Agent reviewing auto and home insurance documents with a customer at a desk

Erie Insurance Review: Is This Regional Carrier Worth Your Business?

Content

Erie Insurance operates in just 12 states and Washington D.C., yet consistently ranks among the top insurers for customer satisfaction. Founded in 1925, this mutual company has built a loyal following through agent relationships and competitive rates—but geographic limitations and a mandatory agent requirement keep it off the radar for many shoppers.

If you live in one of Erie's coverage states, you've probably heard neighbors praise their service or seen their distinctive red logo around town. The question isn't whether Erie has fans—it's whether their model fits your priorities and budget.

What Makes Erie Insurance Different From National Carriers

Erie Insurance Group remains a mutual company, meaning policyholders technically own the business rather than outside shareholders. This structure allows Erie to prioritize long-term customer relationships over quarterly earnings reports, though it doesn't automatically guarantee lower rates or better service.

The company operates through a network of approximately 2,500 independent agents across Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, Wisconsin, and Washington D.C. You cannot buy Erie policies directly online or through call centers—every customer works with a local agent who handles quotes, policy changes, and often serves as the first point of contact for claims.

Erie consistently ranks in the top five nationally for customer satisfaction despite its regional footprint. The company insures roughly 6 million policies and employs about 6,000 people, with headquarters in Erie, Pennsylvania. Annual revenue exceeds $9 billion, making Erie a mid-sized carrier compared to giants like State Farm or Geico, but substantially larger than many regional competitors.

The agent-only model creates a different shopping experience. You won't get instant online quotes at 2 AM, but you will have a dedicated contact who knows your coverage history. For customers who value that relationship—especially when filing complex claims—Erie's approach offers clear advantages. For digital-first shoppers who want to compare five quotes in an hour, it creates friction.

Erie Insurance Coverage Options Breakdown

Auto Insurance Policies and Add-Ons

Author: Brandon Whitaker;

Source: trialstribulations.net

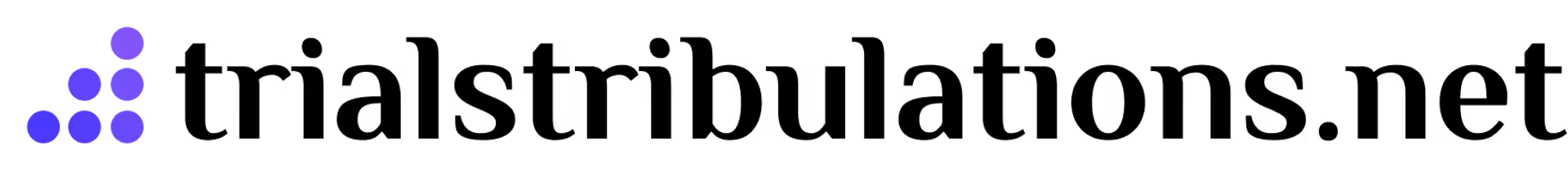

Erie offers standard liability, collision, and comprehensive coverage with several noteworthy add-ons. Rate Lock guarantees your premium won't increase for one year after a claim or violation, provided you remain claim-free during that period—a feature that can save hundreds if you have a single at-fault accident.

The company's auto policies include:

- Liability coverage with limits up to $500,000 per person and $1 million per accident

- Uninsured/underinsured motorist protection

- Medical payments coverage

- Rental car reimbursement up to $50 per day

- Roadside assistance with unlimited towing to the nearest qualified repair facility

- Custom equipment coverage for aftermarket modifications

Erie's Rate Lock Plus extends the guarantee to three years for an additional premium. Accident Forgiveness prevents rate increases after your first at-fault accident, though eligibility typically requires five years of claim-free driving. The company also offers a diminishing deductible that reduces your collision and comprehensive deductibles by $100 for each year without a claim, up to $500.

Gap coverage and new car replacement are available but come with strict eligibility windows—typically within the first two model years and subject to mileage caps. Erie does not offer usage-based insurance programs that track your driving through a mobile app, which means safe drivers who want to prove their habits through telematics will miss potential savings.

Erie’s biggest advantage isn’t size — it’s consistency. In the states where it operates, the company pairs strong financial stability with high claims satisfaction, which explains why it routinely outperforms national brands in customer surveys despite its limited footprint.

— Laura Bennett, Property & Casualty Insurance Analyst

Homeowners and Property Coverage

Erie's homeowners policies use replacement cost valuation for both dwelling and personal property, avoiding the depreciation disputes common with actual cash value policies. The company offers guaranteed replacement cost coverage that pays to rebuild your home even if construction costs exceed your policy limit, though this endorsement requires homes to meet certain maintenance and age standards.

Standard homeowners coverage includes:

- Dwelling protection with extended replacement cost up to 125% of the policy limit

- Personal property coverage at 50-70% of dwelling coverage

- Loss of use coverage for temporary housing during repairs

- Personal liability up to $500,000 (higher limits available)

- Medical payments to others ($1,000-$5,000)

- Built-in identity theft resolution services

Erie's ERIE Secure Home endorsement bundles several protections: water backup coverage up to $25,000, equipment breakdown coverage for home systems, and coverage for refrigerated property if your power goes out. This package costs less than adding each endorsement separately and addresses common claim scenarios that standard policies exclude.

The company writes coverage for homes up to $3 million in value and offers separate policies for rental properties, condos, and mobile homes. Flood and earthquake coverage require separate policies through Erie's partnerships with specialty carriers.

One limitation: Erie applies stricter underwriting standards for older homes and certain roof types. Homes with roofs over 20 years old may face coverage restrictions or requirements for inspection and certification before binding coverage. Some agents report that Erie declines homes with polybutylene plumbing or aluminum wiring unless these systems have been replaced.

Life and Business Insurance Products

Author: Brandon Whitaker;

Source: trialstribulations.net

Erie sells term, whole, and universal life insurance products through its agents, with coverage amounts up to $10 million depending on age and health. The company offers simplified issue policies for smaller amounts that require no medical exam, though rates reflect the reduced underwriting.

Business insurance options include:

- Business owner's policies (BOP) combining property and liability

- Commercial auto for vehicles used in business operations

- Workers' compensation in most Erie states

- Professional liability for select industries

- Commercial umbrella coverage

Erie's business insurance serves small to mid-sized operations—think local contractors, retail shops, and professional offices. The company doesn't compete aggressively for large commercial accounts or specialized industries like restaurants or manufacturing. Agents often describe Erie's business insurance as straightforward but not particularly innovative, with fewer endorsement options than specialty commercial carriers.

How Erie's Pricing Compares Across Its 12-State Footprint

Erie's rates vary significantly by state due to local regulations, competition, and claim patterns. The company often prices below national averages in Pennsylvania, Ohio, and Indiana, where it has the deepest market penetration and longest operating history. In states where Erie entered more recently—like North Carolina and Tennessee—rates tend to align closer to market averages.

Several factors affect your specific premium:

- Credit-based insurance score (in states where permitted)

- Claims history over the past five years

- Coverage limits and deductible selections

- Multi-policy and multi-vehicle discounts

- Home safety features and security systems

- Vehicle safety ratings and anti-theft devices

Erie offers discounts worth noting: a 10% reduction for bundling home and auto, up to 20% off for vehicles with advanced safety features, and 5-10% for completing defensive driving courses. The company also discounts premiums for paid-in-full policies and for setting up automatic payments.

| State | Average Annual Auto Premium | Average Annual Home Premium | Notes |

| Pennsylvania | $1,240 | $1,180 | Erie's home state; most competitive rates |

| Ohio | $1,310 | $1,290 | Strong market presence; below state average |

| Indiana | $1,380 | $1,420 | Competitive in urban areas |

| Maryland | $1,620 | $1,450 | Higher liability limits drive auto costs |

| North Carolina | $1,450 | $1,380 | Rate-regulated state; limited variance |

| Virginia | $1,510 | $1,520 | Competitive for good drivers |

| Tennessee | $1,580 | $1,640 | Newer market; rates near competitors |

| New York | $1,890 | $1,720 | Downstate rates significantly higher |

| Illinois | $1,520 | $1,490 | Urban/rural split creates wide variance |

| Kentucky | $1,680 | $1,560 | Competitive for bundled policies |

| West Virginia | $1,440 | $1,380 | Limited agent network in rural areas |

| Wisconsin | $1,370 | $1,510 | Strong presence in southeastern region |

Sample profiles: 35-year-old driver with clean record, 2020 Honda Accord, 100/300/100 liability, $500 deductibles; $250,000 home built in 2000, $1,000 deductible, replacement cost coverage. Actual rates vary based on individual factors.

The table shows Erie generally prices competitively in its core states but doesn't always beat every competitor. In Pennsylvania and Ohio, Erie frequently appears in the bottom three quotes for middle-aged drivers with clean records. In states like New York and Tennessee, Erie often lands in the middle of the pack.

Your mileage varies based on your specific risk profile. Younger drivers (under 25) report mixed results—Erie sometimes offers aggressive rates to build market share, while other times prices conservatively. Drivers with one accident or violation often find Erie more forgiving than some national carriers, particularly if they've been customers for several years before the incident.

Erie Insurance Claims Process: What Customers Actually Experience

Author: Brandon Whitaker;

Source: trialstribulations.net

Erie's claims satisfaction scores consistently rank above industry averages, but the experience depends partly on your agent's involvement and the complexity of your claim.

The basic claims process works like this:

- Report the claim through your agent, Erie's 24/7 claims line (1-800-458-0811), or the mobile app

- An Erie claims representative contacts you within 24 hours (often sooner for urgent claims)

- For auto claims, Erie directs you to a network repair shop or allows you to choose your own

- An adjuster inspects damage in person or through photos submitted via the app

- Erie issues payment for approved repairs, minus your deductible

For straightforward claims—a hailstorm dents your car, a tree falls on your roof—Erie typically processes everything within a week. Customers report receiving inspection appointments within 2-3 days and payment within 1-2 days after the adjuster approves repairs.

Complex claims take longer. If liability is disputed in a multi-vehicle accident, Erie's investigation can extend several weeks. Water damage claims that require mold remediation and extensive reconstruction sometimes stretch 30-60 days from initial report to final payment, though Erie pays for temporary housing during repairs.

Erie's mobile app lets you submit photos, track claim status, and communicate with your adjuster. The app works well for simple photo documentation but struggles with complex claims requiring multiple estimates or specialist inspections. Some customers report frustration when the app shows limited status updates while their adjuster handles negotiations behind the scenes.

The company operates several drive-in claims centers in major markets where you can get same-day estimates without an appointment. These centers speed up the process for auto claims considerably—you can drive in, get a detailed estimate in 30-45 minutes, and authorize repairs immediately.

One common complaint: Erie sometimes requires customers to obtain multiple estimates for home repairs, even when the initial estimate seems reasonable. This policy protects against inflated contractor bids but adds days to the process and frustrates homeowners dealing with storm damage or burst pipes.

Erie's settlement patterns lean toward repair rather than total loss for vehicles, which benefits owners attached to their cars but sometimes results in vehicles with diminished value after extensive repairs. The company will negotiate diminished value claims in states where required, but customers often need to push for this additional compensation.

Customer Satisfaction and Financial Strength Ratings

Author: Brandon Whitaker;

Source: trialstribulations.net

Erie Insurance earns consistently high marks from third-party rating organizations, though some metrics show room for improvement.

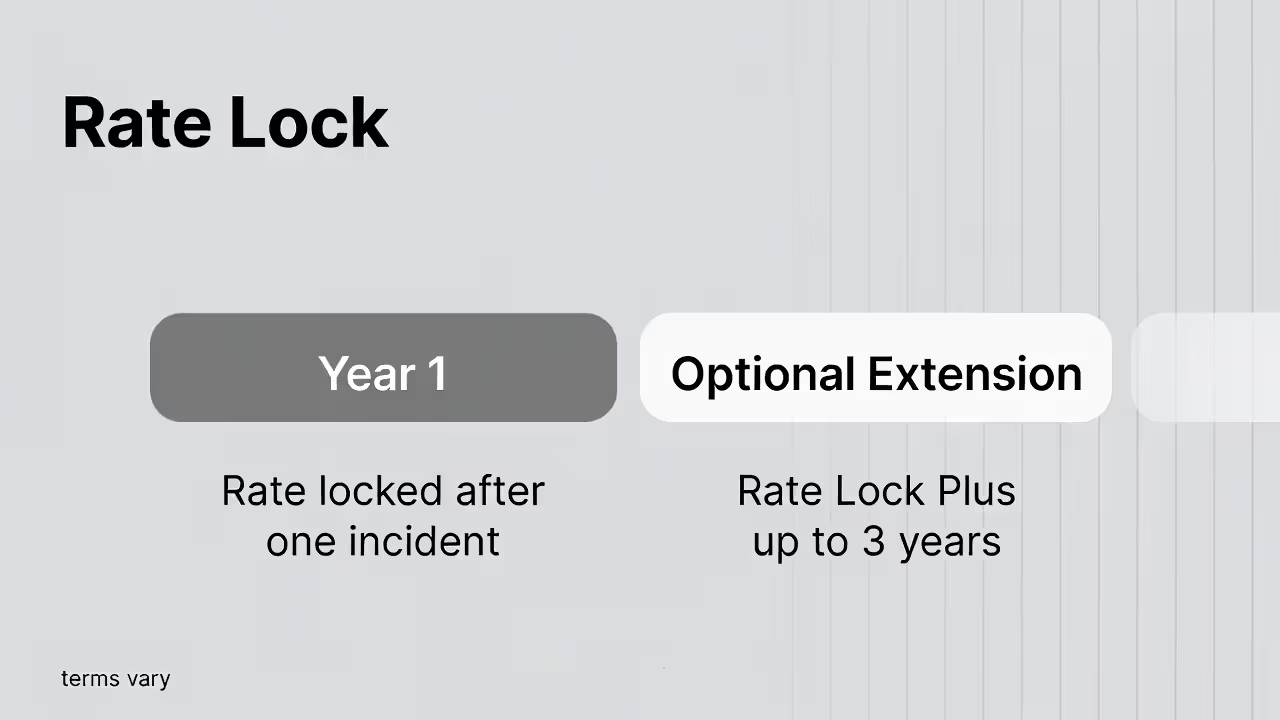

J.D. Power ranked Erie second nationally for auto insurance customer satisfaction in 2023, with a score of 860 out of 1,000—well above the industry average of 826. Erie scored particularly high in policy offerings, billing and payment, and interaction with the company. The company ranked fourth for home insurance satisfaction, with strong marks for claims handling but lower scores for price competitiveness.

AM Best assigns Erie an A+ (Superior) rating for financial strength, the second-highest possible grade. This rating indicates Erie has excellent ability to meet its ongoing insurance obligations. The company maintains a surplus cushion well above regulatory requirements and has posted consistent profitability over the past decade.

The National Association of Insurance Commissioners (NAIC) complaint index measures how many complaints a company receives relative to its market share. A score of 1.0 means the company receives the expected number of complaints; above 1.0 indicates more complaints than expected. Erie's complaint index sits at 0.64 for auto insurance and 0.58 for homeowners insurance—meaning Erie receives significantly fewer complaints than its market share would predict.

The Better Business Bureau gives Erie an A+ rating based on complaint volume, response to complaints, and business practices. The company has resolved 94% of complaints filed through BBB channels within the past three years.

| Company | J.D. Power Auto Score | AM Best Rating | NAIC Complaint Index (Auto) | BBB Grade |

| Erie Insurance | 860 | A+ | 0.64 | A+ |

| State Farm | 826 | A++ | 0.88 | A+ |

| Geico | 838 | A++ | 1.02 | A+ |

| Progressive | 818 | A+ | 0.91 | A+ |

| Allstate | 808 | A+ | 1.06 | A+ |

| Nationwide | 822 | A+ | 0.95 | A+ |

Sources: J.D. Power 2023 U.S. Auto Insurance Study, AM Best 2024 ratings, NAIC 2023 complaint data, BBB ratings as of 2024

These ratings paint Erie as a financially stable company with above-average customer satisfaction and below-average complaint rates. The company doesn't achieve the top financial strength rating (A++) that some larger carriers hold, but the A+ rating indicates strong financial health with minimal risk of insolvency.

Consumer reviews on independent sites show a similar pattern. Erie earns 4.2-4.5 stars on most platforms, with praise focused on agent relationships and claims service, while criticism centers on limited availability, mandatory agent interaction for policy changes, and occasional premium increases at renewal.

Erie’s agent-driven approach creates a more personalized experience, especially during claims when having a dedicated advocate can make a real difference. However, drivers who prefer fully digital tools and instant self-service options may find the process less convenient than with direct-to-consumer insurers.

— Michael Turner, Insurance Market Strategist

Erie Insurance Pros and Cons: The Honest Assessment

Key Advantages

Strong claims satisfaction with local agent support. Erie's combination of responsive claims adjusters and involved local agents creates a safety net when you need help most. Customers consistently report that their agent checks in during claims, helps navigate disputes, and advocates for fair settlements. This matters most for complex claims where having an experienced professional in your corner makes a tangible difference.

Competitive pricing in core markets. If you live in Pennsylvania, Ohio, or Indiana and fit Erie's preferred profile—homeowner, good credit, clean driving record, multiple policies—you'll often find Erie among your cheapest options. The company's deep roots in these states translate to better risk data and more aggressive pricing.

Rate Lock protection prevents post-accident spikes. Most insurers increase your premium substantially after an at-fault accident. Erie's Rate Lock feature guarantees your rate for one year after the incident, buying you time to improve your record before facing an increase. This can save $300-$600 compared to immediate surcharges.

Replacement cost coverage standard on home policies. Erie doesn't play games with actual cash value depreciation on your belongings. If your five-year-old couch gets destroyed in a fire, Erie pays to buy a comparable new couch, not the depreciated value of used furniture. This difference can mean thousands of dollars in a total loss.

Financial stability with mutual company structure. Erie's A+ rating and mutual ownership mean the company focuses on long-term policyholder satisfaction rather than maximizing shareholder returns. While this doesn't guarantee better service, it aligns the company's incentives with customer retention.

Significant Drawbacks

Author: Brandon Whitaker;

Source: trialstribulations.net

Limited to 12 states and Washington D.C. If you live anywhere else in the country, Erie isn't an option. Even within coverage states, some rural counties have limited agent representation, making it difficult to access service without driving 30+ miles.

No direct online purchase or quote comparison. You must contact an agent to get a quote, which adds friction to the shopping process. If you want to compare quotes from five carriers in one evening, Erie's model forces you to schedule a call or meeting, slowing your research.

Mandatory agent relationship for policy changes. Simple tasks like updating your address or adding a vehicle require contacting your agent rather than logging into a website. For customers who prefer self-service digital tools, this feels outdated and inconvenient.

No usage-based insurance programs. Erie doesn't offer telematics programs that monitor your driving to offer discounts. Safe drivers who rarely drive at night or exceed speed limits miss opportunities to prove their low-risk behavior and reduce premiums by 15-30%.

Stricter underwriting for older homes and certain roof types. If your home has an aging roof, older plumbing, or other maintenance issues, Erie may decline coverage or require expensive updates before binding a policy. This makes Erie less accessible for budget-conscious homeowners with older properties.

Premium increases at renewal can be abrupt. While Erie generally offers competitive initial rates, some customers report significant increases at renewal—sometimes 15-20%—without claims or violations. The company attributes this to overall rate adjustments filed with state regulators, but it creates sticker shock for loyal customers.

Who Should Choose Erie Insurance (And Who Shouldn't)

Erie makes the most sense for homeowners in Pennsylvania, Ohio, Indiana, Maryland, Virginia, or North Carolina who value agent relationships and plan to bundle multiple policies. If you own a newer home, drive newer vehicles, maintain good credit, and have a clean driving record, Erie will likely quote competitive rates and deliver strong service.

The ideal Erie customer:

- Lives in one of Erie's core states with good agent density

- Prefers speaking with a dedicated agent rather than navigating automated systems

- Plans to bundle home and auto insurance for maximum discounts

- Has a clean driving record or only minor violations several years old

- Owns a well-maintained home built within the past 20 years

- Values claims service quality over rock-bottom premiums

Erie works less well for certain customer profiles. Young drivers under 25 often find better rates with companies that offer usage-based insurance or good student discounts. Renters who only need auto insurance miss Erie's strongest value proposition—the bundling discount. Urban customers who rarely drive may pay less with pay-per-mile insurance programs that Erie doesn't offer.

Skip Erie if you:

- Live outside Erie's 12-state coverage area

- Want to manage your entire policy through a mobile app without agent contact

- Drive very little and want usage-based insurance

- Own an older home with deferred maintenance or aging systems

- Prefer to shop online and compare multiple quotes instantly

- Have a complex driving history and need a high-risk specialist

Erie also struggles to compete for customers who prioritize cutting-edge technology. The company's mobile app covers basic functions but lacks features like accident detection, dashcam integration, or AI-powered claims photo analysis that some competitors offer. If you want the most advanced digital insurance experience, Erie will feel a generation behind.

The agent requirement cuts both ways. Customers who develop strong relationships with their agents—who call them by name, remember their coverage history, and proactively suggest improvements—rave about Erie's model. Customers who get paired with an unresponsive or disorganized agent face frustration with no easy way to switch agents or manage policies independently.

Before committing to Erie, request quotes from at least three competitors. Erie's rates vary significantly based on individual factors, and the only way to know if Erie offers the best value for your situation is direct comparison. Ask your Erie agent to explain exactly what discounts you qualify for and how your rate might change after the first year.

Frequently Asked Questions About Erie Insurance

Erie Insurance delivers on its core promise: strong claims service and competitive rates in its coverage states, supported by local agents who know your name. The company's mutual structure, financial strength, and consistent customer satisfaction ratings demonstrate a stable insurer focused on long-term relationships rather than quarter-to-quarter growth.

The trade-offs are clear. Erie's geographic limitations, mandatory agent model, and lack of usage-based insurance programs make it a poor fit for many shoppers. But for homeowners in Erie's footprint who value personal relationships and plan to bundle policies, Erie frequently offers compelling value.

Your decision comes down to priorities. If you want the cheapest possible rate regardless of service quality, Erie may not win. If you want cutting-edge mobile apps and complete self-service, Erie will frustrate you. But if you want an insurer that answers the phone, handles claims fairly, and treats you like a person rather than a policy number, Erie deserves serious consideration—assuming you live in one of their 12 states.

Request quotes from Erie and at least two competitors. Compare not just the premium but the coverage details, deductibles, and available endorsements. Ask the Erie agent specific questions about how your rate might change at renewal and what discounts you qualify for. The extra 30 minutes of research can save you hundreds annually while ensuring you get coverage that actually protects your assets when you need it most.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.