U-shaped chart showing average car insurance premiums by driver age with teen and senior icons.

Cheapest Car Insurance by Age: What Drivers Pay at Every Life Stage

Content

Your 17-year-old just got their license, and the insurance quote makes your mortgage payment look reasonable. Your 55-year-old neighbor brags about paying half what you do. Age determines car insurance costs more than almost any other factor, yet most drivers never see the full picture of how premiums shift across decades.

Insurance companies don't price policies based on fairness or convenience. They price them on mathematics—specifically, the statistical likelihood that you'll file a claim. Age serves as one of the most reliable predictors of that risk, which is why a 19-year-old and a 50-year-old with identical driving records can see premium differences exceeding 200%.

Understanding where you fall on the age pricing curve helps you anticipate rate changes, time major purchases, and deploy the right strategies to counter age-based premium increases.

How Insurance Companies Calculate Rates Based on Driver Age

Actuaries build pricing models by analyzing millions of claims across decades. They've identified clear patterns: drivers under 25 file collision claims at rates three times higher than middle-aged drivers. Drivers over 75 show increased claim frequency as reaction times slow and medical episodes become more common.

These patterns create risk categories that insurers use to segment drivers. A 16-year-old falls into the highest-risk category regardless of how responsibly they drive, because the data shows their age cohort collectively causes more accidents. The individual matters less than the group statistics.

Insurance companies layer age data with other rating factors—location, vehicle type, credit score, coverage limits—but age often carries the heaviest weight for young and elderly drivers. A 20-year-old with perfect credit in a safe neighborhood still pays substantially more than a 45-year-old with average credit in a higher-crime area, all else being equal.

Author: Tara Livingston;

Source: trialstribulations.net

The pricing mechanism adjusts continuously. Insurers recalibrate their models annually, incorporating fresh claims data. When a particular age bracket shows improving loss ratios—fewer or less expensive claims—premiums for that group trend downward. The reverse happens when claim costs spike.

State regulations add another layer. Some states prohibit using age as a rating factor after a certain threshold, while others allow it throughout a driver's lifetime. California, Hawaii, and Massachusetts restrict age-based pricing more than most states, which compresses the premium differences between age groups in those markets.

Average Car Insurance Costs by Age Group

Premium averages reveal a distinct U-shaped curve. Costs start extremely high for teens, drop sharply through the twenties, reach a valley in middle age, then climb again after 70.

| Age Bracket | Average Annual Premium | % Difference from National Average | Risk Category |

| 16-19 | $6,728 | +186% | Highest Risk |

| 20-24 | $3,192 | +36% | High Risk |

| 25-34 | $2,341 | -0.5% | Moderate Risk |

| 35-44 | $2,287 | -3% | Low Risk |

| 45-54 | $2,156 | -8% | Lowest Risk |

| 55-64 | $2,134 | -9% | Lowest Risk |

| 65-74 | $2,298 | -2% | Low Risk |

| 75+ | $2,567 | +9% | Moderate Risk |

These figures represent full-coverage policies with standard liability limits, collision, and comprehensive coverage. Minimum liability-only policies cost significantly less but follow the same age-based pattern.

The national average hovers around $2,350 annually for drivers across all ages. Teens pay nearly triple that amount. A parent adding a 17-year-old to their policy might see their household insurance bill jump from $2,400 to $7,200 annually—a $4,800 increase for a single additional driver.

When Do Rates Drop Most Dramatically?

Author: Tara Livingston;

Source: trialstribulations.net

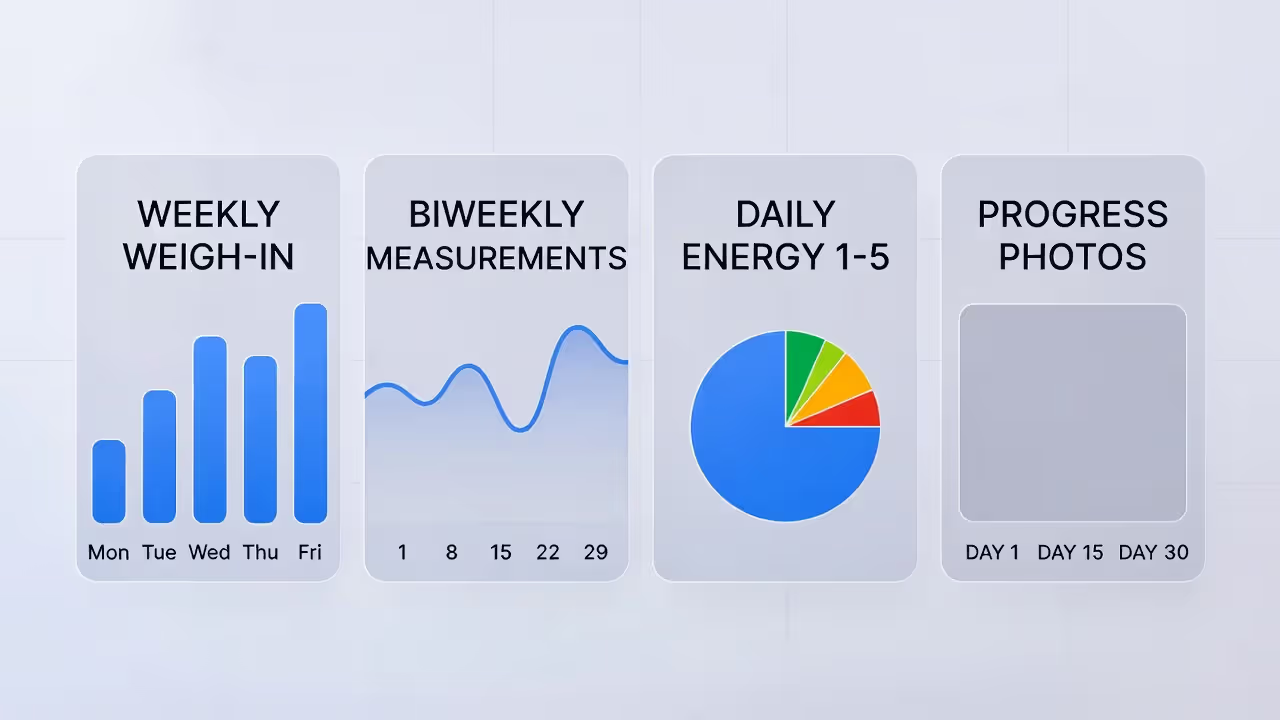

The steepest decline occurs between ages 19 and 25. A driver who pays $6,200 at 19 might pay $3,800 at 22 and $2,600 at 25—a 58% reduction over six years, assuming a clean driving record.

The drop accelerates at specific birthdays. Many insurers program automatic rate reductions at ages 21 and 25, tied to statistical inflection points where claims frequency falls measurably. The 25th birthday typically triggers the largest single-year decrease, often 10-15% even without any policy changes.

Smaller decreases continue into the thirties and forties. A 28-year-old pays roughly 8% less than a 25-year-old. A 35-year-old pays about 5% less than a 30-year-old. The reductions become incremental rather than dramatic, but they compound over time.

The Senior Driver Rate Inflection Point

Premiums stabilize between ages 50 and 70, creating a two-decade window where rates remain relatively flat. This represents the cheapest car insurance by age for most drivers—the period when experience offsets any emerging age-related risk factors.

Around age 70-72, the curve reverses. Premiums begin climbing, slowly at first. A 72-year-old might pay 3% more than a 65-year-old. By 75, that gap widens to 9-12%. Drivers over 80 can see increases of 15-20% compared to their mid-sixties rates.

The inflection point varies by insurer and state. Some companies start increasing rates at 68, others wait until 73. States with senior driver protections may delay or limit these increases, but the underlying risk calculations eventually push premiums upward as claim frequency rises.

Why Teens and Young Drivers Face the Highest Premiums

Statistics explain the sticker shock. Drivers aged 16-19 have fatal crash rates nearly three times higher than drivers aged 20 and older, according to the Insurance Institute for Highway Safety. Per mile driven, teens crash more than any other age group.

Inexperience compounds poor judgment. A teen driver hasn't encountered black ice, hasn't learned how much space to leave when following a semi-truck, hasn't developed the instinct to check mirrors before changing lanes. These skills take years and thousands of miles to develop.

Risk categories for teen driver insurance reflect this reality. Insurers classify 16-year-olds as maximum risk regardless of personality or maturity. A straight-A student who completed driver's education still falls into the same actuarial bucket as a reckless peer, because the data shows both groups produce similar claim patterns collectively.

Distraction plays an oversized role. Teens use phones while driving at higher rates than adults. They're more likely to carry multiple passengers, which increases crash risk exponentially. A teen driver with two or more teen passengers faces quadruple the crash risk of driving alone.

The gender gap matters too. Teen boys pay 10-15% more than teen girls on average, reflecting higher rates of speeding, aggressive driving, and nighttime crashes among male adolescents.

Strategies to Lower Teen Driver Insurance Costs

Author: Tara Livingston;

Source: trialstribulations.net

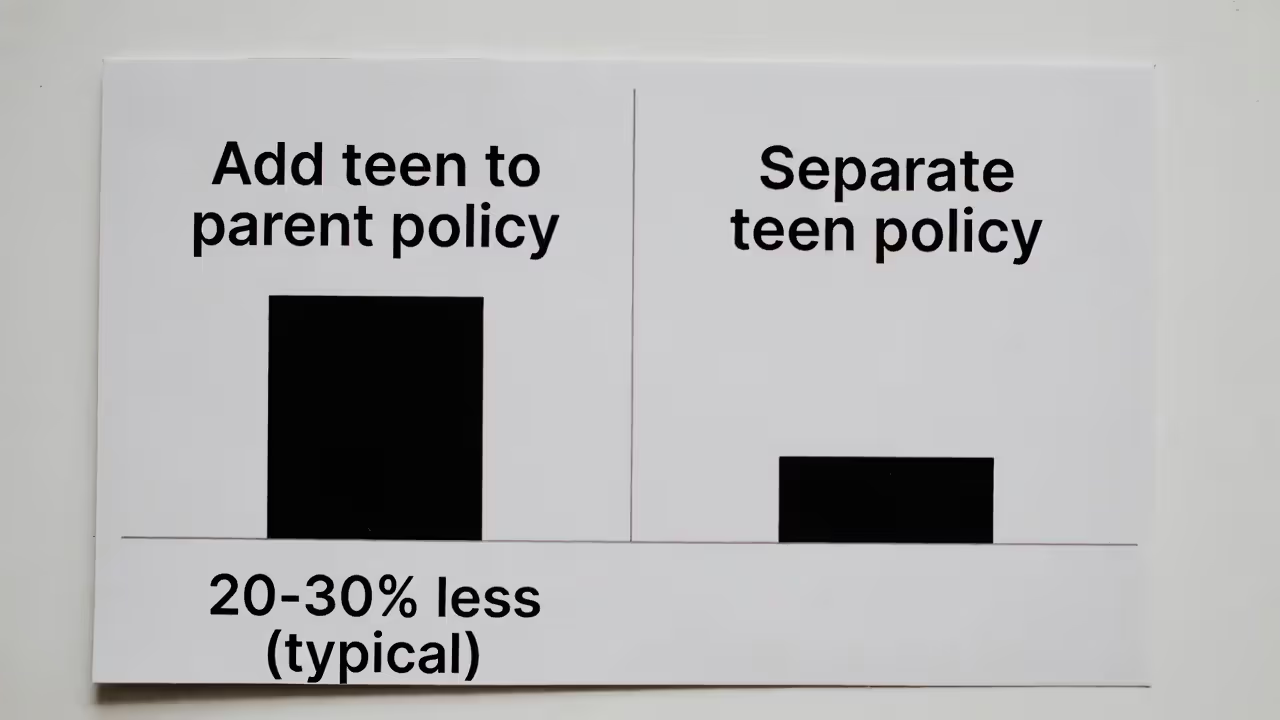

Adding a teen to a parent's policy rather than buying separate coverage saves 20-30% on average. Family multi-car discounts and shared deductibles reduce per-driver costs.

Good-student discounts reward academic performance, typically requiring a 3.0 GPA or better. These discounts range from 8-15% and remain available through college, sometimes up to age 25. Insurers reason that disciplined students make more careful drivers.

Driver training courses beyond basic driver's education can unlock additional discounts of 5-10%. Defensive driving courses, especially those certified by the National Safety Council, signal reduced risk to underwriters.

Choosing the right vehicle matters enormously. Insuring a teen in a used Honda Accord costs 40% less than insuring them in a new Mustang. Insurers charge more for powerful, sporty vehicles driven by young drivers—the combination of inexperience and performance capability multiplies risk.

Telematics programs that monitor driving behavior offer potential savings of 10-30% for teens who demonstrate safe habits. These programs track speed, braking, cornering, and nighttime driving. A teen willing to accept monitoring can prove they're lower risk than their age suggests.

Raising deductibles from $500 to $1,000 cuts premiums by roughly 15%. Families with emergency savings can absorb a higher out-of-pocket cost in exchange for lower monthly payments.

The Sweet Spot: Which Ages Get the Best Insurance Deals?

Drivers between 50 and 65 enjoy the lowest premium averages across the age spectrum. Insurance companies reward this group with mature driver discounts, typically 5-10% off standard rates, recognizing decades of experience and statistically lower claim rates.

This age bracket benefits from multiple advantages simultaneously. They've accumulated long insurance histories, often with the same carrier, which unlocks loyalty discounts. They typically own homes, which makes them eligible for bundling discounts when combining auto and homeowners policies. Their credit profiles have matured, and credit-based insurance scores peak during these years for most people.

Claim frequency hits its lowest point between ages 55 and 64. Drivers in this range file fewer collision claims, fewer comprehensive claims, and smaller liability claims than any other age group. They drive more carefully, maintain vehicles better, and avoid high-risk behaviors like speeding or driving impaired.

The stability factor influences pricing too. Middle-aged drivers change jobs less frequently, move less often, and maintain more consistent driving patterns. Insurers view stability as predictive of lower risk, since erratic life circumstances correlate with higher claim rates.

Premium averages bottom out around age 57-58 for most drivers. Someone who has maintained a clean record since their twenties, stayed with the same insurer for a decade, bundled policies, and driven a modest vehicle can see rates 65% lower than what they paid at age 22.

Geographic variations affect the sweet spot slightly. Urban drivers might see their lowest rates arrive at 52, while rural drivers might wait until 60. The pattern holds regardless—middle age delivers the best pricing.

When Senior Driver Rates Start Climbing Again

Author: Tara Livingston;

Source: trialstribulations.net

The reversal begins subtly. A 68-year-old notices their renewal increased $80 despite no claims or tickets. A 74-year-old sees a 12% jump that their agent attributes to "age-related adjustments." By 80, premiums may exceed what that same driver paid at age 35.

Cognitive and physical changes drive the increases. Reaction times slow measurably after 70. Vision deteriorates, especially night vision and peripheral awareness. Medications can cause drowsiness or confusion. These factors don't make every senior a dangerous driver, but they shift the statistical risk profile for the age cohort.

Senior driver rates reflect another reality: crash severity. When older drivers do crash, injuries tend to be more serious and medical costs higher. A 75-year-old involved in a moderate collision faces greater injury risk than a 45-year-old in an identical crash, which increases claim costs for insurers.

Some states mandate testing or renewal requirements for senior drivers. Illinois requires road tests for drivers 75 and older at each renewal. California requires in-person renewal for drivers over 70. These requirements don't directly affect premiums, but they reflect the same underlying risk concerns insurers price into policies.

Age isn’t just a number in auto insurance pricing — it’s one of the strongest statistical predictors of risk. Understanding how premiums shift across life stages allows drivers to anticipate rate changes and proactively use the right strategies to reduce costs.

— Daniel Mercer, Auto Insurance Analyst

Not all companies increase senior rates aggressively. Some insurers specialize in mature drivers and offer competitive pricing through age 80 or beyond. Shopping around becomes critical after 70, since rate disparities between companies widen significantly for senior drivers.

Mileage matters more for seniors. Many retired drivers reduce annual mileage dramatically, which should reduce premiums. Low-mileage discounts of 10-20% are available for drivers logging under 7,500 miles annually. Seniors who don't proactively request these discounts often overpay.

Defensive driving courses designed for seniors can reduce premiums 5-10% in most states. AARP offers a Smart Driver course that satisfies requirements in many jurisdictions. Completing the course every three years maintains the discount and can offset age-related increases partially.

7 Ways to Find Cheaper Coverage Regardless of Your Age

Author: Tara Livingston;

Source: trialstribulations.net

Compare quotes from at least five insurers every two years. Premium averages vary wildly by company and age bracket. One insurer might offer excellent rates for drivers under 30 but charge seniors more. Another might specialize in mature drivers but price young drivers uncompetitively. The only way to find your best match is systematic comparison shopping.

Stack every available discount. Most drivers qualify for 4-6 discounts but only claim 1-2. Bundling home and auto saves 15-25%. Paperless billing saves 3-5%. Paying in full rather than monthly saves 5-8%. Anti-theft devices, safety features, and professional affiliations all unlock additional reductions. A driver who stacks six discounts paying 10% each doesn't save 60%—discounts typically apply sequentially, not additively—but the compound effect still reaches 35-40%.

Adjust coverage on older vehicles. Collision and comprehensive coverage make sense when a car is worth $8,000 or more. Once a vehicle's value drops below $3,000, paying $600 annually for collision coverage becomes inefficient—two years of premiums exceed the maximum possible claim. Dropping to liability-only can cut premiums 40-50% on older vehicles.

Increase deductibles strategically. Moving from a $250 to $1,000 deductible reduces premiums 25-30%. This works best for drivers with emergency funds who can absorb a higher out-of-pocket cost. The premium savings typically recover the higher deductible within 2-3 years even if a claim occurs.

Enroll in telematics or usage-based programs. These programs track driving behavior through smartphone apps or plug-in devices. Safe drivers can earn discounts of 20-40% based on actual performance rather than demographic assumptions. Young drivers and seniors benefit most, since these programs let them prove they're safer than their age group's statistics suggest.

Improve credit scores. Most states allow credit-based insurance scores to influence premiums. Improving a credit score from 620 to 720 can reduce auto insurance costs 15-20%. Paying down credit card balances, correcting errors on credit reports, and maintaining consistent payment histories all boost insurance scores over time.

Bundle strategically but verify savings. Bundling auto and home insurance with one carrier typically saves money, but not always. Some insurers offer minimal bundling discounts of 5% while competitors offer 20%. Get separate quotes for each policy individually, then compare against the bundled price to confirm actual savings. Occasionally, buying from two different specialists costs less than bundling with a generalist.

Frequently Asked Questions About Age and Car Insurance Rates

Making Age Work for You

Age influences car insurance costs more than most drivers realize, but understanding the pricing curve creates opportunities. Young drivers can deploy specific strategies to counter their age disadvantage—good student discounts, telematics programs, vehicle selection, and family policy additions all reduce premiums substantially.

Middle-aged drivers should leverage their position at the bottom of the age pricing curve by stacking discounts aggressively and negotiating with insurers from a position of statistical strength. This is the time to lock in long-term relationships with carriers and maximize policy benefits.

Senior drivers facing rate increases should shop competitors specifically targeting their age group, reduce coverage on older vehicles, emphasize low mileage, and complete defensive driving courses to offset age-based premium growth.

The age pricing curve is predictable, which makes it manageable. Drivers who anticipate rate changes, time major decisions strategically, and deploy age-appropriate cost-reduction tactics can save thousands over a lifetime of coverage.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.