Homeowner and insurance agent reviewing an auto and home insurance policy outside a house with a car in the driveway

American Family Insurance Review: Coverage, Pricing & Customer Experience

Content

American Family Insurance has operated quietly in the Midwest for nearly a century, building a solid regional presence while larger carriers dominate national advertising. For drivers and homeowners in their coverage area, this Madison, Wisconsin-based insurer offers competitive rates and strong local agent support—but geography limits who can buy.

This review examines what American Family delivers: where you can purchase policies, what coverage costs compared to alternatives, how claims get handled, and whether customer ratings justify switching from your current carrier.

What Makes American Family Insurance Different

Founded in 1927 as Farmers Mutual Insurance Company, American Family Insurance (often called AmFam) grew from a small Wisconsin mutual into the 13th-largest property/casualty insurer in the United States. The company serves roughly 19 million policies across multiple states, though it remains significantly smaller than giants like State Farm or Geico.

American Family sells auto, home, life, business, farm, and umbrella insurance. Unlike direct-to-consumer carriers such as Progressive or Geico, AmFam relies heavily on a network of exclusive agents who handle policy sales and service. This agent-focused model appeals to customers who prefer face-to-face conversations over mobile apps, though the company has invested substantially in digital tools over the past five years.

The typical American Family customer lives in the Midwest or Mountain West, owns a home, and values long-term relationships with a local agent. Many policyholders bundle auto and home coverage to capture multi-policy discounts that can reach 20% or more.

American Family targets middle-income households seeking standard coverage rather than high-net-worth clients who need specialized policies for collectibles, fine art, or estates exceeding $2 million. If you drive a 2018 Honda Accord and own a three-bedroom ranch in suburban Wisconsin, you fit their core demographic perfectly.

Where American Family Operates and Who Can Buy

Author: Brandon Whitaker;

Source: trialstribulations.net

American Family writes policies in 19 states, concentrated in the Midwest and Western regions. This limited footprint means most Americans cannot buy coverage from AmFam regardless of interest.

| State | Available | Year Entered Market |

| Arizona | Yes | 1963 |

| Colorado | Yes | 1954 |

| Georgia | Yes | 2012 |

| Idaho | Yes | 1969 |

| Illinois | Yes | 1935 |

| Indiana | Yes | 1960 |

| Iowa | Yes | 1934 |

| Kansas | Yes | 1958 |

| Minnesota | Yes | 1939 |

| Missouri | Yes | 1952 |

| Nebraska | Yes | 1956 |

| Nevada | Yes | 1971 |

| North Dakota | Yes | 1962 |

| Ohio | Yes | 2014 |

| Oregon | Yes | 2014 |

| South Dakota | Yes | 1941 |

| Utah | Yes | 1959 |

| Washington | Yes | 2014 |

| Wisconsin | Yes | 1927 |

Regional concentration creates both advantages and limitations. American Family understands local weather patterns, building codes, and repair costs better than national carriers spreading resources across all 50 states. An agent in Madison knows that Wisconsin hail claims spike in June and July, while Colorado agents prepare for spring wildfire season.

However, if you live in Texas, Florida, California, or New York—states representing nearly one-third of the U.S. population—American Family cannot serve you. Families who relocate frequently may find themselves forced to switch carriers when moving outside AmFam's footprint.

To check eligibility, visit the American Family website and enter your ZIP code. The system immediately confirms whether coverage exists in your area and connects you with a local agent if available.

American Family Insurance sits in a unique position—it’s large enough to offer broad coverage and financial stability, yet regional enough to maintain a strong local agent presence. For customers within its 19-state footprint, the value often comes down to bundling and relationships. If you prioritize personalized service over national scale, AmFam can be a strong contender—just make sure the pricing holds up against competitors.

— Mark Ellison, Insurance Industry Analyst

Coverage Options and Policy Features

Auto Insurance Coverage

American Family auto policies include standard liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. State minimum liability limits apply, but the company recommends 100/300/100 coverage ($100,000 per person for bodily injury, $300,000 per accident, $100,000 for property damage) for adequate protection.

Optional coverages include:

- Accident forgiveness: Prevents rate increases after your first at-fault accident

- New car replacement: Pays full replacement cost for vehicles less than two years old if totaled

- Loan/lease gap coverage: Covers the difference between your car's value and remaining loan balance

- Rideshare coverage: Extends protection when driving for Uber or Lyft

American Family offers usage-based insurance through KnowYourDrive, a telematics program that monitors driving behavior via smartphone app or plug-in device. Safe drivers can earn discounts up to 40% by avoiding hard braking, rapid acceleration, and late-night driving.

Home Insurance Coverage

Homeowners policies cover dwelling, other structures, personal property, loss of use, and liability. American Family writes replacement cost policies that rebuild your home to current specifications without depreciation, assuming you carry adequate coverage limits.

Standard policies exclude flood and earthquake damage. Homeowners in flood zones must purchase separate NFIP policies, while earthquake coverage requires an endorsement adding 10-20% to annual premiums depending on location.

Notable home insurance features include:

- Extended replacement cost: Pays up to 125% of dwelling coverage if rebuilding costs exceed your limit

- Water backup coverage: Covers damage from sewer or drain backups (typically $10,000 limit)

- Identity theft protection: Reimburses expenses related to identity theft up to $25,000

- Green home reconstruction: Pays extra costs to rebuild using energy-efficient materials

American Family recently introduced MyHome, a home insurance product that combines traditional coverage with smart home device discounts. Policyholders who install monitored smoke detectors, water leak sensors, or security systems receive premium reductions.

Life and Specialty Products

Author: Brandon Whitaker;

Source: trialstribulations.net

Beyond auto and home, American Family sells term and whole life insurance, business insurance for small companies, farm and ranch coverage, motorcycle and boat policies, and personal umbrella coverage extending liability protection to $5 million.

Bundling multiple policies with American Family triggers significant discounts. A household carrying auto, home, and umbrella coverage typically saves 15-25% compared to purchasing each policy separately. The company also offers multi-car discounts (up to 20%), good student discounts (up to 15%), and loyalty discounts that increase over time.

How American Family Pricing Compares

American Family premiums fall near the industry average—neither the cheapest option nor the most expensive. Actual costs vary dramatically based on location, driving record, credit score, coverage limits, and deductibles.

Average annual premiums by product:

| Insurance Company | Average Auto Premium | Average Home Premium | Bundling Discount % |

| American Family | $1,678 | $1,456 | 18% |

| State Farm | $1,592 | $1,383 | 17% |

| Allstate | $1,889 | $1,622 | 20% |

| Nationwide | $1,745 | $1,501 | 19% |

These figures represent national averages compiled from industry data. Your actual premium depends on dozens of rating factors.

Auto insurance pricing factors:

- Age and gender (young male drivers pay the most)

- Driving record (accidents and tickets increase rates 20-40%)

- Annual mileage (commuting 30 miles daily costs more than 10 miles)

- Vehicle make and model (repair costs and theft rates matter)

- Credit score (poor credit can double premiums in most states)

- Coverage limits and deductibles (higher deductibles lower premiums)

Home insurance pricing factors:

- Home age and construction type (older homes with outdated electrical systems cost more)

- Roof condition (roofs over 15 years old face surcharges or coverage restrictions)

- Claims history (multiple claims within three years trigger rate increases)

- Distance to fire station (homes more than five miles away pay higher premiums)

- Deductible amount (raising deductibles from $500 to $2,500 cuts premiums 25-30%)

American Family offers numerous discounts that can significantly reduce premiums:

- Multi-policy discount: Bundle auto and home for 15-20% savings

- Multi-car discount: Insure multiple vehicles for up to 20% off

- Good driver discount: No accidents or tickets for three years earns 10-15% off

- Good student discount: Full-time students with B average or better save up to 15%

- Defensive driving discount: Complete approved course for 5-10% reduction

- Pay-in-full discount: Pay annual premium upfront for 5% savings

- Paperless discount: Enroll in electronic documents for $25-50 annual savings

- Homeownership discount: Auto insurance costs less for homeowners

- Anti-theft device discount: Install approved alarm systems for 5-10% off

Stacking multiple discounts can reduce premiums by 40% or more. A 45-year-old homeowner with clean driving record, bundled policies, and paid-in-full annual premium might pay $900 annually for auto coverage that would otherwise cost $1,500.

Claims Process and Settlement Speed

Author: Brandon Whitaker;

Source: trialstribulations.net

American Family handles claims through local agents, a 24/7 phone hotline, mobile app, or website portal. Most policyholders prefer calling their agent first, who guides them through the process and acts as an advocate during settlement negotiations.

Filing a claim:

- Report the incident within 24 hours (delays can jeopardize coverage)

- Provide details: date, time, location, parties involved, police report number

- Upload photos of damage through the mobile app

- Receive claim number and adjuster assignment

- Schedule vehicle or home inspection

- Review settlement offer and negotiate if necessary

- Receive payment via check or direct deposit

American Family settles most auto claims within 7-10 business days for straightforward accidents with clear liability. Complex claims involving injuries, disputed fault, or extensive property damage can take 30-60 days or longer.

Home insurance claims follow similar timelines, though major losses like fires or severe storm damage require more extensive investigation. Emergency repairs (tarping a roof, boarding windows) get approved immediately to prevent further damage, with full settlement coming later.

The company operates drive-in claims centers in major metropolitan areas where adjusters inspect vehicles without appointments. This convenience speeds the process—you can have damage assessed, rental car arranged, and repair shop selected within two hours.

American Family's mobile app includes a photo estimator tool that uses artificial intelligence to assess minor damage and provide instant settlement offers. For small claims under $2,000, this feature eliminates the need for in-person inspections entirely.

Customer Ratings and Complaint Records

Author: Brandon Whitaker;

Source: trialstribulations.net

American Family earns mixed ratings across different evaluation metrics. The company performs well in financial strength but receives mediocre scores for customer satisfaction and complaint frequency.

J.D. Power scores:

American Family ranked 10th out of 23 carriers in the 2023 U.S. Auto Insurance Study with a score of 818 out of 1,000 (industry average: 826). The company scored above average for policy offerings but below average for price and billing.

In the 2023 U.S. Home Insurance Study, American Family ranked 12th out of 24 carriers with a score of 803 out of 1,000 (industry average: 813). Customers rated the company average or slightly below in all measured categories.

NAIC complaint index:

The National Association of Insurance Commissioners tracks complaints relative to market share. A score of 1.0 represents the expected complaint level; scores above 1.0 indicate more complaints than expected.

American Family's 2022 NAIC complaint ratios:

- Auto insurance: 1.08 (8% more complaints than expected)

- Homeowners insurance: 0.92 (8% fewer complaints than expected)

These figures place American Family near the industry median—neither exceptionally good nor notably problematic.

BBB rating:

The Better Business Bureau assigns American Family an A+ rating based on complaint resolution and business practices. Common complaint themes include:

- Claim settlement disputes (disagreements over repair costs or coverage denials)

- Premium increases after renewals (rates jumping 15-25% without claims)

- Communication delays (difficulty reaching adjusters or receiving status updates)

- Policy cancellations (non-renewal notices in high-risk areas)

Most complaints get resolved through BBB mediation, with American Family responding to 94% of complaints within 14 days.

Financial strength ratings:

AM Best assigns American Family an A (Excellent) rating, indicating strong financial stability and ability to pay claims. This rating has remained stable for over 20 years.

Moody's rates American Family A2, while Standard & Poor's assigns an A rating. These investment-grade ratings confirm the company maintains adequate reserves and conservative investment practices.

Author: Brandon Whitaker;

Source: trialstribulations.net

Pros and Cons: Is American Family Right for You?

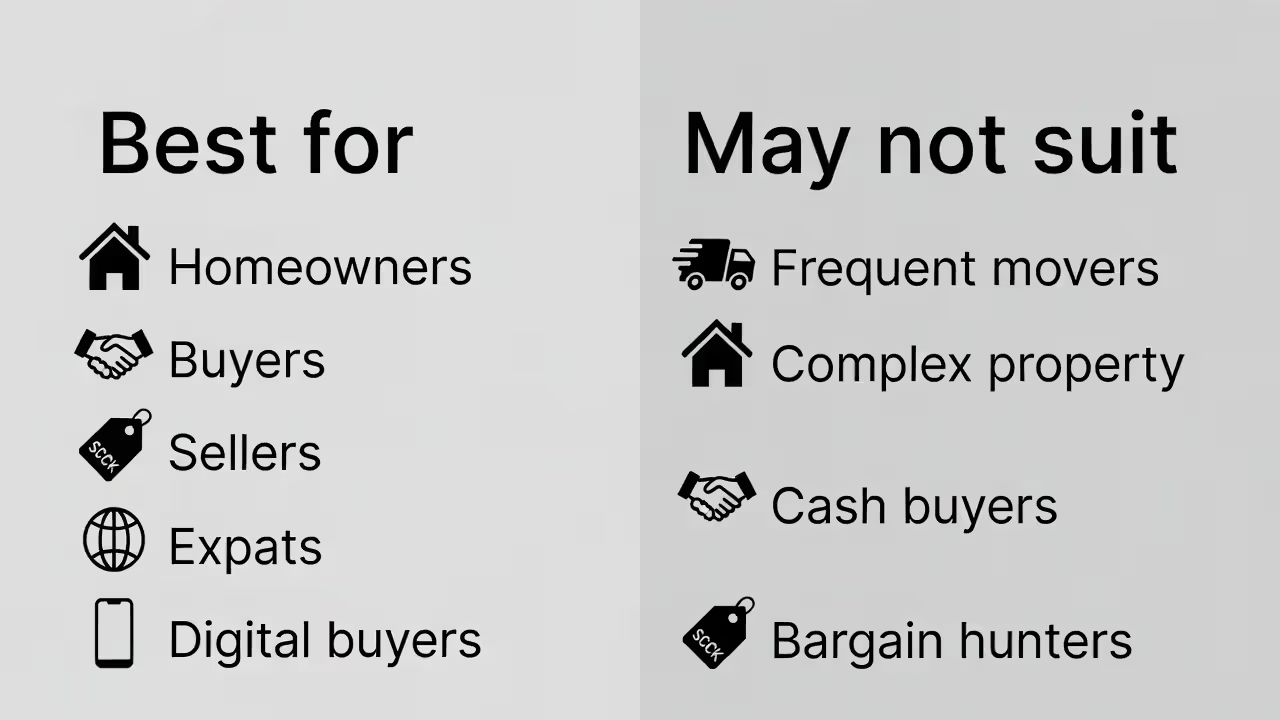

American Family works best for:

- Midwest and Mountain West residents who value local agent relationships

- Homeowners seeking bundled auto and home coverage with substantial discounts

- Drivers with clean records who qualify for multiple discounts

- Customers who prefer traditional service over purely digital interactions

- Policyholders planning to stay in coverage areas long-term

A 35-year-old married couple in suburban Denver owning a home and two vehicles represents American Family's ideal customer. They benefit from bundling discounts, multi-car savings, and homeownership discounts while working with a local agent who understands Colorado weather risks.

American Family may not suit:

- Residents of states outside the 19-state coverage area

- Drivers with accidents or tickets seeking the absolute lowest rates (high-risk specialists like The General may cost less)

- Tech-focused customers who want cutting-edge mobile apps and online features

- Frequent movers who relocate across state lines every few years

- High-net-worth individuals needing specialized coverage for valuable assets

A 22-year-old single driver with a recent speeding ticket living in California cannot buy American Family coverage regardless of interest. Even within coverage areas, young drivers with imperfect records often find cheaper options through direct writers like Geico or Progressive.

Competitive comparison:

American Family competes directly with State Farm, Allstate, and Nationwide in its coverage territory. State Farm offers similar agent-based service with broader availability and slightly lower average premiums. Allstate provides comparable coverage but typically charges 10-15% more. Nationwide matches American Family's product lineup and pricing while operating in more states.

Regional carriers like Auto-Owners Insurance (Midwest) and PEMCO (Pacific Northwest) sometimes beat American Family on price within specific states. Shopping multiple quotes remains essential—premium differences of 30-40% for identical coverage occur regularly.

Frequently Asked Questions

American Family Insurance delivers solid, middle-of-the-road coverage backed by strong financial stability and local agent support. The company cannot compete with national carriers on availability or cutting-edge technology, but it serves its regional customer base competently with competitive pricing and comprehensive product offerings.

For eligible households prioritizing agent relationships and bundling discounts over rock-bottom prices or digital-first service, American Family deserves serious consideration. Request quotes from American Family alongside two or three competitors to determine whether this regional carrier offers the best value for your specific situation. Premium differences of hundreds or even thousands of dollars annually make comparison shopping worthwhile regardless of carrier reputation or brand familiarity.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.