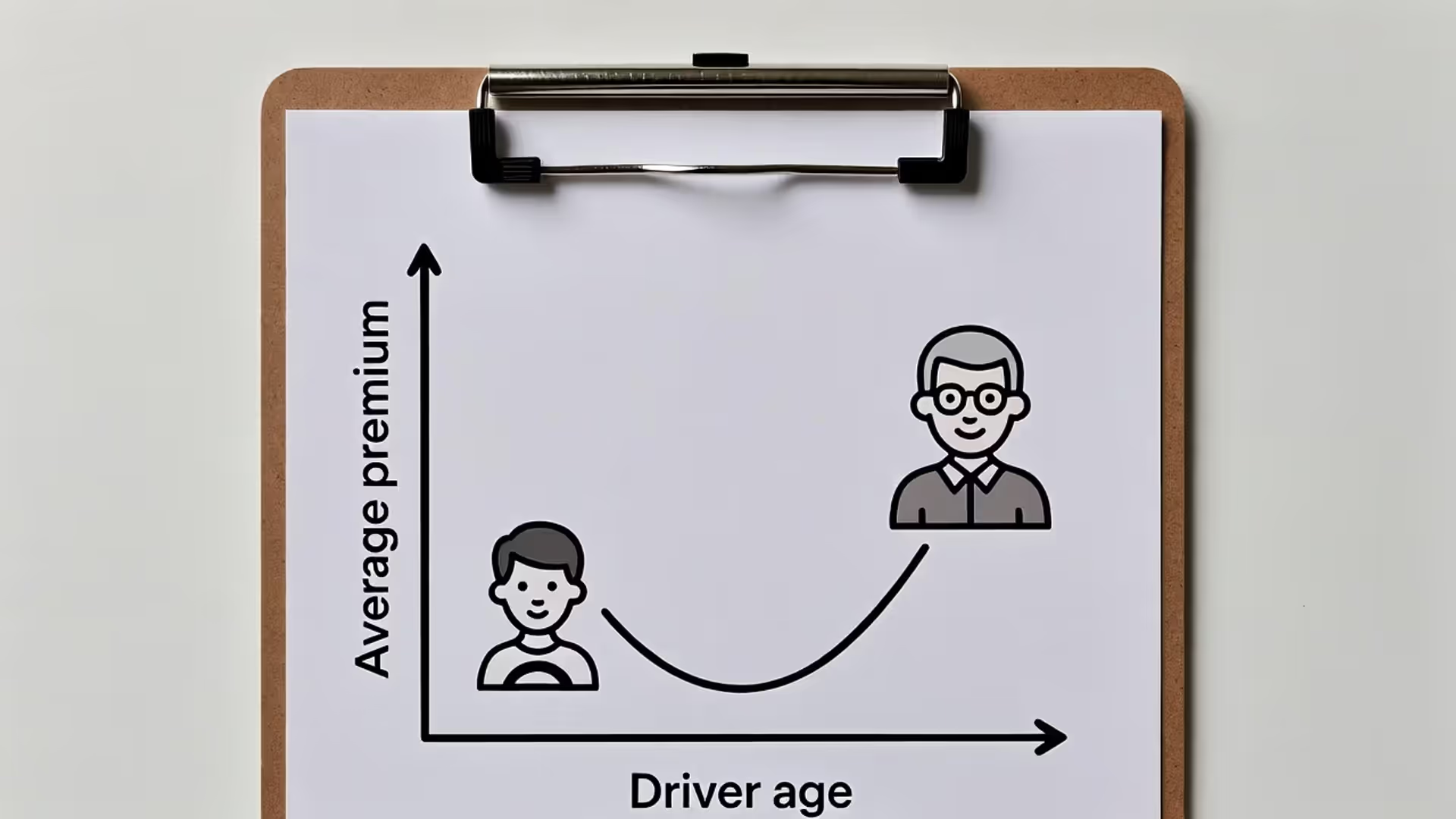

High-risk drivers with standard homes: If you have multiple speeding tickets or an at-fault accident, your auto premium might be $3,500 with a standard carrier but only $2,400 with a high-risk specialist like The General or Direct Auto. Even if bundling your home insurance saves 20% on the auto policy, $2,800 (bundled) still exceeds $2,400 (unbundled high-risk auto) plus $1,200 (separate home policy).

Luxury or high-value homes: Specialized carriers like Chubb, Pure, or AIG Private Client excel at insuring homes worth $750,000+ with agreed-value coverage, higher liability limits, and better claims service. Their auto insurance rates may be higher than mass-market carriers, making it cheaper to insure your home with a specialist and your cars with Geico or Progressive.

State-specific pricing anomalies: Insurance rates vary dramatically by state due to different regulations, weather risks, and legal environments. In Michigan, with its unique no-fault auto insurance system, you might find much better auto rates with a regional carrier that doesn't offer competitive home insurance. In Florida, where hurricane risk affects home premiums, you might save by using a Citizens Property Insurance policy (the state-backed insurer) for your home and a national carrier for auto.

New customer incentives: Carriers frequently offer aggressive discounts to attract new customers—six months of reduced rates, accident forgiveness, or vanishing deductibles. Sometimes the new-customer discount on a standalone policy exceeds the bundle savings, at least initially. You'll need to calculate whether the temporary standalone savings outweigh long-term bundle benefits.

Service quality trade-offs: The cheapest bundle might come from a carrier with poor claims service, limited agent access, or frustrating digital tools. Saving $300 annually matters less if you spend hours on hold during a claim or face delays getting your car repaired after an accident. Some people rationally choose to pay more for better service, especially on home insurance where claims can involve tens of thousands of dollars.

Step-by-Step: How to Calculate Your True Bundle Savings

Author: Calvin Prescott;

Source: trialstribulations.net

Marketing percentages mean nothing without comparing actual dollar amounts across realistic scenarios. Here's how to determine what bundling quote savings you'll genuinely receive:

Step 1: Get standalone quotes first. Before requesting bundle quotes, obtain separate prices from 4-6 carriers for auto insurance alone and home insurance alone. Use identical coverage levels across all quotes—same liability limits, deductibles, and optional coverages. This establishes your baseline cost.

Step 2: Request bundled quotes from the same carriers. Now ask each carrier for a bundle quote with identical coverage. Some insurers will automatically show you bundle pricing; others require you to specifically request multi-policy discounts. Make sure you're comparing the same coverage—carriers sometimes change deductibles or limits when presenting bundle quotes.

Step 3: Calculate total annual costs. Add up the full-year premiums for both policies under each scenario:

- Standalone scenario: Cheapest auto quote + cheapest home quote = total cost

- Bundle scenario: Combined premium from each carrier offering bundles = total cost per carrier

Step 4: Factor in payment fees and billing preferences. Some carriers charge $5-$8 per month for installment payments instead of paying annually. If you can't afford to pay $2,500 upfront, those fees add $60-$96 to your annual cost. Bundling typically means one bill instead of two, potentially saving one set of installment fees.

Step 5: Evaluate coverage differences. The cheapest quote isn't always the best value. Compare:

- Liability limits (higher is better for protecting assets)

- Deductibles (lower means less out-of-pocket after a claim)

- Replacement cost vs. actual cash value (for home and auto)

- Optional coverages included (rental car, roadside assistance, water backup, identity theft)

- Claims service reputation (check J.D. Power ratings and consumer complaint ratios)

Step 6: Project three-year costs. Insurance rates change at renewal. A carrier offering the lowest price today might increase rates 15% next year while competitors raise rates only 5%. Check each carrier's rate increase history in your state (available through state insurance department websites). Multiply your first-year cost by estimated increases to project three-year totals.

Step 7: Account for life changes. If you're planning to buy a home, add a teen driver, or pay off your car loan soon, these changes affect your premiums differently with each carrier. Ask agents how your rates would change under these scenarios before committing to a bundle.

Real example: Sarah gets standalone quotes of $1,600 for auto (Progressive) and $1,100 for home (Amica). State Farm offers a bundle at $2,450 total ($1,400 auto + $1,050 home), advertising a 20% discount. Her standalone total is $2,700, so the bundle saves $250 annually. However, Amica's claims service rating is significantly higher than State Farm's for home insurance. Sarah decides the $250 savings doesn't justify switching from a carrier known for excellent claims handling, especially since her home is her largest asset.

Frequently Asked Questions About Insurance Bundle Discounts

Bundling quote savings deliver genuine value for many households, but the advertised percentages rarely tell the complete story. Your actual savings depend on how your specific risk profile, coverage needs, and location interact with each carrier's pricing algorithms and discount structures. The lowest-cost option might be a bundle from one carrier, standalone policies from two different companies, or a hybrid approach where you bundle some policies while keeping others separate.

The insurance market rewards informed consumers who compare multiple scenarios rather than accepting the first bundle discount offered. Take time to gather detailed quotes, calculate total costs including fees and payment plans, evaluate service quality differences, and project how your rates might change over the next few years. The hour you invest in thorough comparison shopping can save hundreds or thousands of dollars while ensuring you get appropriate coverage from a carrier that will handle claims fairly when you need them most.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.