Person reviewing a car insurance quote beside registration and policy documents on a desk.

7 Insurance Quote Mistakes That Cost You Money (And How to Avoid Them)

Content

Getting a car insurance quote seems straightforward—answer a few questions, get a price, buy the policy. But small errors during this process can cost you hundreds of dollars annually or leave you exposed when you file a claim. Insurers base premiums on precise risk calculations, and even minor inaccuracies can trigger rate hikes or coverage denials.

Most drivers don't realize they're making mistakes until renewal time brings sticker shock or an accident claim gets rejected. Understanding where quote errors happen and how to prevent them protects both your wallet and your coverage.

Why Your Mileage Estimate Matters More Than You Think

Annual mileage ranks among the most commonly misreported data points on insurance applications. Many drivers guess their yearly miles without checking odometer readings or calculating their actual driving patterns. This seemingly minor detail directly impacts your premium because insurers use mileage as a key risk indicator—more time on the road means higher accident probability.

A driver who reports 8,000 annual miles but actually drives 15,000 pays a premium based on lower risk exposure. When you file a claim, insurers often check odometer readings from repair shops against your stated mileage. If the numbers don't match, they may adjust your rate retroactively, reduce claim payments, or even cancel your policy for material misrepresentation.

The opposite problem also costs money. Overestimating your mileage by reporting 20,000 miles when you only drive 10,000 means you're paying for risk you're not creating. The premium difference between low-mileage and high-mileage drivers can reach 15-30% with most carriers.

Calculate your actual annual mileage by tracking your odometer for a few typical weeks, then multiplying by 52. Include your daily commute, weekend errands, and occasional road trips. If you work from home three days weekly, your commute mileage drops by 60%—a detail worth capturing accurately.

Insurers verify mileage through multiple channels: odometer photos during the quote process, repair shop records after accidents, and state inspection data where applicable. Some carriers now offer telematics programs that track exact mileage via smartphone apps or plug-in devices, eliminating estimation errors while potentially earning you usage-based discounts.

Author: Calvin Prescott;

Source: trialstribulations.net

Choosing the Wrong Coverage Levels: The Goldilocks Problem

Selecting coverage amounts requires balancing adequate protection against budget constraints. Too little coverage leaves you financially exposed; too much wastes premium dollars on protection you don't need. Most quote mistakes happen at these extremes.

Minimum Coverage vs. Full Coverage—What's Actually Right for You

State minimum coverage meets legal requirements but rarely provides sufficient protection. A driver carrying California's minimum $15,000 per person bodily injury limit who causes a serious accident faces personal liability for medical bills exceeding that amount. Hospital stays, surgeries, and long-term care easily surpass minimum limits, putting your assets at risk.

Financial advisors typically recommend bodily injury coverage of at least $100,000 per person and $300,000 per accident, with $100,000 property damage. These limits protect most middle-income households from catastrophic loss. If your net worth exceeds these amounts, consider $250,000/$500,000 limits or an umbrella policy.

Full coverage—a term that technically means comprehensive plus collision—makes sense when your vehicle's value justifies the cost. A general rule: if your car is worth less than ten times your annual collision and comprehensive premium, consider dropping these coverages. A vehicle worth $3,000 with a $600 annual premium for physical damage coverage doesn't pencil out financially.

Deductible Mistakes That Backfire During Claims

Choosing your deductible based solely on lowering your quote creates problems later. A $2,000 deductible might cut your premium by $300 annually, but if you can't afford $2,000 out-of-pocket after an accident, you've saved money in the wrong place.

Your deductible should match your emergency fund capacity. If you have $5,000 in savings, a $1,000 deductible makes sense. With only $1,000 saved, a $500 deductible provides better financial protection despite the higher premium. The premium difference between deductible levels typically ranges from $100-400 annually—meaningful but not worth financial strain during a claim.

Some drivers select different deductibles for comprehensive versus collision. Since comprehensive claims (theft, weather, animal strikes) often involve total losses where deductible amounts matter less, a higher comprehensive deductible can save money without much downside. Collision claims more frequently involve repairable damage where you'll pay your deductible, so a lower amount may justify the extra premium.

| Coverage Type | State Minimum | Recommended | Full Coverage |

| Bodily Injury Liability | $15,000-$25,000 per person | $100,000/$300,000 | $250,000/$500,000 |

| Property Damage | $5,000-$25,000 | $100,000 | $100,000-$250,000 |

| Collision | Not required | $500-$1,000 deductible | $500 deductible |

| Comprehensive | Not required | $500-$1,000 deductible | $250-$500 deductible |

| Medical Payments | $1,000-$5,000 or not required | $5,000-$10,000 | $10,000+ |

| Uninsured Motorist | Varies by state | Match liability limits | Match or exceed liability |

The Hidden Risk of Leaving Drivers Off Your Policy

Author: Calvin Prescott;

Source: trialstribulations.net

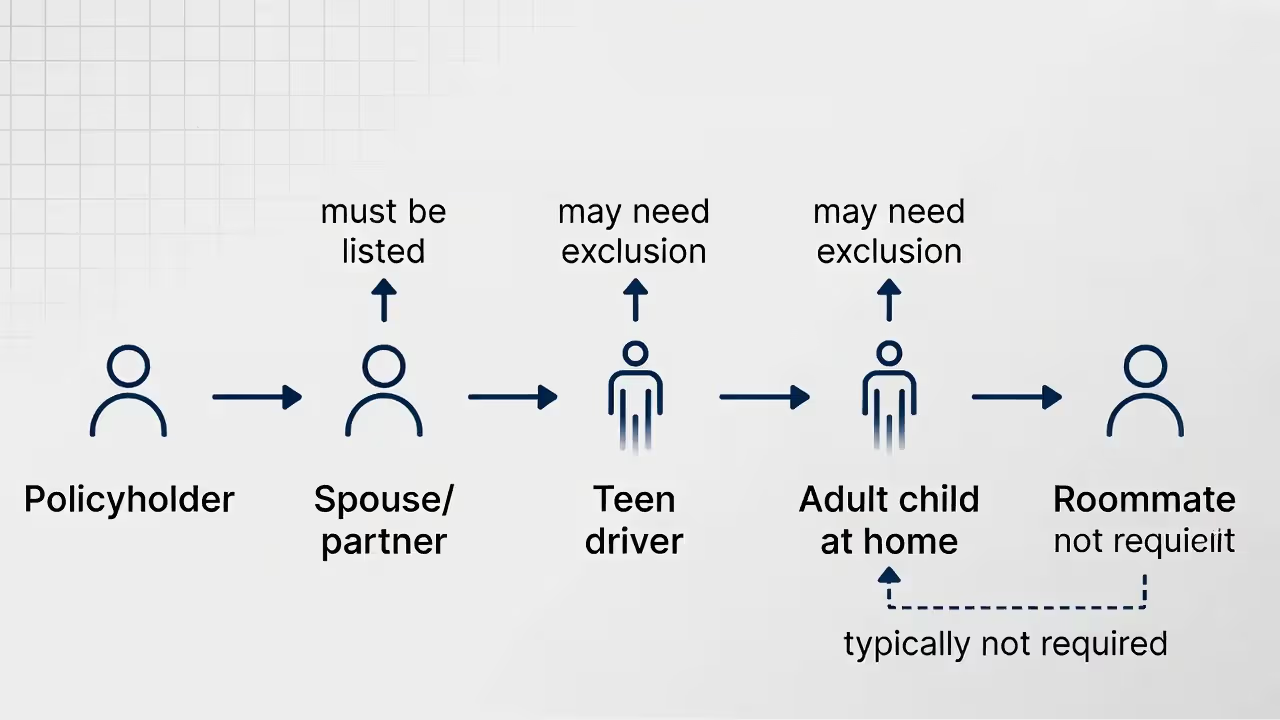

Driver omission represents one of the most serious quote mistakes. Insurers price policies based on every household member with license access to your vehicles. Leaving someone off your application—intentionally or accidentally—constitutes material misrepresentation that can void coverage when that person has an accident.

The most common scenario involves adult children living at home. Your 23-year-old son stays with you between jobs and occasionally borrows your car. Even if he drives your vehicle twice monthly, most insurers require him listed on your policy. Household members are presumed to have regular access to your vehicles unless explicitly excluded.

Explicit exclusion solves the problem when a household member has their own insurance or a driving record so poor that adding them would make coverage unaffordable. Named driver exclusions—available in most states—formally bar specific individuals from coverage under your policy. If that excluded person drives your car and causes an accident, your insurance won't pay. This protects you from rate increases due to their risk profile but creates liability exposure if they drive despite the exclusion.

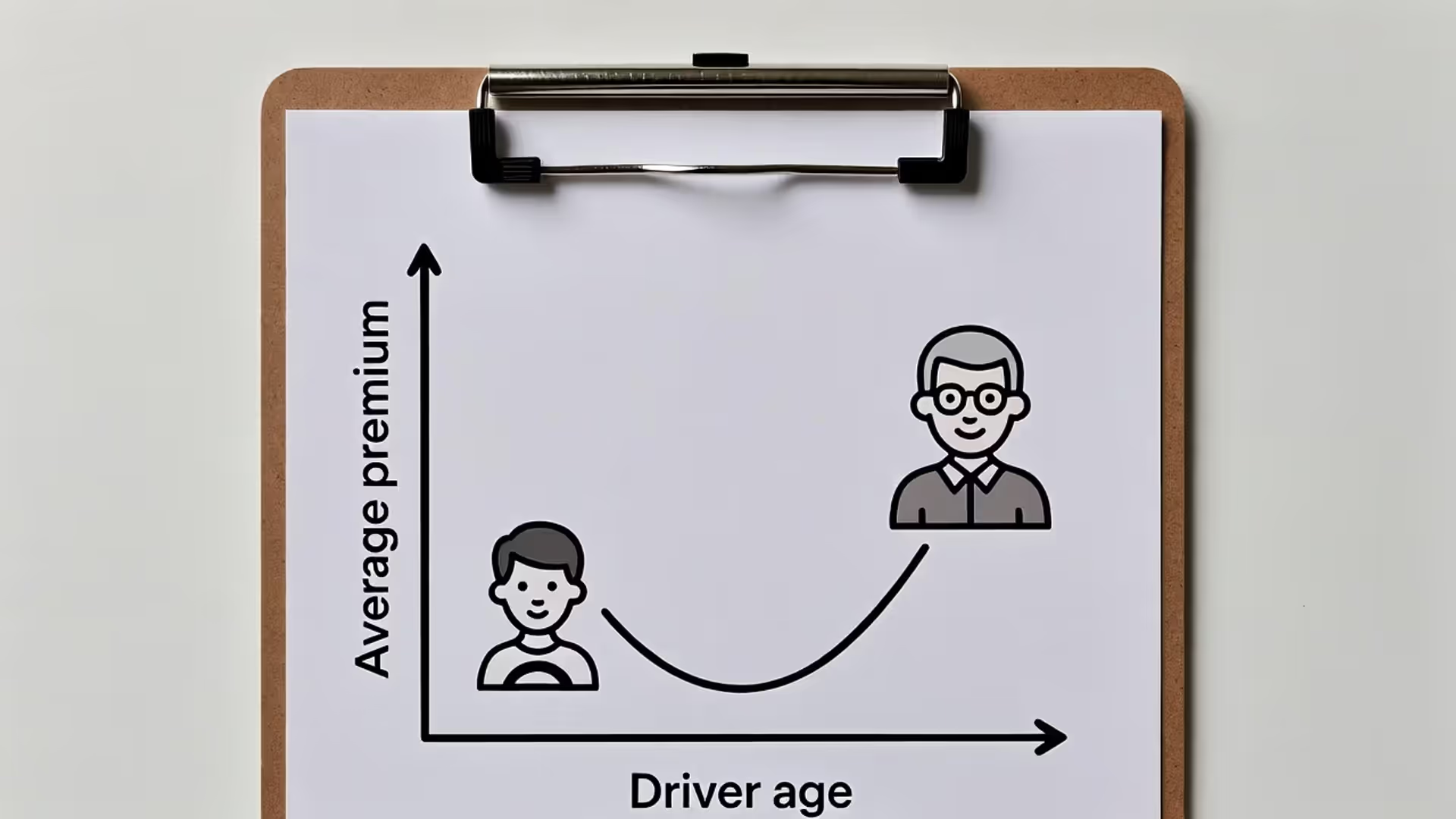

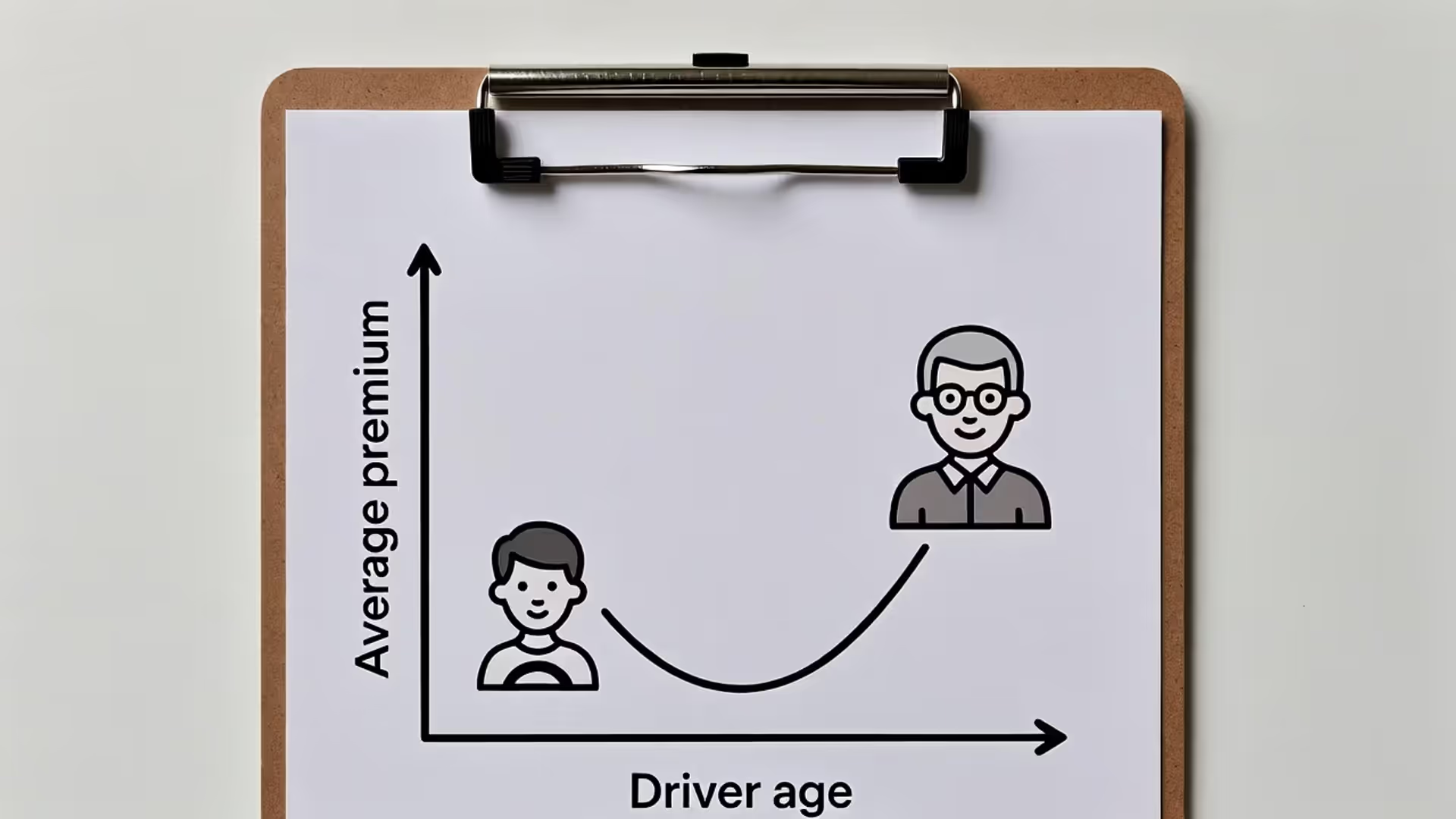

Teen drivers present the opposite temptation. Adding a 16-year-old to your policy can double or triple your premium. Some parents delay adding their teenager, hoping to avoid the cost increase. This gamble backfires catastrophically if your teen causes a serious accident while driving your car. The insurer will deny the claim, leaving you personally liable for all damages—potentially hundreds of thousands of dollars.

Occasional drivers outside your household generally don't require listing. Your sister who visits twice yearly and borrows your car for errands falls under permissive use—most policies automatically cover licensed drivers you allow to drive your vehicle. But frequency matters. If that sister stays with you for three months while relocating for work, she transitions from occasional visitor to household member requiring disclosure.

The claims process reveals driver omissions quickly. After an accident, insurers investigate who was driving and their relationship to the policyholder. They'll check DMV records for household members, review social media for evidence of regular vehicle access, and interview neighbors if needed. The effort they invest in this investigation correlates with claim size—a $5,000 fender-bender might slide through, but a $200,000 injury claim triggers thorough scrutiny.

Address Errors That Trigger Premium Surprises

Author: Calvin Prescott;

Source: trialstribulations.net

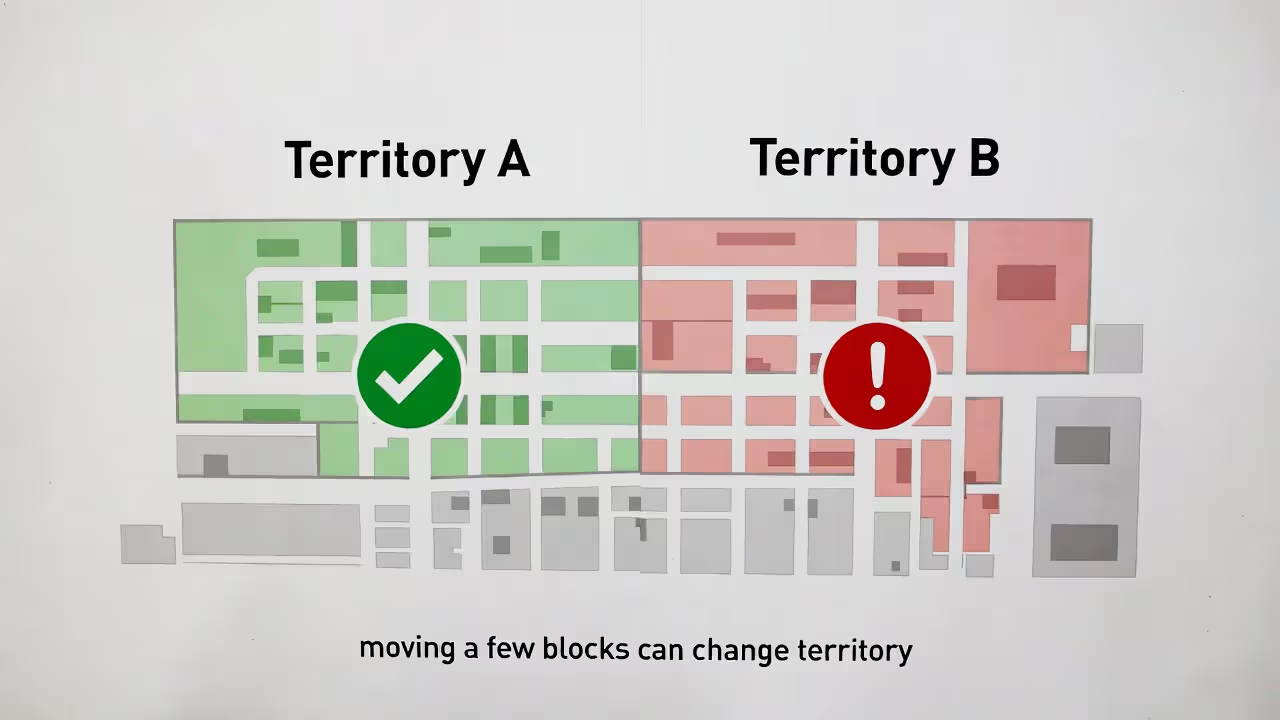

Your address determines your insurance rate more than most drivers realize. Insurers divide geographic areas into rating territories based on accident frequency, theft rates, vandalism, and claims costs. Moving a few blocks can shift you into a different territory with substantially different rates.

The garaging address—where your vehicle is parked overnight—matters most for rating purposes. This may differ from your mailing address. College students who take their car to campus should list the campus address as the garaging location, even if their parents' address remains their legal residence. The difference between a rural hometown and an urban campus can swing premiums by 40% or more.

ZIP code boundaries create sharp rate divides. Two neighbors on opposite sides of a ZIP code line might pay dramatically different premiums for identical coverage. A driver on the safer side who uses their friend's address across the street to save money commits insurance fraud—a serious offense that can result in policy cancellation and difficulty obtaining coverage later.

Moving without updating your address creates multiple problems. First, you're paying a rate based on your old location's risk profile, which may be higher or lower than your new area. Second, if you move to a higher-rate area but don't update your policy, you're technically underinsured—the insurer can adjust your rate retroactively or reduce claim payments. Third, you might not receive important policy documents, renewal notices, or cancellation warnings sent to your old address.

Update your address within 30 days of moving. Most insurers allow online address changes that trigger immediate rate recalculation. Sometimes the rate drops, sometimes it increases—but accurate information prevents bigger problems later. If you're moving soon, get quotes for your new address before relocating so the premium change doesn't surprise you.

Seasonal address changes affect snowbirds and college students. If you spend six months in Florida and six months in Michigan, your policy should reflect this split. Some insurers rate based on where the vehicle is garaged most of the year; others use the higher-risk location. Storing a vehicle at a vacation home for extended periods may require listing that as a secondary garaging location.

5 Other Quote Errors That Inflate Your Rate or Deny Your Claim

Author: Calvin Prescott;

Source: trialstribulations.net

Beyond the major mistakes, several smaller errors accumulate to cost you money or create coverage gaps.

Misreporting Your Vehicle's Safety Features

Modern vehicles come with numerous safety technologies that qualify for insurance discounts: automatic emergency braking, lane departure warning, blind spot monitoring, and adaptive cruise control. Failing to report these features means missing discounts worth 5-15% of your premium.

The opposite error—claiming safety features your vehicle lacks—creates problems during claims. If you report having automatic emergency braking but your car doesn't have it, the insurer may question other information on your application. Always verify your vehicle's exact trim level and features using the VIN decoder or window sticker.

Anti-theft devices also earn discounts. Factory alarm systems, GPS tracking, and VIN etching qualify with most carriers. Aftermarket systems may require documentation proving installation.

Wrong Vehicle Usage Classification

Insurers distinguish between pleasure use, commuting, and business use. Pleasure use means no regular commute—the lowest-risk category. Commuting adds daily drive-to-work miles. Business use covers vehicles driven for work purposes beyond commuting, like sales calls or deliveries.

Many drivers select pleasure use to reduce premiums despite commuting daily. This misclassification can void coverage if you have an accident during your commute. The insurer investigates accident circumstances, and if the accident occurred during your undisclosed commute, they may deny the claim.

Gig economy work requires special attention. If you drive for Uber, Lyft, DoorDash, or similar services, personal auto insurance doesn't cover accidents during business activities. You need commercial coverage or a rideshare endorsement. Failing to disclose this usage leaves you completely uninsured while working—a gap many gig workers discover too late.

Inaccurate Claims History

Your claims history from the past five years significantly impacts your premium. Some drivers "forget" minor claims hoping to avoid rate increases. Insurers access comprehensive loss history databases (CLUE reports) that show all claims filed under your name, regardless of what you report.

Discrepancies between your reported history and database records raise red flags. If you omit a claim, the insurer will find it during underwriting and may question your application's overall accuracy. Be thorough and honest about all claims, even small ones you paid out-of-pocket after initially filing.

Not-at-fault accidents still appear on your record and can affect rates with some carriers, though the impact is smaller than at-fault claims. Comprehensive claims (theft, weather damage) typically have less rate impact than collision claims.

An insurance quote is only as accurate as the information behind it. Even small misstatements about mileage, drivers, or vehicle use can lead to higher premiums or denied claims. Precision at the application stage is one of the most overlooked ways to protect both your rate and your coverage.

— Melissa Grant, Auto Insurance Underwriting Specialist

Credit Information Discrepancies

Most states allow insurers to use credit-based insurance scores when rating policies. These scores differ from credit scores but use similar data. Errors in your credit report—incorrect late payments, accounts that aren't yours, or outdated information—can inflate your insurance score and increase premiums.

Check your credit reports from all three bureaus before shopping for insurance. Dispute any errors and wait for corrections to process before applying. The premium difference between excellent and poor credit-based insurance scores can reach 50-100% with some carriers.

A few states (California, Hawaii, Massachusetts, Michigan) prohibit or limit credit-based insurance scoring. If you live elsewhere and have poor credit, ask about carriers that weigh credit less heavily or offer alternative rating methods.

Bundling Assumptions

Many drivers assume bundling auto and home insurance automatically saves money. While bundling often provides discounts of 15-25%, it's not universal. Sometimes separate policies from different carriers cost less than a bundle from one carrier.

The mistake happens when drivers accept a bundled quote without comparing it to separate policies. Get standalone quotes for each coverage type, then compare the total to bundled quotes. Factor in the convenience of single-company service, but don't sacrifice hundreds of dollars annually for minor convenience.

Some carriers offer bundle discounts only when you meet specific thresholds—like having both home and auto insurance with liability limits above certain amounts. Verify bundle discount requirements and confirm the discount appears on your quote before buying.

How to Double-Check Your Quote Before Buying

Author: Calvin Prescott;

Source: trialstribulations.net

Catching quote mistakes before purchase requires systematic review. Start by gathering supporting documents: vehicle registration, current insurance declarations page, driver's licenses for all household members, vehicle VIN, and recent odometer reading.

Compare the quote details against these documents line by line. Verify every data point: vehicle year, make, model, VIN, garaging address, mileage, coverage limits, deductibles, and listed drivers. Check that safety features and anti-theft devices are correctly noted.

Review your driving record through your state's DMV. Ensure the insurer has accurate information about tickets, accidents, and license status. Discrepancies between your record and what the insurer uses for rating should be corrected before binding coverage.

Ask your agent or the online quote system specific questions: - "Which household members need to be listed on this policy?" - "Does my garaging address affect my rate, and is it correct?" - "What documentation do you need to verify my vehicle's safety features?" - "Are there any discounts I might qualify for that aren't included?" - "What happens if my circumstances change after I buy this policy?"

Get quotes from at least three carriers. Price variation for identical coverage can exceed 50% between companies. Use the same coverage limits, deductibles, and information for each quote to ensure valid comparison.

Read the policy documents before the end of your free-look period (typically 10-30 days after purchase). Confirm coverage matches what you bought. If you find errors, contact your insurer immediately—most allow corrections within the free-look period without penalty.

Set a calendar reminder to review your policy six months before renewal. Circumstances change—you might drive less, move, pay off your car loan, or add safety features—and these changes could lower your premium if you report them.

FAQ: Common Questions About Insurance Quote Accuracy

Getting an accurate insurance quote requires attention to detail and honest disclosure. The few minutes spent verifying information before purchase can save you thousands of dollars and prevent coverage gaps that leave you exposed. Treat your insurance application with the same care you'd give any important financial document—because that's exactly what it is. Small errors create big problems, but systematic review catches mistakes before they cost you money or deny you coverage when you need it most.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.