Insurance declarations page highlighting liability, collision, and comprehensive coverages with deductibles.

What Does Full Coverage Auto Insurance Actually Mean? A Complete Breakdown for US Drivers

Content

Walk into any insurance agency and ask for "full coverage," and your agent will know exactly what you mean—even though no insurance company actually sells a product with that name. This widely-used shorthand describes a specific bundle: your state's mandatory liability requirements combined with two optional protections that cover damage to your own vehicle—collision and comprehensive insurance.

The insurance industry adopted this casual terminology because it's easier than explaining "liability insurance with added collision and comprehensive physical damage coverages, each with separately chosen deductibles." But this convenience comes at a cost. Many vehicle owners believe "full" means absolute protection against every possible loss, only to discover critical gaps after filing a claim.

Here's what makes the term misleading: two drivers can both claim they have "full coverage" while carrying vastly different protection levels. One might carry $500,000 in liability limits with $250 deductibles on comprehensive and collision. Another might barely meet their state's $25,000 minimum liability requirement while adding the same physical damage protections. Both technically have "full coverage," yet one faces dramatically more financial exposure.

Your insurance company's policy documents won't reference "full coverage" at all. Instead, you'll see itemized listings for bodily injury liability, property damage liability, collision, and comprehensive—separate coverages you've selected and bundled together. Recognizing this distinction helps you make informed decisions about which protections you actually need and which marketing terms deserve scrutiny.

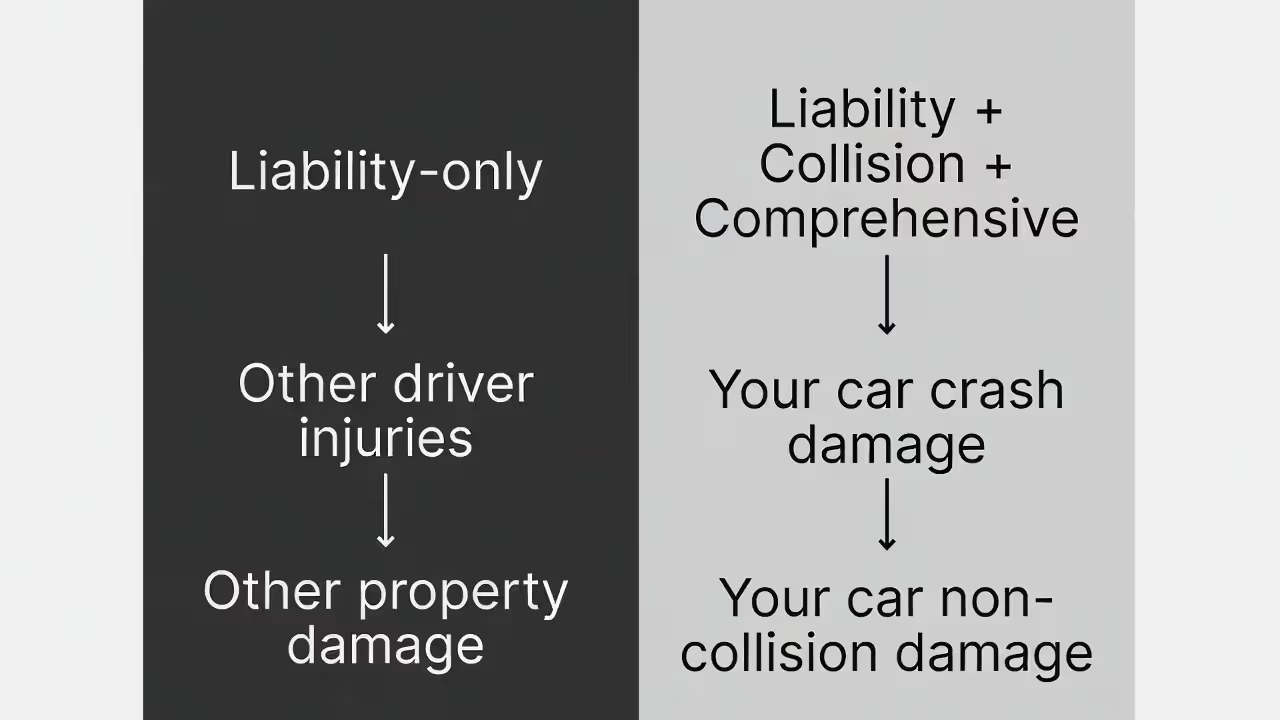

Liability vs Full Coverage: What Each Policy Actually Covers

These two approaches represent fundamentally different insurance philosophies. Liability protection guards against financial damage you cause to others. Adding collision and comprehensive means you're also protecting your own vehicle investment, creating the package commonly called full coverage.

Author: Calvin Prescott;

Source: trialstribulations.net

What Liability Insurance Covers (and What It Doesn't)

Standard liability policies divide into two sections: bodily injury and property damage. When you cause an accident, these coverages handle the other party's expenses—their medical treatment, vehicle repairs, lost income during recovery, and legal costs if they file suit against you. Your policy's legal defense provision protects you in court, even if the lawsuit proves baseless.

The critical limitation: liability never covers your own vehicle. After causing a fender-bender, your insurance handles the other driver's $3,500 repair bill, but you're writing a personal check to fix your own car. A deer runs into your path? You're covering those repairs yourself. Return to your parking spot to find someone scratched obscenities into your paint? Liability won't help. Wake up to discover your vehicle has been stolen? You've lost that investment entirely.

State governments establish minimum liability requirements—usually ranging from $25,000 to $50,000 per injured person, with separate minimums for property damage. These baseline amounts rarely prove adequate for serious collisions. Medical bills from a single severe injury can surpass $100,000 before rehabilitation even begins. When damages exceed your limits, injured parties can pursue your personal assets through civil court.

Carrying only liability makes financial sense in specific situations: you're driving a 2009 vehicle with 175,000 miles worth perhaps $2,500. Even if an insurance payout came through, you'd receive maybe $2,000 after your deductible. At that point, you're essentially betting on your own careful driving while maintaining protection against lawsuits—letting the vehicle's low value absorb the risk of damage.

What Gets Added with Full Coverage

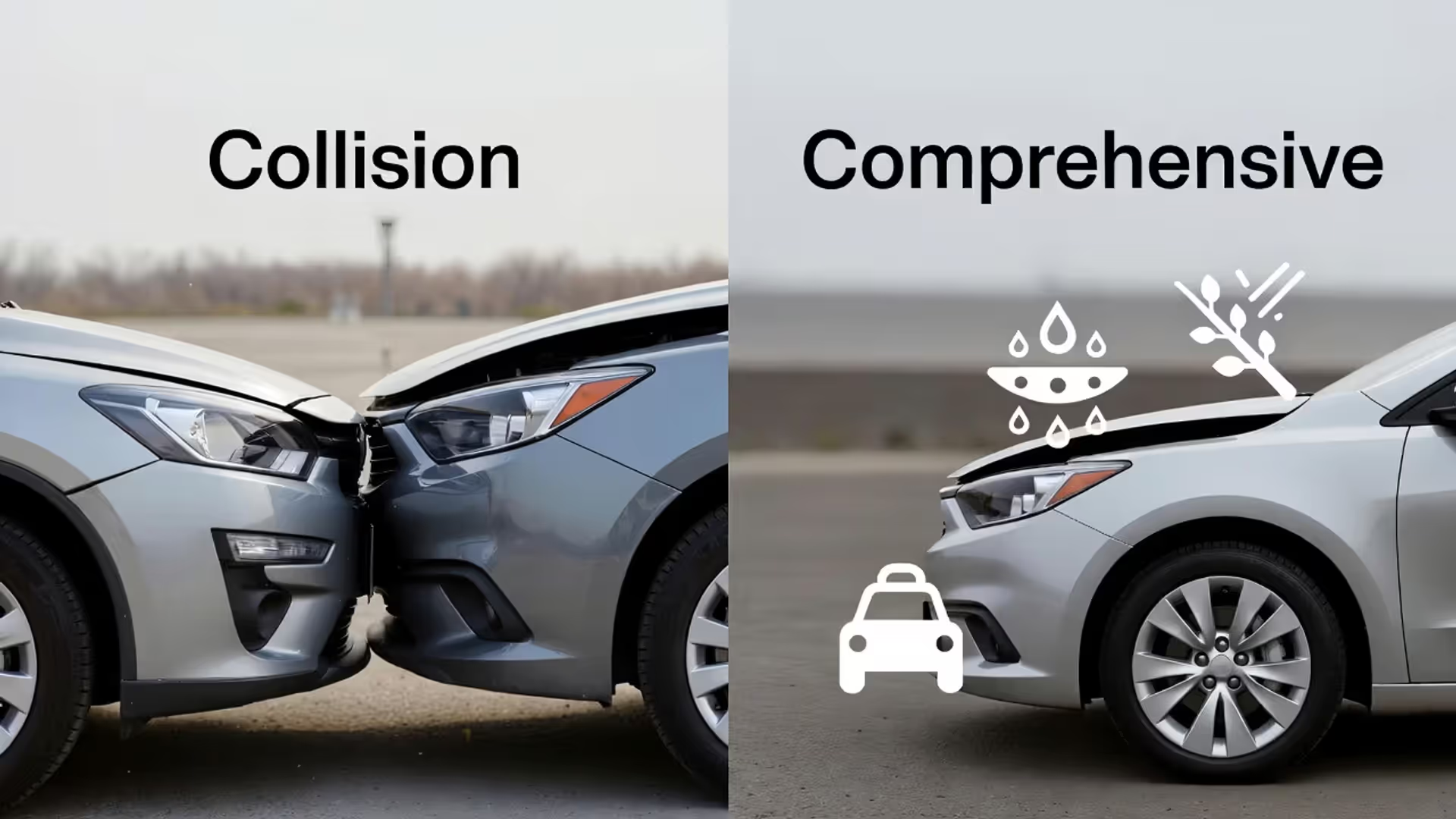

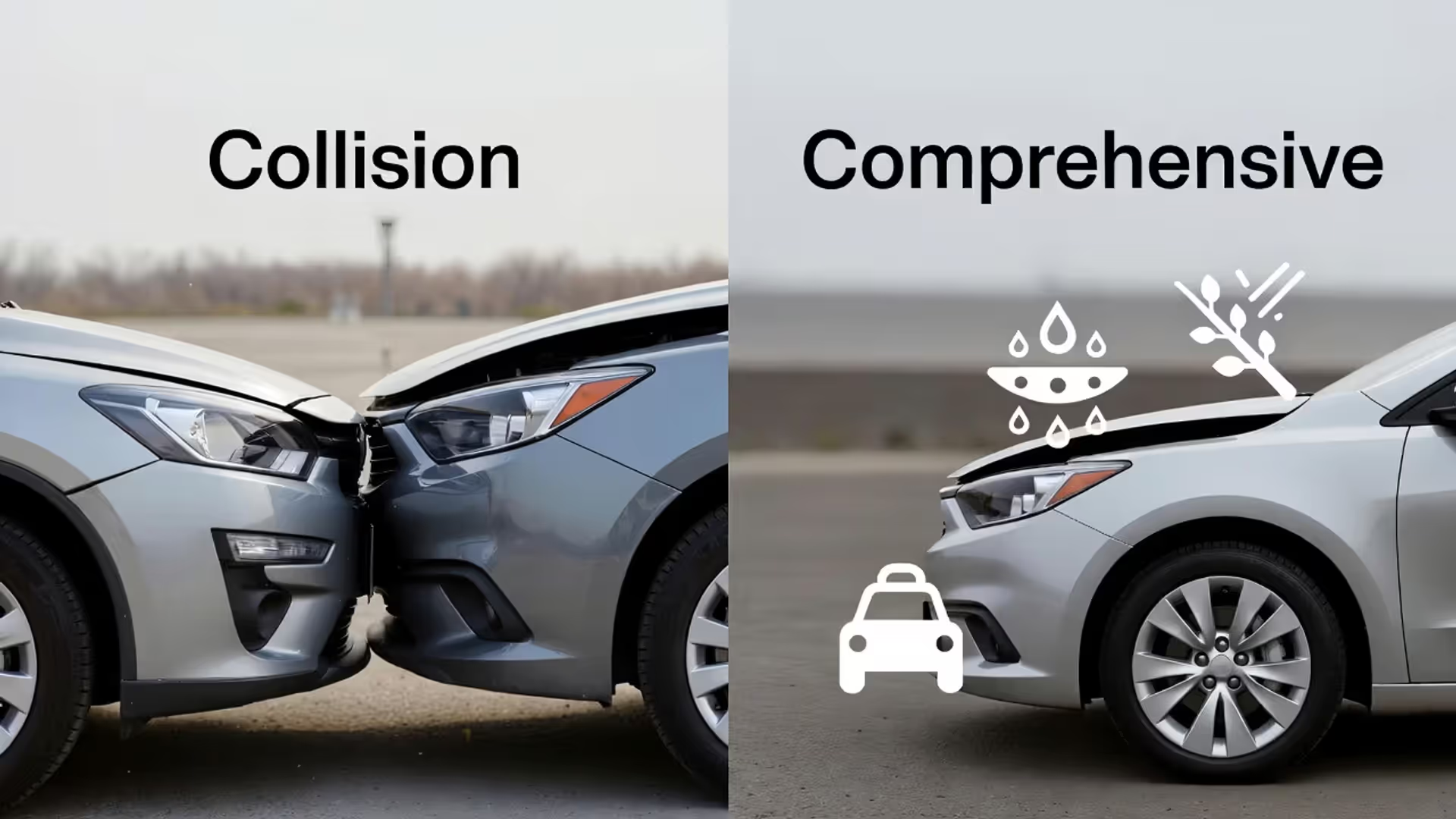

Including collision and comprehensive transforms your insurance from purely defensive to actively protecting your investment. Now when your vehicle suffers damage, your insurer handles repairs or replacement costs minus your selected deductible, regardless of what caused the loss.

Collision coverage responds to impact events: you cause a multi-vehicle accident, someone sideswipes you, you back into a concrete pillar, or you slide off an icy road into a tree. Who's at fault becomes irrelevant to your claim. Lost control in a snowstorm and crashed into a median barrier? Collision handles it even though no other driver was involved.

Comprehensive addresses everything else: your vehicle gets stolen from a parking garage, vandals smash your windows, a hailstorm leaves dimples across your hood, floodwaters submerge your engine, or you strike a deer crossing a rural highway. These non-collision perils fall under comprehensive protection. One note: that stolen laptop sitting on your back seat falls under homeowners or renters insurance, not auto comprehensive, though the window damage would be covered.

This combination protects your financial stake in the vehicle. When you're driving a $30,000 car, this protection typically costs between $800 and $1,500 annually based on your selected deductibles, your location's risk factors, and your driving history. Lenders who finance your purchase require both coverages as a loan condition—they won't let their collateral go unprotected until you've paid off the full balance.

The Two Components That Make Coverage "Full"

Author: Calvin Prescott;

Source: trialstribulations.net

Physical damage protection splits into two distinct policies, each designed to handle different types of losses. Knowing which coverage applies to which scenario eliminates confusion when you're filing a claim.

Collision Coverage Explained: When Your Car Hits Something

This coverage activates anytime your vehicle strikes another object or gets struck—whether that object is another vehicle, a stationary structure, an animal, or the pavement itself after you lose control.

Real-world collision scenarios include:

Merging onto an interstate, you miscalculate spacing and scrape another vehicle's quarter panel. Your collision policy handles your repair costs while your liability coverage addresses their damage. Even if the other driver was actually at fault, collision lets you file with your own company and start repairs immediately rather than waiting for the other insurer's investigation. Your company then pursues recovery through subrogation and may reimburse your deductible if they succeed.

Taking a corner too fast on wet pavement, your vehicle slides into a drainage ditch and rolls onto its side. No other vehicles were anywhere near you, making liability irrelevant. Your collision protection covers the rollover damage after you pay your deductible.

Stopped at a traffic signal, you're rear-ended by an inattentive driver who then speeds away before you can note their license plate. Without any way to identify the at-fault party, your collision coverage becomes your primary recourse for getting repairs done. Some policies also include uninsured motorist property damage for hit-and-run situations, depending on your state's requirements.

Collision operates without considering fault. Your insurer processes your claim and issues payment regardless of whether you caused the accident, though at-fault claims typically trigger rate increases at your next renewal period. You're not denied coverage because you made a driving error—that's literally what you're paying to protect against.

Most insurers offer deductible options from $250 up to $2,000. Selecting higher deductibles reduces your premium cost but means you're absorbing more of each claim yourself. Choosing a $1,000 deductible instead of $250 might save you $300 each year, but when you file a claim, you're paying $750 more out-of-pocket than you would have with the lower option.

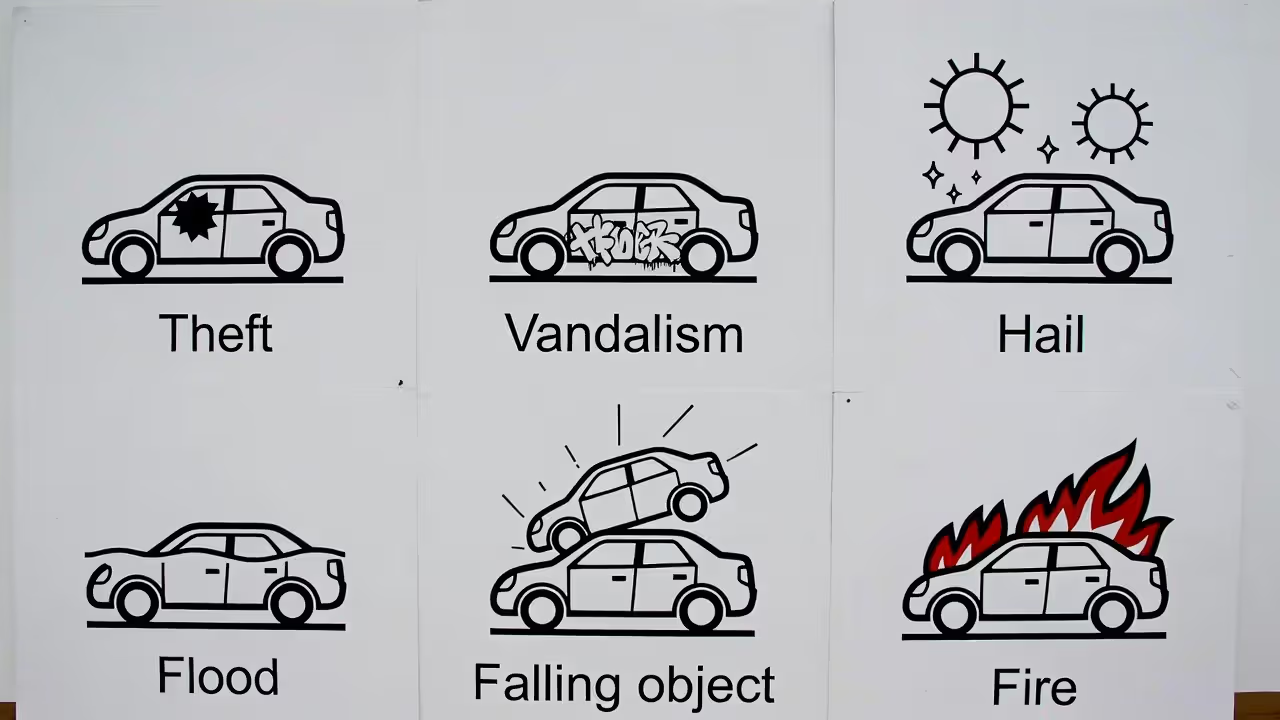

Comprehensive Insurance Meaning: Everything Else That Can Go Wrong

Author: Calvin Prescott;

Source: trialstribulations.net

Despite its name suggesting complete protection, comprehensive actually serves as the catch-all category for physical damage that doesn't involve collision. Think of it as covering acts of nature, criminal activity, and random misfortune.

Typical comprehensive claims involve:

Theft and vandalism: Someone steals your vehicle from your apartment complex overnight, or angry vandals spray-paint offensive language across your doors. Comprehensive provides replacement value or repair costs after your deductible.

Weather-related damage: Golf-ball-sized hail punches dents across your roof and hood. Tornado winds flip your parked vehicle onto its side. Flash flooding sends water through your engine compartment. Hurricane-force winds drive a tree branch through your rear window. Each of these weather events triggers comprehensive coverage.

Wildlife encounters: Driving through farmland at dusk, a deer bounds into your path and you strike it head-on. Bears break into your vehicle at a campground searching for food. Mice nest in your engine compartment over winter and chew through wiring harnesses. These biological hazards all fall under comprehensive protection.

Falling debris: A rotted tree limb crashes onto your parked car during a windstorm. Construction materials tumble from an overpass onto your windshield. Your neighbor's roof shingles blow loose and damage your hood. Comprehensive covers these falling object impacts.

Fire and explosion damage: Whether caused by an accident, arson, or mechanical malfunction, fire damage to your vehicle gets handled through comprehensive claims.

The phrase ‘full coverage’ creates a false sense of total protection. In reality, it’s simply a combination of liability, collision, and comprehensive — and the strength of that protection depends entirely on the limits and deductibles you choose. Understanding what’s included — and what isn’t — prevents costly surprises after a claim.

— Lauren Mitchell, Auto Insurance Coverage Analyst

Windshield damage occupies unique territory in many policies. Insurers often waive your comprehensive deductible entirely for windshield replacement, or apply a reduced deductible like $100 rather than your standard $500. Damage to side windows, rear glass, or sunroofs typically requires your full deductible. Review your specific policy's glass provisions to understand what applies.

Most drivers select lower deductibles for comprehensive than collision—often $100 to $500. Since comprehensive claims rarely result from driver mistakes, insurers consider them lower risk. Filing a comprehensive claim usually affects your future rates less severely than collision claims, though submitting multiple claims within a short timeframe raises concerns with any insurer.

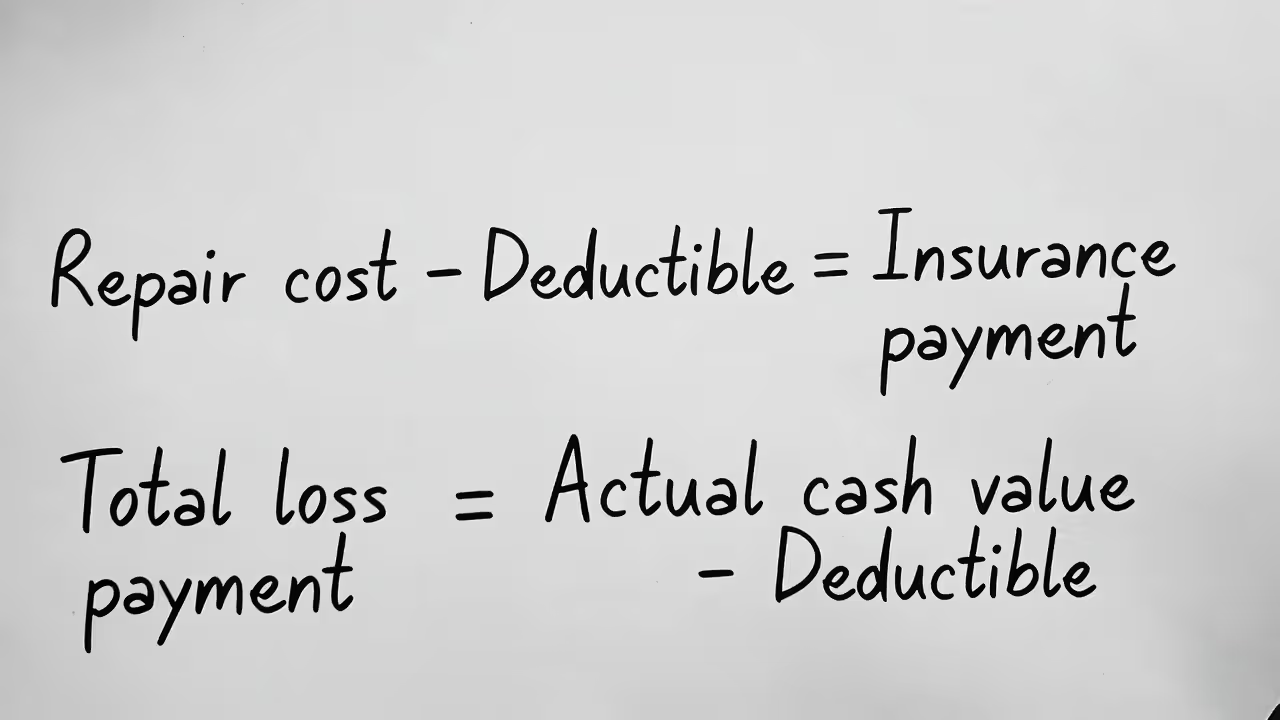

How Deductibles and Coverage Limits Work Together

Author: Calvin Prescott;

Source: trialstribulations.net

Your deductible represents your financial responsibility before insurance payments begin. Your coverage limit defines the maximum your insurer will pay. These two figures determine both your premium cost and your potential out-of-pocket exposure after a loss.

Collision and comprehensive maintain independent deductibles. You might select $500 for collision claims and $250 for comprehensive, or choose any other combination that suits your budget and risk tolerance. When you file a claim, only the relevant deductible applies. If hail damages your vehicle on Monday and you cause an accident on Tuesday, you'll pay both deductibles because you're submitting two separate claims under different coverage types.

Physical damage coverage limits equal your vehicle's actual cash value—its current market worth accounting for age, accumulated mileage, and overall condition. When your $12,000 vehicle gets totaled, your insurer pays that $12,000 minus your deductible, regardless of whether your outstanding loan balance exceeds that amount. This creates serious financial gaps for owners who are underwater on their financing, which is precisely what gap insurance addresses.

| Deductible Option | Annual Premium Estimate | What You Pay After a $4,000 Claim | Works Best For |

| $250 | $1,400 | $250 out-of-pocket | Those preferring minimal financial exposure; drivers who file frequent claims; households without emergency fund reserves |

| $500 | $1,150 | $500 out-of-pocket | Average drivers balancing affordable premiums against manageable claim costs |

| $1,000 | $950 | $1,000 out-of-pocket | Risk-tolerant drivers with solid savings; those with excellent driving histories; people comfortable self-insuring smaller damages |

Choosing higher deductibles makes mathematical sense when you maintain emergency savings and rarely file claims. If you haven't submitted a claim in a decade, you've essentially paid your insurance company hundreds of dollars annually to hold what amounts to a $500 or $1,000 emergency fund. Increasing your deductible and banking the premium difference builds your own reserve instead.

Lower deductibles suit drivers who'd struggle to cover $1,000 in unexpected repair costs, or those facing elevated risk situations—inexperienced drivers, urban environments with frequent minor accidents, or regions experiencing severe weather events. The added premium expense purchases financial predictability.

Some insurance companies offer vanishing deductible programs that reduce your out-of-pocket costs by $50 to $100 for each claim-free year. After maintaining a clean record for five years, your original $500 deductible might shrink to $250. These reward programs encourage safe driving while keeping your base premiums lower than simply purchasing a minimal deductible from the start.

Who Actually Needs Full Coverage Auto Insurance?

Author: Calvin Prescott;

Source: trialstribulations.net

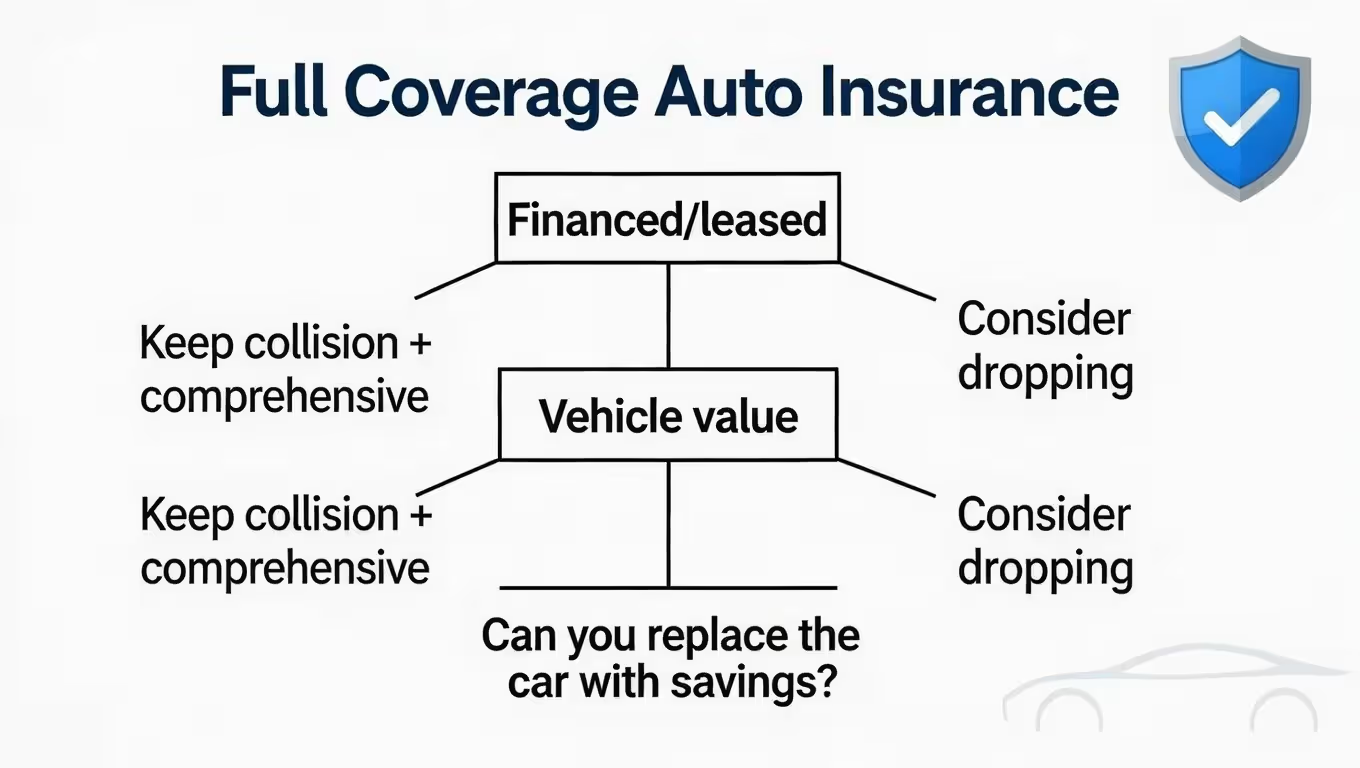

Whether you need collision and comprehensive comes down to three key considerations: contractual obligations, your vehicle's current worth, and your personal financial resilience.

Financed or leased vehicles: Your lender contractually requires collision and comprehensive as a loan condition. They hold a financial interest (lien) on the vehicle and won't risk that collateral remaining unprotected. Lease contracts include identical requirements. You cannot legally drop physical damage coverages while making payments. Attempting to do so triggers force-placed insurance from your lender at significantly inflated rates that they'll add to your loan balance.

Current vehicle value: Insurance professionals recommend dropping collision and comprehensive when your annual premium plus deductible together exceed 10% of your vehicle's market value. For a car worth $4,000, paying $800 in premiums with a $500 deductible means you're risking $1,300 to protect a $4,000 asset. A total loss claim nets you perhaps $3,500, barely justifying the annual expense. At this point, self-insuring becomes the mathematically sound choice.

Personal financial situation: Could you absorb the loss of your vehicle tomorrow and arrange replacement transportation? If not, maintain collision and comprehensive regardless of the vehicle's age or value. A $5,000 car might not seem particularly valuable, but if losing it means you can't reach your workplace and you lack savings for replacement, that coverage remains essential. Insurance exists to transfer risks you cannot personally afford to absorb.

Geographic risk factors: Urban neighborhoods with elevated theft rates, regions experiencing frequent severe weather, or areas with high accident frequencies justify keeping comprehensive and collision longer than the math alone would suggest. Your vehicle might only be worth $6,000, but if you live where hailstorms occur regularly or vehicle theft is common, comprehensive protection continues providing value well beyond its cost.

Personal driving history: A record showing multiple at-fault accidents or serious traffic violations increases your collision claim likelihood substantially. Even when driving an older, lower-value vehicle, your risk profile might justify maintaining coverage that other drivers in similar vehicles would drop.

State governments mandate only liability coverage—no state requires collision or comprehensive as a licensing or registration condition. Some states do require proof of financial responsibility, either through insurance or a surety bond, to register vehicles. Standard liability satisfies these requirements completely.

What Full Coverage Doesn't Include (Common Gaps)

Author: Calvin Prescott;

Source: trialstribulations.net

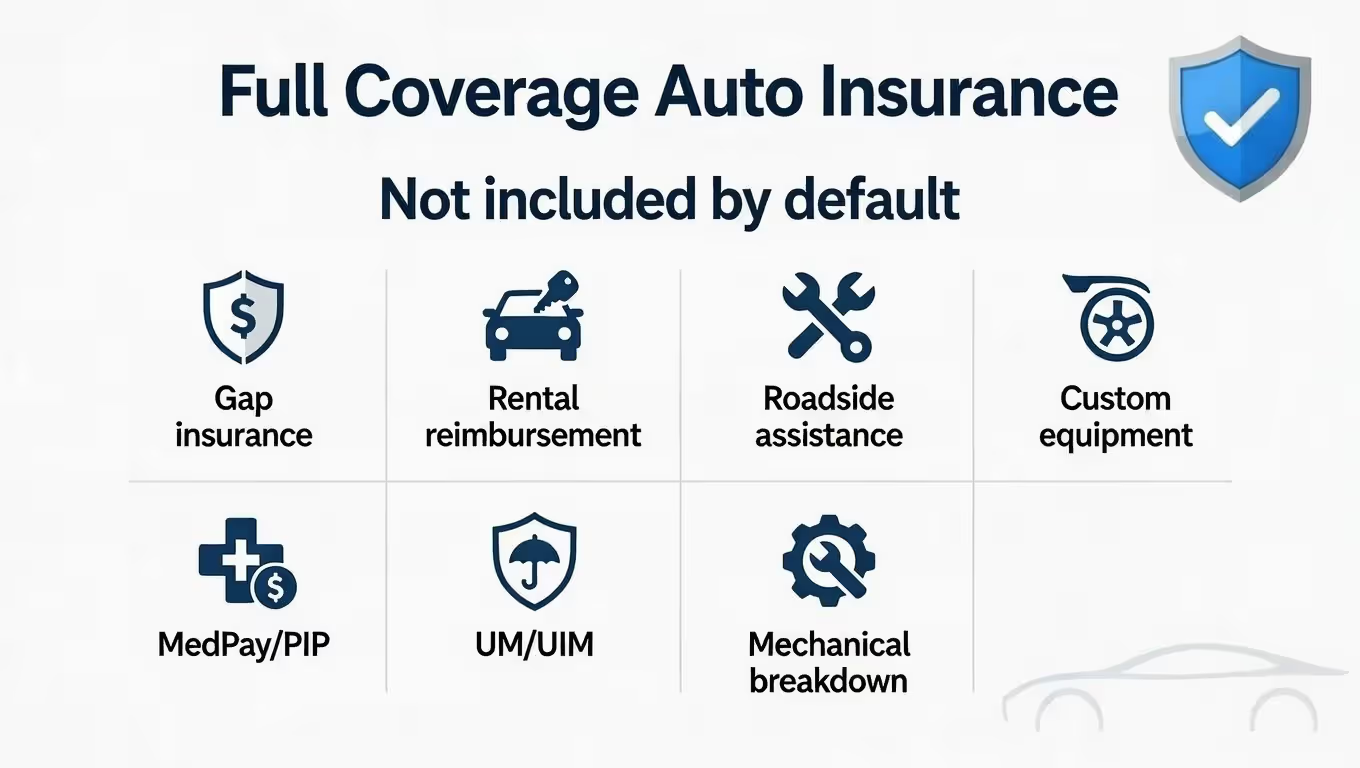

Even the most comprehensive standard policies contain significant coverage gaps that surprise vehicle owners when they file claims. Understanding these common exclusions helps you identify which optional coverages warrant adding to your base policy.

Gap insurance: Imagine owing $25,000 on a vehicle worth only $20,000 that gets totaled in an accident. Your insurer pays the actual cash value of $20,000 minus your deductible—leaving you personally responsible for the remaining loan balance. Gap insurance covers this difference between your loan balance and your vehicle's depreciated value. New car buyers who made minimal down payments or selected extended loan terms should strongly consider this protection.

Rental reimbursement: Your vehicle sits in a repair facility for two weeks following an accident. Standard collision coverage pays for repairs but provides nothing toward a rental vehicle while you're waiting. Rental reimbursement coverage typically costs $20 to $40 annually and provides $30 to $50 daily toward rental expenses, up to specified limits.

Roadside assistance: Your battery dies in a parking lot, you get a flat tire on the highway, or you accidentally lock your keys inside the vehicle. Standard physical damage coverage doesn't dispatch tow trucks or provide roadside service. Roadside assistance through your auto insurer typically costs $10 to $25 annually, though automobile clubs like AAA offer more extensive programs with additional benefits.

Custom equipment and aftermarket modifications: That upgraded sound system, custom wheel package, lift kit, or performance modifications you installed typically aren't covered under standard policies. Custom equipment coverage extends protection to these additions, though you'll need receipts and professional documentation of the modifications and their value.

Medical payments and personal injury protection: These coverages pay your medical expenses and lost wages after an accident regardless of fault determination. They're completely separate from collision and comprehensive physical damage coverage. Some states mandate PIP as part of basic insurance; others make it optional. The term "full coverage" refers strictly to vehicle damage, not injury protection.

Uninsured and underinsured motorist coverage: When an at-fault driver lacks insurance entirely or carries insufficient liability limits to cover your damages, this protection steps in. It's not automatically included in standard full coverage packages, though many states either require it or strongly encourage adding it to your policy.

Diminished value claims: After major accident repairs, your vehicle's resale value drops even when repairs are completed perfectly—simply because it now has an accident history. Standard insurance policies don't automatically compensate for this diminished value loss. Some states allow pursuing diminished value claims, but they require separate negotiation beyond your standard claim settlement.

Mechanical breakdown: Your transmission fails due to normal wear and tear at 90,000 miles. Your engine seizes because you neglected regular oil changes. Standard full coverage doesn't address mechanical failures or maintenance issues. Extended warranty programs or mechanical breakdown insurance policies address these specific risks separately.

Frequently Asked Questions About Full Coverage Insurance

Full coverage auto insurance combines mandatory liability protection with optional physical damage coverages for your own vehicle, creating comprehensive protection against most common driving risks. The term itself emerged as insurance industry shorthand rather than representing an official standardized policy type, explaining why coverage quality and protection levels vary dramatically between policies that technically qualify as "full coverage."

Selecting appropriate coverage requires balancing premium expenses against your personal financial capacity to absorb vehicle loss. Financed vehicles require collision and comprehensive by contract. Older vehicles you own outright might not justify the coverage expense when you've accumulated sufficient savings to replace them. Your geographic location, personal driving patterns, and individual risk tolerance all factor into this decision.

The notable gaps in standard full coverage—gap insurance, rental reimbursement, and roadside assistance among others—aren't insurance company oversights. They're separate protection products addressing specific risk scenarios. Evaluate each optional coverage based on your personal circumstances rather than assuming "full" automatically means comprehensive protection against every conceivable loss scenario.

Review your coverage annually as your situation evolves. As your vehicle depreciates, the mathematical justification for coverage shifts. What made perfect financial sense when protecting a $20,000 vehicle might not apply when it's worth $8,000. Adjust your deductible selections and coverage types as both your financial situation and vehicle value change over time. Insurance should protect you against losses you genuinely cannot afford to absorb personally—anything beyond that represents paying someone else to hold your emergency savings.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.