Independent insurance agent reviewing quote comparison documents with a customer in an office

Auto Owners Insurance Review: Coverage, Costs, and Customer Experience

Content

You won't find Auto Owners Insurance commercials during Sunday Night Football. The company doesn't offer instant online quotes, and you can't buy a policy from their website at midnight. Since 1916, this Lansing, Michigan-based insurer has stuck with one distribution channel: independent insurance agents. About 2.6 million people across two dozen states trust Auto Owners with their coverage, often because an agent recommended them—not because they saw a gecko or heard a jingle.

This review examines whether that old-school approach still makes sense in 2024, breaking down what you'll actually pay, how claims get handled, and whether the agent requirement helps or hurts your wallet.

What Makes Auto Owners Insurance Different from Other Carriers

Here's what sets Auto Owners apart: you cannot buy their insurance without talking to an agent. Their website won't spit out a quote. No chatbot will walk you through coverage options. Roughly 6,000 independent agents across their service area handle every policy sale, and these agents typically represent multiple insurance companies—not just Auto Owners.

This creates an interesting dynamic. Your agent can (and should) compare Auto Owners against their other carriers to find you the best deal. But it also means no 2 a.m. quote shopping from your couch. Everything happens during business hours, through a real person.

The company currently sells policies throughout these regions: the Southeast (Alabama, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, West Virginia), the Midwest (Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Nebraska, North Dakota, Ohio, South Dakota, Wisconsin), and selective Western markets (Arizona, Arkansas, Colorado, Idaho, Pennsylvania, Utah). Live in Texas, Florida, California, or New York? You're out of luck. Even within covered territory, some counties or ZIP codes remain off-limits based on risk factors the company won't insure.

One structural difference matters: Auto Owners operates as a mutual company. Policyholders technically own it, not Wall Street shareholders. Does this translate to cheaper rates? Not necessarily. But it removes quarterly earnings pressure that sometimes pushes publicly traded insurers toward aggressive rate increases.

Coverage Options and Policy Flexibility

Standard Auto and Home Policies

Author: Calvin Prescott;

Source: trialstribulations.net

Auto Owners sells the coverage you'd expect. Liability protection starts at state minimums (often 25/50/25) and scales up to 500/500/500 for drivers wanting serious protection. Collision and comprehensive deductibles run from $100 to $2,500, though most people pick $500 or $1,000. Medical payments, uninsured motorist coverage, and roadside assistance round out the typical auto policy.

Homeowners insurance includes dwelling coverage, personal property protection, liability, and loss-of-use payments if you can't live in your home during repairs. The company writes HO-3 forms for houses, HO-4 policies for apartment renters, HO-6 coverage for condo owners, and HO-8 forms for older homes where rebuilding to exact specifications would cost more than the property's worth.

What works well: Auto Owners lets you mix and match coverage limits instead of forcing you into pre-packaged tiers. Want $250,000 liability on your car but $500,000 on your house? No problem. Need a $2 million umbrella policy sitting on top of both? Your agent can build that stack however it needs to look for your asset protection strategy.

Specialty Coverage Add-ons

Beyond basic auto and home policies, Auto Owners covers motorcycles, boats, RVs, and collector cars. Their classic car program requires vehicles to be at least 25 years old or meet collectible criteria. Most classic policies cap annual mileage around 5,000 miles and offer agreed-value coverage—meaning you and the company decide upfront what the car's worth, eliminating disputes if it gets totaled.

Small business owners can bundle commercial coverage with personal policies. Commercial auto, general liability, property insurance, and workers' comp all flow through the same agent network. This sometimes unlocks better pricing when personal and business coverage connect, plus you get one point of contact instead of juggling multiple insurers.

The company also sells life insurance and annuities, though these fall outside most people's property-casualty shopping. Some agents push these products hard; others never mention them unless you ask.

How Much Does Auto Owners Insurance Cost?

Author: Calvin Prescott;

Source: trialstribulations.net

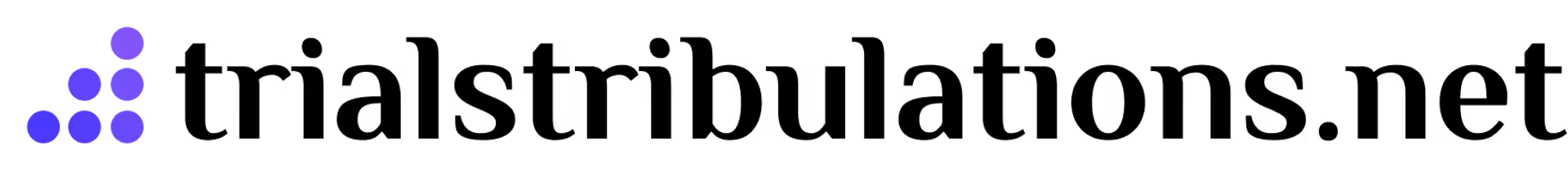

Real talk: your premium depends on dozens of variables. A 35-year-old Ohio driver with a clean record might pay $850 yearly for full coverage on a Honda Accord. That same person in Michigan? Probably $1,700 or more, thanks to that state's no-fault system and unlimited medical coverage requirements. A 22-year-old with a speeding ticket? Add another $800-$1,200 regardless of state.

Auto Owners typically lands in the middle of the price pack. They're rarely the cheapest—Geico and Progressive often undercut them for low-risk drivers. But they're seldom the most expensive either. High-risk drivers sometimes find cheaper rates elsewhere with specialty insurers.

The easiest way to cut your premium? Bundle auto and home coverage. Depending on your state and specific policies, you'll save 15% to 25%. Other discounts you should ask about: multi-vehicle (10-15% off), good student discounts for kids maintaining B averages (up to 25%), and defensive driving course completion (5-10%). Some agents automatically apply these; others won't unless you specifically request them.

Factors That Impact Your Quote

Credit scores drive significant pricing differences in states where insurers can use them. Someone with excellent credit might pay 40% less than their neighbor with poor credit, even if both have spotless driving records. Whether that's fair is debatable. That it's legal in most Auto Owners states isn't.

Your vehicle's safety equipment matters. Anti-lock brakes, multiple airbags, anti-theft systems, and stability control typically earn modest discounts. Newer vehicles with automatic emergency braking, lane-keeping assist, or adaptive cruise control may qualify for additional savings—though you'll need to remind your agent about these features. They don't always check.

Annual mileage creates bigger rate swings than most people realize. Drive 8,000 miles a year? You'll pay considerably less than someone logging 20,000 miles. Started working from home? Retired? Tell your agent and adjust your estimated annual mileage. That change alone could drop your premium 5-15%.

Raising your collision deductible from $500 to $1,000 might save $150-$200 annually. Go five years without filing a claim, and you've banked $750-$1,000—more than enough to cover that higher deductible if you eventually need it. This math works when you've got emergency savings to handle the larger out-of-pocket hit.

Author: Calvin Prescott;

Source: trialstribulations.net

The Independent Agent Model: Pros and Cons

Working through independent agents means getting personalized service from someone who actually knows your local market. Good agents understand why windstorm coverage costs more along the Carolina coast, or why Michigan's no-fault system pushes everyone's rates higher. They review your policies annually, catch coverage gaps before you file a denied claim, and fight for you when disputes arise.

The downside? Speed and convenience take a hit. You can't log into a website, tweak your coverage, and instantly see your new premium. Changes require phone calls, emails, or office visits. Response time varies wildly—some agents reply within hours, others take days. Your experience depends heavily on which agent you pick, and quality ranges from exceptional to mediocre.

Finding an Auto Owners agent is simple enough. Their website has a locator tool—enter your ZIP code, get a list of nearby agents. Most operate small offices with one to five employees. Some work within larger agencies representing 10-15 different insurers; others focus tightly on two or three preferred carriers.

When you're vetting agents, ask how many insurance companies they represent. An agent working with eight carriers has more flexibility to shop your coverage around than someone locked into two. Also ask about their claims involvement. Do they actively help you file and follow up with adjusters, or just hand you a phone number? The best agents manage claims on your behalf, pestering adjusters until your check arrives.

The relationship aspect cuts both ways. Longtime customers often get preferential treatment—agents may fight harder during claims or hunt more aggressively for discounts. New customers haven't built that goodwill yet. On the flip side, some people prefer the anonymity of online insurers where every interaction stays purely transactional.

Auto-Owners proves that a traditional, agent-driven model can still compete in a digital-first market. Its strength isn’t flashy marketing or instant online quotes — it’s financial stability, disciplined underwriting, and long-term agent relationships. For the right customer, that consistency can matter more than convenience.

— Michael Turner, Property & Casualty Insurance Analyst

Claims Process and Settlement Speed

Auto Owners runs a 24/7 claims line at 800-527-2000. You can also report through your agent, though calling the main line directly usually speeds things up. The company typically assigns an adjuster within one business day. For car accidents, expect contact within 24 hours. Property claims—especially after widespread storms—may take longer as adjusters work through backlogs.

The process follows standard industry steps. For auto claims, an adjuster inspects the damage, provides a repair estimate, and issues payment once repairs finish (or pays your body shop directly). Auto Owners maintains preferred repair shop networks but won't force you to use them. Choose a non-network shop, and you'll need to manage any cost disputes with them yourself.

Home claims involve more complexity. Water damage requires immediate documentation—photograph everything before cleanup starts. The adjuster assesses damage, determines what's covered, and issues payment for covered losses minus your deductible. Personal property gets paid at depreciated value unless you bought replacement cost coverage. That five-year-old sofa? You'll receive used-sofa money, not new-sofa money, under standard policies.

Settlement speed depends on claim complexity. Simple windshield replacements might close in days. Total loss vehicles typically settle within two weeks once you've handled the title paperwork. Major home damage—fires, tornadoes, serious water issues—can stretch weeks or months as contractors bid on repairs and work proceeds in phases.

Financial Strength and Customer Satisfaction Ratings

Author: Calvin Prescott;

Source: trialstribulations.net

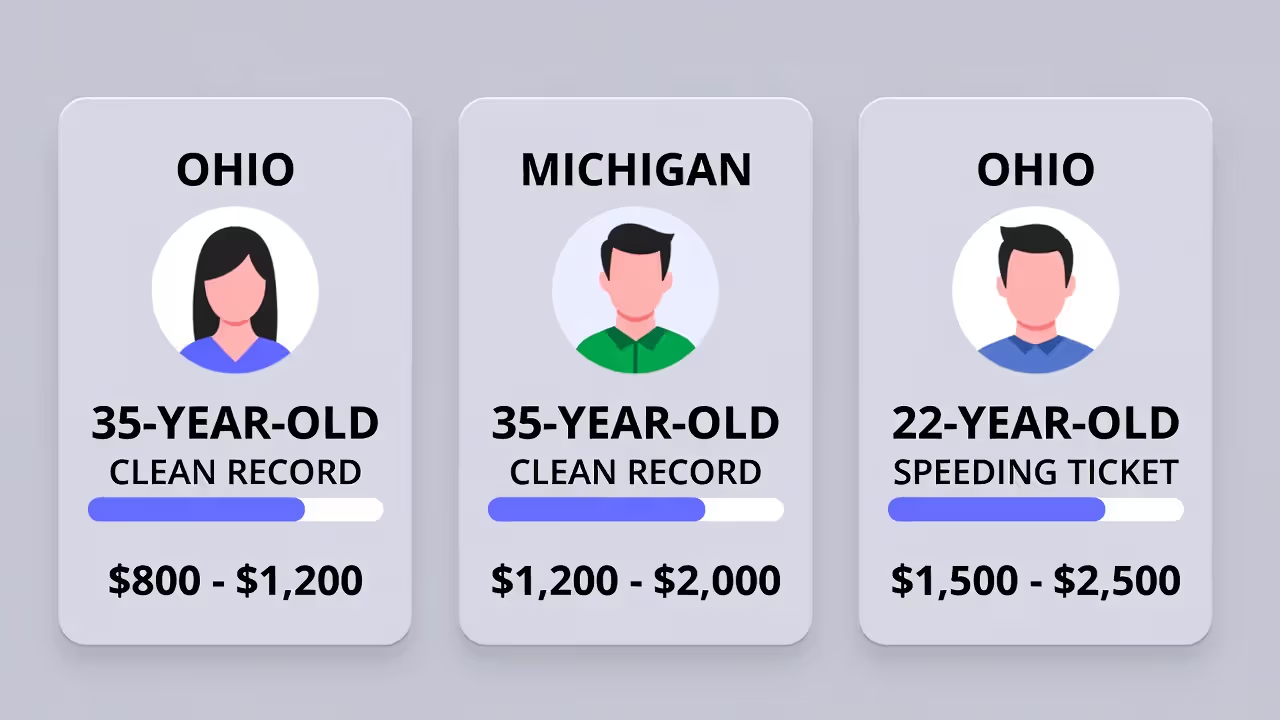

Auto Owners holds an A++ rating from AM Best, the insurance industry's primary financial strength evaluator. That's the highest possible grade, achieved by fewer than 15% of all insurers. The company has maintained this top-tier rating for decades, signaling consistent financial management and claims-paying ability even during catastrophic events.

| What's Being Measured | Auto Owners Result | Typical Industry Result | Why This Matters |

| AM Best's financial strength assessment | A++ (Superior) | A (Excellent) | Shows ability to pay claims during disasters |

| J.D. Power's customer satisfaction survey | 3 out of 5 stars | 3 out of 5 stars | Measures experience across all customer touchpoints |

| NAIC's complaint ratio | 0.68 | 1.00 | Tracks complaint volume relative to company size |

| Better Business Bureau accreditation | A+ grade | Varies by company | Evaluates business practices and dispute resolution |

The NAIC complaint index needs explanation. A score of 1.00 equals average—meaning the company receives exactly the number of complaints you'd expect based on its market share. Scores below 1.00 indicate fewer complaints than expected; above 1.00 means more. Auto Owners' 0.68 translates to 32% fewer complaints than you'd predict, which reflects well on their service.

J.D. Power scores place Auto Owners squarely at industry average—neither impressive nor concerning. The company scores highest in policy variety and billing processes, with lower marks for price competitiveness and digital tools. This matches their agent-centric model: strong traditional service, weaker online experience.

Performance varies by state. Auto Owners performs best in core Midwest markets like Michigan and Ohio, where they've operated longest and maintain the densest agent networks. Newer expansion states sometimes show less competitive pricing as the company builds actuarial data and agent relationships.

Who Should Consider Auto Owners Insurance (And Who Shouldn't)

Author: Calvin Prescott;

Source: trialstribulations.net

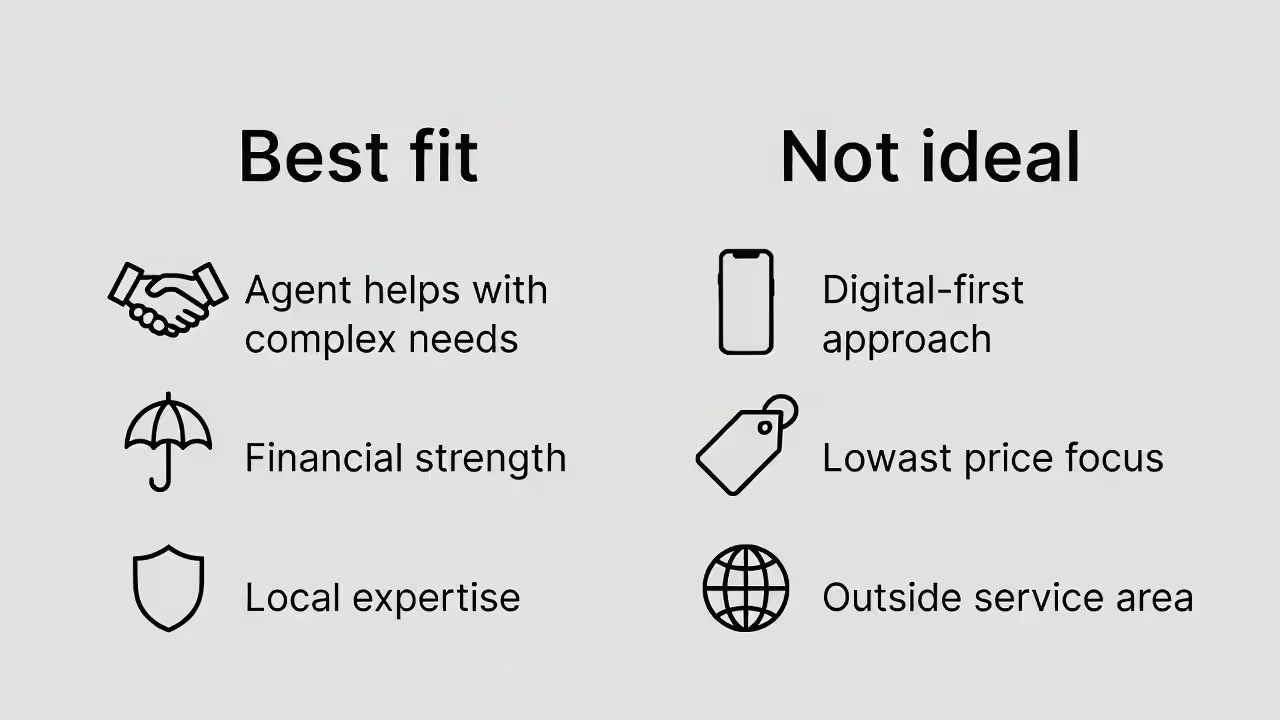

Auto Owners works well for people who prefer face-to-face conversations over app-based interactions. If you'd rather discuss coverage options with a human who'll review your policies annually—and you don't mind the slower pace of agent-mediated transactions—this model fits. Customers with complicated needs (multiple properties, business insurance, classic cars, high-value homes) often benefit most from experienced agent guidance.

The company also appeals to anyone prioritizing financial stability. That A++ rating provides confidence that your claim will get paid even after major disasters wipe out thousands of homes simultaneously. While most large insurers maintain solid ratings, Auto Owners' multi-decade track record offers extra reassurance.

However, tech-focused consumers who expect instant online quotes, mobile app policy management, and 24/7 digital access will find this experience frustrating. Auto Owners' website and mobile app lag years behind direct competitors. You can view policy documents and ID cards digitally, but making coverage changes requires contacting your agent.

Price-sensitive shoppers should compare carefully. Auto Owners rarely offers the absolute lowest rate, particularly for young drivers, single-policy customers, or people with less-than-perfect credit. Direct-to-consumer insurers with sophisticated pricing algorithms frequently beat Auto Owners on price for straightforward, low-risk profiles.

Geography eliminates the company for most Americans. If you live anywhere outside their 26-state service area—including major markets like California, Texas, Florida, or New York—the question becomes irrelevant. Even within covered states, some rural areas or high-risk coastal zones have limited agent availability.

Frequently Asked Questions About Auto Owners Insurance

Auto Owners Insurance fills a particular niche—financially rock-solid, agent-dependent, regionally focused, and traditionally minded. You won't find cutting-edge digital tools or the absolute lowest premiums, but the claims-paying ability and below-average complaint ratios suggest they handle the fundamentals competently.

The agent model creates natural customer selection. People who choose Auto Owners typically value the relationship and hands-on service that agent representation provides. Those hunting for the cheapest possible rate or preferring fully digital interactions pick different carriers. Neither approach is inherently better—the right choice depends on your priorities, where you live, and how you prefer interacting with your insurance company.

Before making a decision, collect quotes from at least three insurers including one direct seller and one other agent-based company. Compare more than just premiums—examine coverage limits, deductibles, and available discounts. Ask agents specific questions about how they support claims and how quickly they typically respond to service requests. The agent you select matters as much as the company they represent.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.