Side-by-side graphic comparing collision coverage (car crash) and comprehensive coverage (hail, theft, falling branch).

Collision vs Comprehensive Insurance: Which Coverage Does Your Car Need?

Content

Most drivers know they need car insurance, but the distinction between collision and comprehensive coverage confuses even experienced vehicle owners. These two policy types protect against entirely different risks, yet insurance companies often bundle them together under "full coverage"—a term that obscures their separate functions.

Understanding the difference matters when you're deciding whether to buy both coverages, drop one to save money, or file a claim after damage occurs. Each policy responds to specific situations, carries its own deductible, and affects your premium differently. Making the wrong assumption about which coverage applies can leave you paying thousands out of pocket for repairs you thought were covered.

What Each Type of Insurance Actually Covers

Collision insurance pays for damage to your vehicle when it strikes—or is struck by—another object. That object might be another car, a guardrail, a mailbox, or a building. The defining characteristic: your vehicle hits something or something hits your vehicle during a driving incident.

Comprehensive insurance covers nearly everything else that damages your car. Think of it as protection against non-collision events: theft, vandalism, fire, falling objects, natural disasters, and animal strikes. Insurance professionals sometimes call it "other than collision" coverage, which more accurately describes its scope.

Collision Insurance Coverage Scenarios

Author: Brandon Whitaker;

Source: trialstribulations.net

You're driving through an intersection when another driver runs a red light and T-bones your sedan. Your collision coverage pays for your vehicle's repairs regardless of who caused the crash. If the other driver has insurance, your company may recover the costs through subrogation, and you might get your deductible back.

Single-vehicle accidents also fall under collision. You swerve to avoid debris on the highway and strike a concrete barrier. You back out of your driveway and hit your mailbox. You lose control on an icy road and slide into a ditch. In each case, collision coverage responds because your vehicle impacted an object.

Even when your parked car gets hit, collision insurance handles the claim. Someone backs into your vehicle in a parking lot and drives away without leaving a note. You file under your collision coverage, pay your deductible, and your insurer covers the rest.

Comprehensive Insurance Coverage Scenarios

A hailstorm passes through your neighborhood overnight, leaving your car's hood and roof dimpled with dozens of dents. Comprehensive coverage pays for the bodywork because weather caused the damage without any collision occurring.

Vandals key your car's paint or smash your windows while you're shopping. Comprehensive handles these malicious acts. The same coverage applies if someone steals your vehicle entirely or breaks in to take your stereo system.

Animal strikes represent one of the most common comprehensive claims. You're driving at dusk when a deer jumps in front of your car. Despite braking hard, you hit the animal and damage your front bumper, grille, and headlights. Because you struck an animal rather than a stationary object or another vehicle, comprehensive coverage applies—not collision.

| Damage Type | Covered by Collision | Covered by Comprehensive | Notes |

| Hit another car | Yes | No | Applies regardless of fault |

| Hit by uninsured driver | Yes | No | Your collision pays first |

| Vehicle theft | No | Yes | Includes stolen parts/accessories |

| Fire damage | No | Yes | Engine fires, arson, wildfires |

| Animal strike (deer, elk, etc.) | No | Yes | Most common comprehensive claim |

| Vandalism/keying | No | Yes | Includes broken windows |

| Pothole damage | No | Yes | Suspension/wheel damage from road hazards |

| Tree falls on parked car | No | Yes | Wind, rot, or unknown cause |

| Flood damage | No | Yes | Never covered by collision |

| Rollover accident | Yes | No | Single-vehicle collision |

How Weather Damage and Accidents Are Covered Differently

Author: Brandon Whitaker;

Source: trialstribulations.net

Weather-related damage almost always falls under comprehensive coverage, but the distinction trips up many drivers. If a storm knocks a tree branch onto your parked car, comprehensive pays. If you're driving and hit that same fallen branch lying in the road, comprehensive still applies because road debris counts as a road hazard, not a collision.

Flooding represents a clear-cut comprehensive claim. Whether your car sits in rising water in your driveway or stalls out when you drive through a flooded street, comprehensive coverage handles the damage. Flood-damaged vehicles often result in total losses because water ruins electrical systems and contaminates fluids throughout the engine.

Hail damage varies in severity but always triggers comprehensive coverage. Minor hail might cause cosmetic dents that cost $2,000 to repair. Severe storms can shatter glass and dent panels so extensively that repair costs exceed the vehicle's value.

Ice and snow create confusion because the coverage depends on what happens. Black ice causes you to lose control and slide into a guardrail? That's collision—you hit an object. Ice falls from an overpass and cracks your windshield? Comprehensive covers it as a falling object.

The "act of God" phrase misleads drivers into thinking all natural events fall under comprehensive. Lightning striking your car or a tornado flipping it over? Comprehensive. But if high winds blow your car off the road and you crash into a tree, collision coverage applies because the claim involves your vehicle striking an object, even though wind contributed to the accident.

Collision and comprehensive insurance protect against very different risks, yet many drivers treat them as interchangeable. Understanding how each coverage works — and when it applies — is essential to avoiding costly gaps in protection and unexpected out-of-pocket expenses.

— Laura Bennett, Auto Insurance Coverage Specialist

Real Claim Examples: When to File Collision vs Comprehensive

Scenario 1: You're driving through a residential area when a dog runs into the street. You swerve right to avoid it and scrape the entire passenger side of your car along a parked vehicle. File under: Collision. Your car hit another vehicle, making this a collision claim regardless of your intention to avoid the dog.

Scenario 2: During your morning commute, a deer jumps from the roadside directly into your path. You brake but can't avoid impact. The collision totals your vehicle. File under: Comprehensive. Animal strikes always fall under comprehensive coverage, even when the animal causes catastrophic damage.

Scenario 3: You return to your parked car after a movie and discover someone sideswiped your driver's door, leaving paint transfer and a deep dent. No note, no witnesses. File under: Collision. Hit-and-run damage to a parked vehicle counts as collision because another vehicle struck yours.

Scenario 4: A severe thunderstorm drops golf-ball-sized hail for fifteen minutes. Your windshield cracks, and your hood and roof show dozens of dents. File under: Comprehensive. Weather damage without any collision event falls under comprehensive.

Scenario 5: You're rear-ended at a stoplight. The impact pushes your car forward into the vehicle ahead of you. File under: Collision. You have damage from two impacts—being hit from behind and hitting the car in front. Your collision coverage pays for both damage points on your vehicle.

Scenario 6: You park under a large oak tree at work. During the day, a dead branch breaks off and crashes through your rear windshield. File under: Comprehensive. Falling objects trigger comprehensive coverage whether the tree is healthy or diseased.

Scenario 7: Thieves break your driver's window and steal your laptop and GPS unit. They don't take the car. File under: Comprehensive for the broken window. Your auto insurance won't cover the stolen personal items—that's a homeowners or renters insurance claim.

Scenario 8: You're pulling into a parking space when you misjudge the distance and hit a concrete parking block, cracking your front bumper. File under: Collision. You struck a stationary object while operating your vehicle.

Deductible Structures and How They Affect Your Out-of-Pocket Costs

Author: Brandon Whitaker;

Source: trialstribulations.net

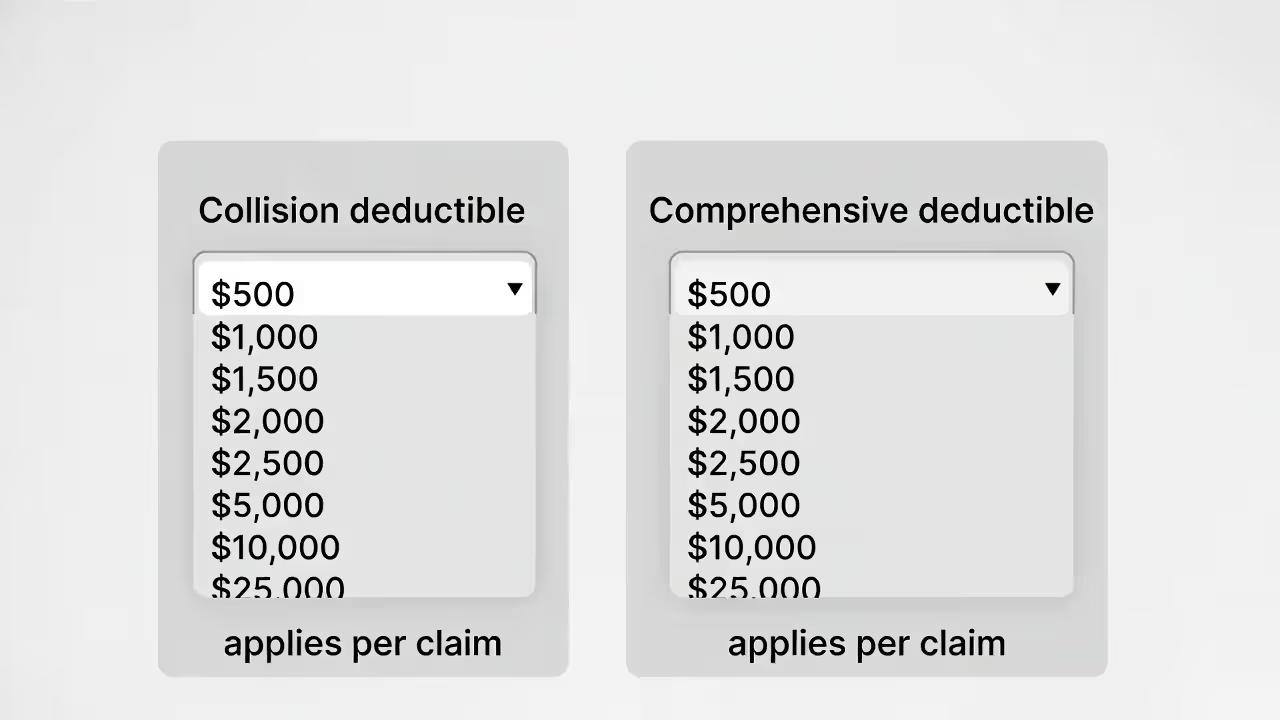

Deductibles represent the amount you pay before insurance covers the remaining repair costs. Collision and comprehensive policies each carry separate deductibles, and you choose these amounts when you purchase coverage.

Most insurers offer deductible options ranging from $100 to $2,000, with $500 and $1,000 being the most common choices. Your deductible selection directly impacts your premium—higher deductibles mean lower monthly costs because you're assuming more financial risk.

Here's how deductibles work in practice: Your car suffers $3,500 in damage from a covered event. With a $500 deductible, you pay $500 and insurance covers $3,000. With a $1,000 deductible, you pay $1,000 and insurance covers $2,500. The deductible applies per claim, not per year.

| Deductible Amount | Typical Annual Premium Savings vs. $250 Deductible | Best For |

| $250 | Baseline (no savings) | Drivers who want minimal out-of-pocket costs; those with limited emergency savings |

| $500 | $100–$150 annually | Most drivers; balances affordable premiums with manageable deductible |

| $1,000 | $200–$300 annually | Drivers with emergency funds; those with good driving records and lower claim likelihood |

| $2,000 | $300–$450 annually | High-net-worth individuals; owners of older vehicles where coverage mainly protects against total loss |

The math matters when deciding on deductibles. If raising your deductible from $500 to $1,000 saves you $250 annually, you'll recoup that savings in two years if you don't file a claim. But if you file a claim in year one, you're out an extra $500 immediately.

Many drivers choose different deductibles for collision and comprehensive. You might select a $500 comprehensive deductible but a $1,000 collision deductible. This strategy makes sense if you park in an area with high theft or hail risk but have a strong driving record with few accident risks.

Small claims often aren't worth filing once you factor in deductibles. If a shopping cart dings your door causing $400 in damage and you carry a $500 deductible, insurance won't pay anything. You'll spend $400 fixing it yourself while still reporting the incident to your insurer, potentially affecting your rates.

Cost Comparison: What You'll Pay for Each Coverage Type

Author: Brandon Whitaker;

Source: trialstribulations.net

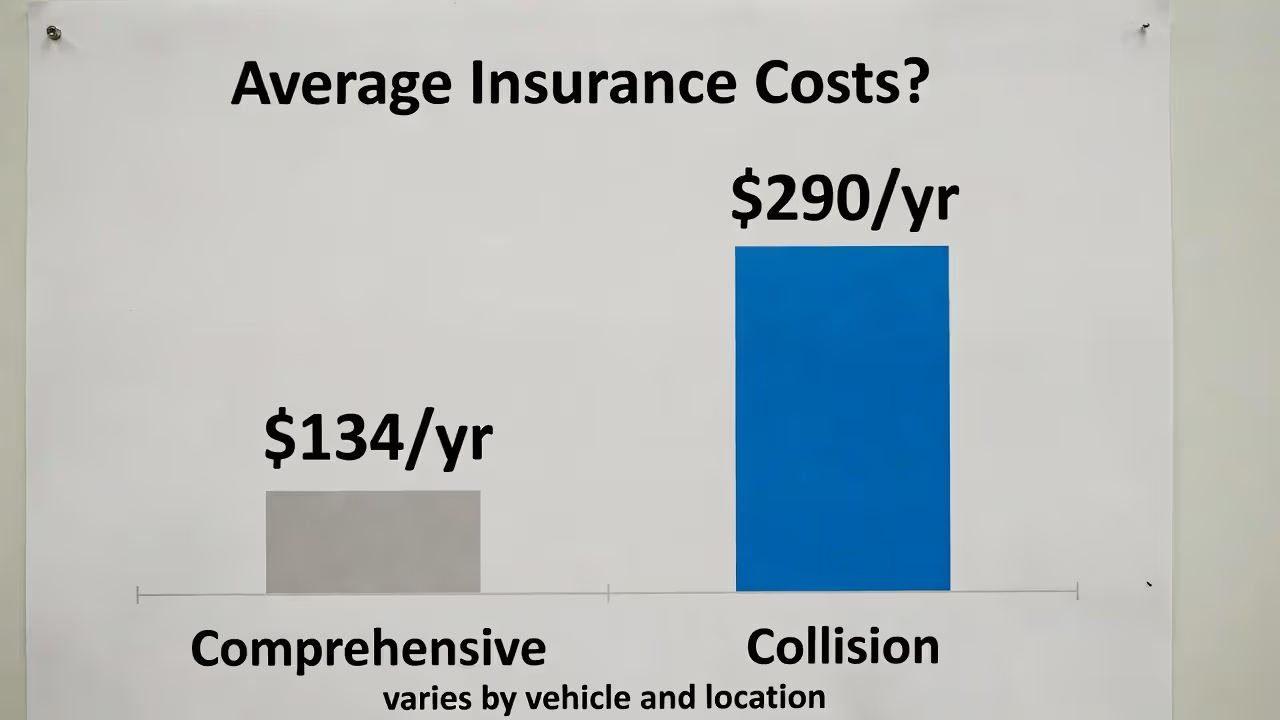

Comprehensive insurance typically costs less than collision coverage because comprehensive claims tend to be less frequent and less expensive. The average driver pays $134 annually for comprehensive coverage versus $290 for collision, according to recent industry data, though rates vary significantly by location and vehicle.

Your ZIP code dramatically affects comprehensive premiums. Urban areas with high theft rates see comprehensive costs spike. Regions with frequent hail, like Colorado's Front Range or Texas's panhandle, charge more for comprehensive. Collision rates depend more on traffic density and local accident statistics.

Vehicle value and age determine whether these coverages make financial sense. The rule of thumb: if your car's value falls below ten times the annual cost of collision and comprehensive coverage combined, consider dropping both. For a car worth $3,000, if you're paying $400 annually for these coverages, you'll recover your premium costs in just over seven years—but your car continues depreciating.

Newer vehicles with loans or leases require both coverages. Lenders protect their financial interest by mandating collision and comprehensive until you pay off the loan. Once you own the vehicle outright, the decision becomes purely financial.

A 2015 sedan worth $8,000 might cost $600 annually to insure with both collision and comprehensive. If you drop both coverages, you save $600 yearly but assume all risk for repairs or replacement. One at-fault accident or theft would cost you the full $8,000. Whether that trade-off makes sense depends on your driving record, where you park, and your ability to replace the vehicle if necessary.

Luxury and sports vehicles carry higher premiums for both coverage types. A BMW costs more to insure than a Honda of similar age because parts and labor run higher. Theft-prone vehicles like certain pickup trucks and Honda Civics see elevated comprehensive premiums.

Your driving record affects collision rates more than comprehensive. Multiple at-fault accidents will spike your collision premium significantly. Comprehensive claims for weather or theft typically have less impact on future rates, though this varies by insurer.

Do You Need Both, One, or Neither?

The decision depends on your vehicle's value, your financial situation, and your risk tolerance. No universal answer fits every driver, but several factors should guide your choice.

When Lenders Require Both Coverages

Author: Brandon Whitaker;

Source: trialstribulations.net

Any outstanding auto loan or lease agreement almost certainly requires collision and comprehensive coverage. Lenders hold a financial interest in your vehicle until you complete payments. If you total an uninsured car, you still owe the full loan balance despite having no vehicle.

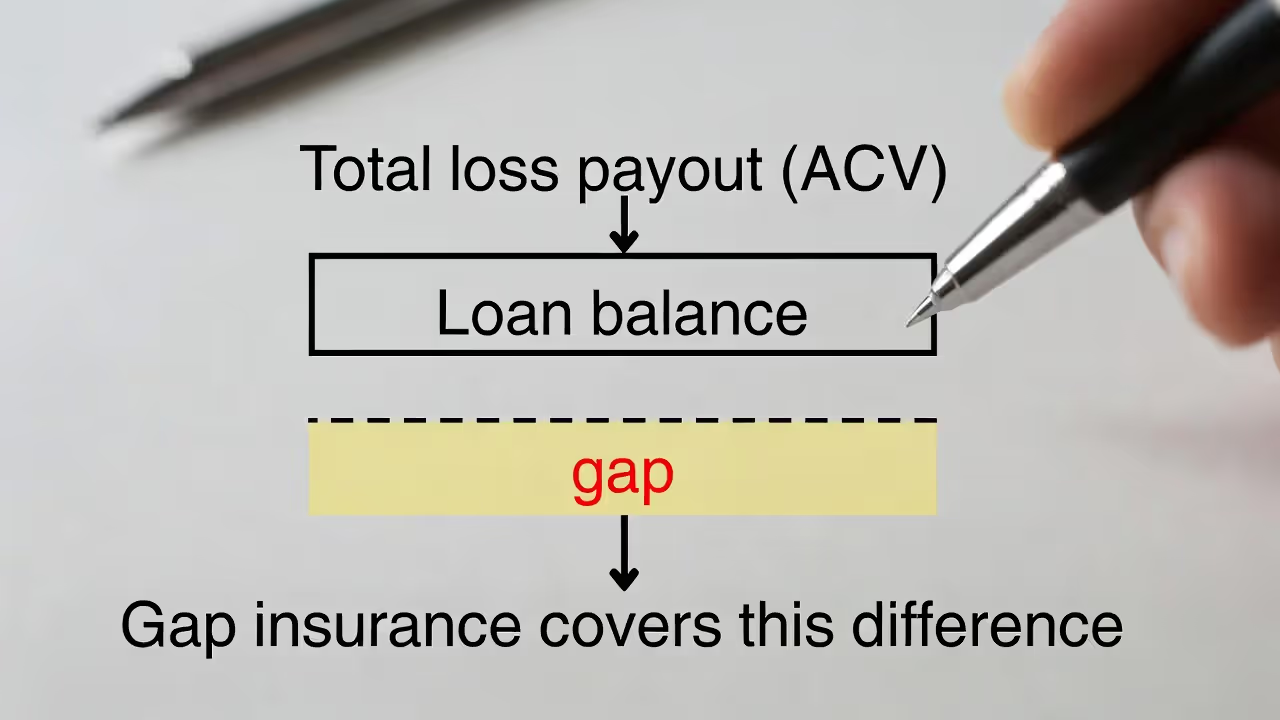

Gap insurance becomes relevant here. If you owe $18,000 on a car that's totaled with an actual cash value of $15,000, your collision or comprehensive coverage pays the insurer $15,000. Gap insurance covers the $3,000 difference so you don't owe money on a car you can't drive.

Even after paying off your loan, your lender won't automatically notify your insurance company. You must maintain coverage until the lienholder releases their interest, which appears on your insurance declarations page.

Situations Where One Coverage Is Enough

Dropping one coverage while keeping the other rarely makes sense because the risks they cover are fundamentally different. You can't predict whether you're more likely to hit another car or have your vehicle stolen.

However, some situations favor one coverage over the other. If you drive a $2,000 vehicle but live in an area with high hail frequency, keeping comprehensive while dropping collision might work. Your car isn't worth much, making collision claims unlikely to exceed your deductible by enough to matter, but a hailstorm could still total it.

Conversely, someone with an older car in a low-crime area with a garage might drop comprehensive while keeping collision if they're a new driver with higher accident risk.

Most financial advisors recommend keeping both coverages or dropping both simultaneously. The premium savings from dropping just one coverage usually doesn't justify the gap in protection.

Drivers with vehicles worth less than $4,000 should seriously consider dropping both coverages. Calculate one year's premiums for collision and comprehensive combined. If that amount equals 25% or more of your car's value, you're essentially self-insuring at that point. Three or four years of premiums could buy a replacement vehicle.

Classic or collector vehicles need special consideration. Standard collision and comprehensive policies pay actual cash value, which may not reflect a classic car's true worth. Agreed-value policies designed for collector vehicles provide better protection.

Frequently Asked Questions About Collision and Comprehensive Coverage

Choosing between collision and comprehensive insurance isn't an either-or decision for most drivers—you need both to protect against the full range of risks your vehicle faces. But understanding exactly what each coverage handles helps you file claims correctly, select appropriate deductibles, and decide when dropping coverage makes financial sense.

Your decision should account for your vehicle's current value, your outstanding loan balance if any, your driving environment, and your personal risk tolerance. Review your coverage annually as your car depreciates and your financial situation changes. What made sense when you bought your car new may not make sense five years later when it's worth half as much.

The key is making an informed choice rather than simply accepting whatever coverage your agent suggests or keeping the same policy year after year without evaluation. Your insurance should match your current situation, not your circumstances from when you first bought the policy.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.