Driver looking at an insurance policy summary on a phone inside a parked car.

Liability Car Insurance Explained: What It Covers and Why You Need It

Content

Here's the deal with liability car insurance: it pays for damage you cause to other people. Not your car. Not your medical bills. Just theirs.

I know that sounds simple, but you'd be shocked how many drivers don't get this until they're sitting in their totaled Honda, scrolling through their policy on their phone, and realizing their $500 repair check isn't coming. Most people buy liability coverage because their state says they have to—it's checkbox insurance. Then an accident happens, lawyers get involved, and suddenly those policy limits actually mean something.

When you cause an accident, liability coverage protects your bank account, your house, your future paychecks. Without it? Courts can garnish your wages, slap liens on your property, or suspend your license until you pay up.

Here's where people get tripped up: they think liability and collision are the same thing, they believe "full coverage" is an actual product you can buy, or they grab the cheapest state-minimum policy without realizing they're one bad intersection away from financial disaster.

This guide breaks down how liability insurance actually works, what those confusing number combinations mean, and how to pick limits that'll protect you when things go sideways—not just keep you barely legal.

What Is Liability Car Insurance and How Does It Work?

Liability insurance kicks in when you're at fault in an accident. You rear-end someone at a stoplight? That's on you. Run a red light and T-bone a minivan? Also you. Back into a parked Mercedes at Costco? Yep, still you. Your liability coverage handles the financial mess for everyone you've hit.

Notice the pattern? It's always about other people.

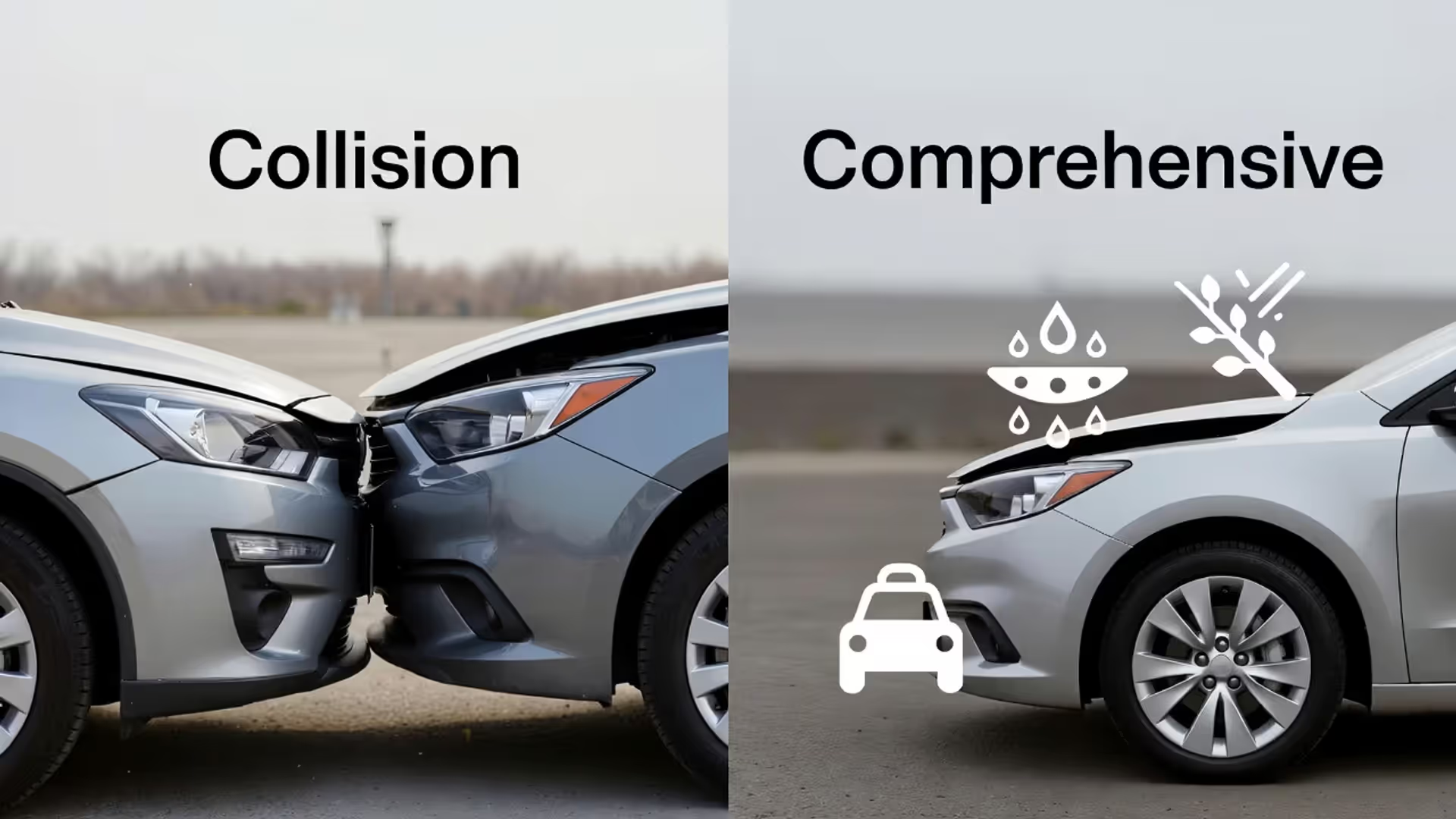

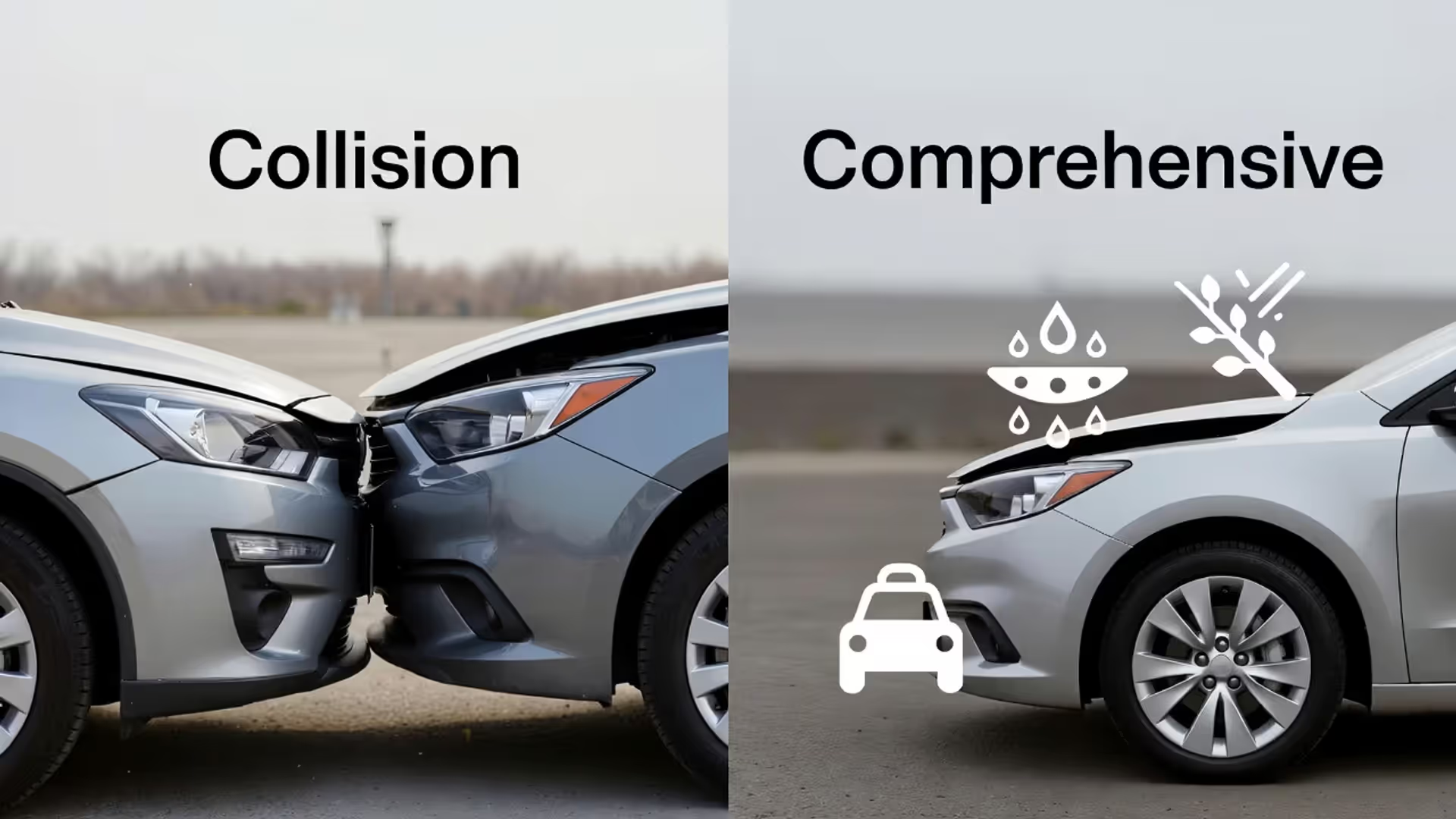

Your banged-up bumper? Not covered. Your broken wrist? Nope. Your laptop that flew off the passenger seat? Sorry. You'd need collision coverage for your car repairs, medical payments coverage for your injuries, and comprehensive for everything else. Those are separate policies with separate premiums. Liability only flows one direction: from your insurance company to the people you've hurt or whose stuff you've wrecked.

Insurance companies figure out who's at fault by reading police reports, interviewing witnesses, looking at photos, and checking traffic laws. In most states, the at-fault driver's liability insurance pays the victim's bills up to the policy limits. Let's say you carry $50,000 in bodily injury liability per person, and the other driver racks up $80,000 in medical bills. Your insurer pays the first $50,000. You're personally on the hook for the remaining $30,000. That's when lawsuits happen, payment plans get negotiated, or bankruptcy filings start.

There's another piece people forget about: legal defense. When someone sues you after an accident, your liability policy pays for lawyers, court costs, and settlement negotiations—again, only up to your limits. Legal defense alone can run $50,000+, even if you win the case.

Author: Tara Livingston;

Source: trialstribulations.net

The Two Components: Bodily Injury vs. Property Damage Liability

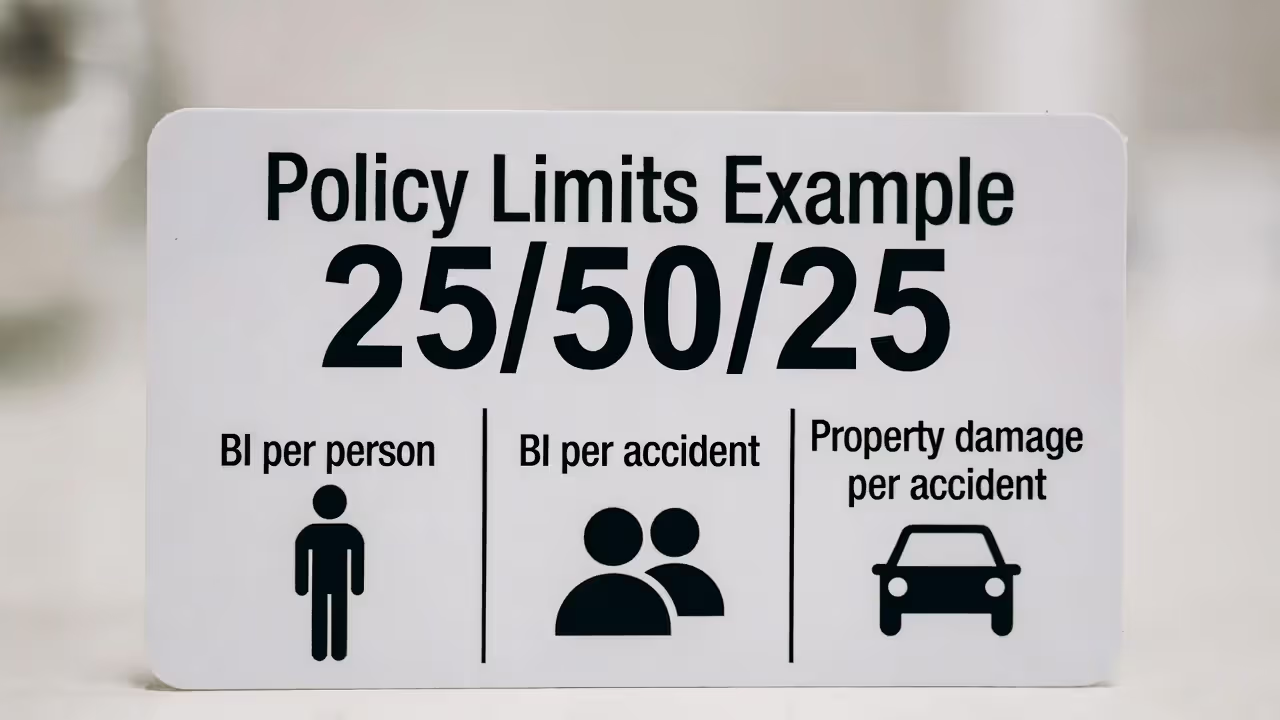

Every liability policy splits into two buckets: bodily injury and property damage. You'll see them written as three numbers separated by slashes, like 25/50/25. Understanding this notation matters, because it shows exactly how much protection you actually have.

Bodily Injury Liability: Medical Bills and Legal Costs

Bodily injury liability covers medical expenses, lost wages, pain and suffering, and legal fees when you injure someone else. The first two numbers in your policy limits refer to bodily injury: the first is what your insurer pays any single injured person, the second is the total your insurer pays when multiple people get hurt in one accident.

Coverage listed as 25/50 means your insurer pays up to $25,000 for any one injured person and a maximum of $50,000 total when several people are injured in the same crash. You cause a pileup and five people need medical care? Your insurer won't pay more than $50,000 total, even if all five victims have $200,000 in combined hospital bills.

Medical costs add up fast. An ambulance ride alone runs $1,200. ER treatment for broken bones costs $5,000–$10,000. Surgery, physical therapy, and ongoing care for serious injuries routinely top $100,000. When victims can't work during recovery or suffer permanent disabilities, you're liable for lost income and reduced future earnings that can balloon into six or seven figures.

Pain and suffering—compensation for emotional distress, mental anguish, and reduced quality of life—adds another layer. These non-economic damages often exceed actual medical bills, especially in catastrophic injury cases. Juries in some states have awarded millions for pain and suffering alone, which explains why carrying just your state's minimum bodily injury limits can be financially catastrophic.

Liability insurance isn’t about protecting your car — it’s about protecting your financial future. Drivers who rely on state minimum limits often underestimate how quickly medical bills and legal claims can exceed their coverage, putting personal assets and income at serious risk.

— Jonathan Reed, Auto Insurance Liability Specialist

Property Damage Liability: Repairing What You Hit

Property damage liability pays to fix or replace other people's cars, buildings, fences, mailboxes, or anything else you demolish in a crash. The last number in your policy notation (the 25 in 25/50/25) shows your property damage limit—in this case, $25,000 per accident.

You total a brand-new SUV worth $45,000? Your $25,000 property damage coverage pays the first $25,000, leaving you responsible for the remaining $20,000. And property damage claims aren't limited to vehicles. Plow into a storefront, knock down a utility pole, or destroy someone's landscaping—those repair costs come out of your property damage liability bucket.

Modern cars cost a fortune. The average new car price in the US tops $48,000, with luxury vehicles, trucks, and SUVs running significantly higher. Even seemingly minor fender-benders can generate $8,000–$12,000 in repair bills once you factor in sensors, backup cameras, and advanced safety tech built into front and rear bumpers.

Property damage liability also covers rental car costs while the other driver's vehicle is being repaired, towing fees, and storage charges. When you damage multiple vehicles in one accident, your property damage limit applies to the combined cost of everything you've destroyed—not separately per vehicle.

State-by-State Liability Requirements: Minimum Coverage Rules Across the US

Author: Tara Livingston;

Source: trialstribulations.net

Every state except New Hampshire and Virginia requires drivers to carry liability insurance. Minimum requirements vary wildly, though, creating a patchwork of regulations that confuse drivers who move or travel across state lines.

Minimum coverage rules ensure accident victims get at least some compensation, but many states set their minimums so low they barely cover a single ER visit. California, for example, requires just 15/30/5—$15,000 per person for bodily injury, $30,000 per accident, and $5,000 for property damage. That $5,000 property damage floor might not even cover bumper replacement on a modern pickup truck.

Here's how minimum liability requirements compare across major states:

| State | Bodily Injury (per person) | Bodily Injury (per accident) | Property Damage |

| California | $15,000 | $30,000 | $5,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 |

| Illinois | $25,000 | $50,000 | $20,000 |

| Ohio | $25,000 | $50,000 | $25,000 |

| Georgia | $25,000 | $50,000 | $25,000 |

| North Carolina | $30,000 | $60,000 | $25,000 |

| Michigan | $50,000 | $100,000 | $10,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Massachusetts | $20,000 | $40,000 | $5,000 |

| Washington | $25,000 | $50,000 | $10,000 |

| Colorado | $25,000 | $50,000 | $15,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Maine | $50,000 | $100,000 | $25,000 |

| New Hampshire | Not required | Not required | Not required |

| Virginia | $25,000 or pay $500/year | $50,000 or pay $500/year | $20,000 or pay $500/year |

New Hampshire lets drivers go uninsured but holds them fully financially responsible for any accidents they cause. Virginia offers a quirk: pay a $500 annual uninsured motor vehicle fee to drive legally without insurance, though you're still personally liable when you cause crashes.

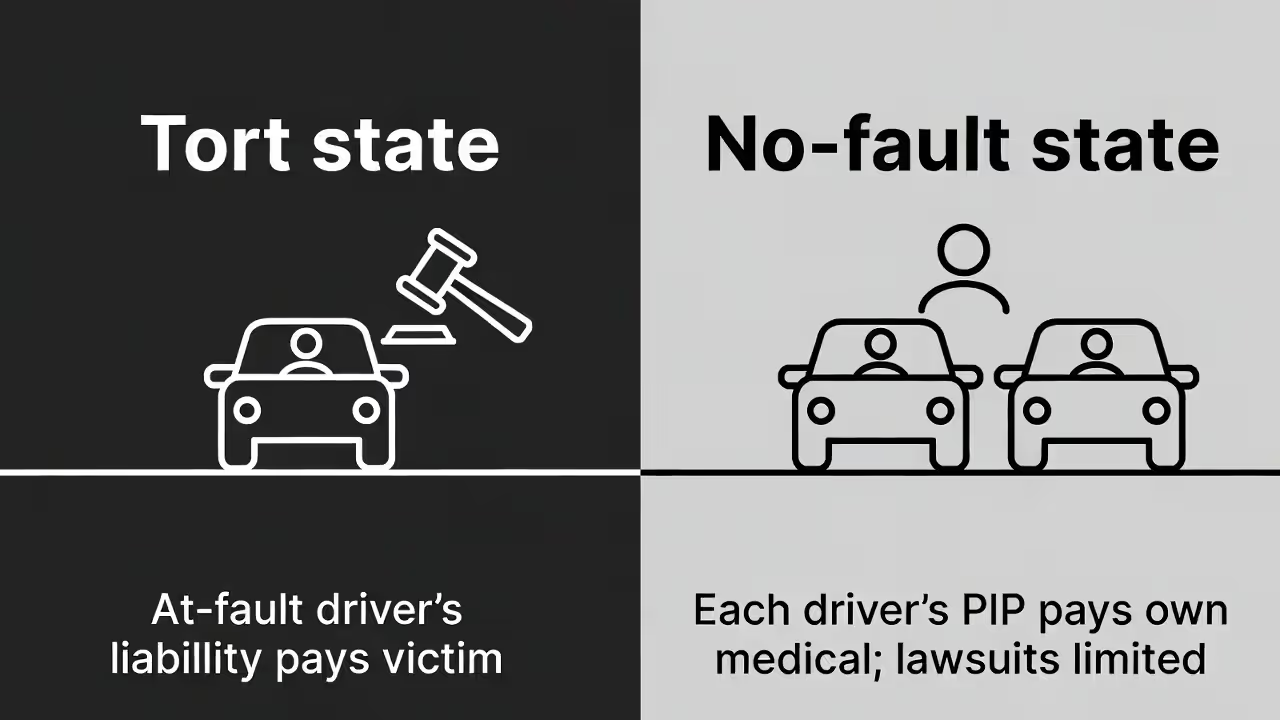

State liability laws also determine whether you live in a tort state or a no-fault state. In tort states (the majority), the at-fault driver's liability coverage pays the victim's expenses. In no-fault states like Florida, Michigan, and New York, each driver's personal injury protection (PIP) covers their own medical bills regardless of fault, though victims can still sue for serious injuries.

Why Minimum Coverage Often Isn't Enough: Gaps You Should Know

Author: Tara Livingston;

Source: trialstribulations.net

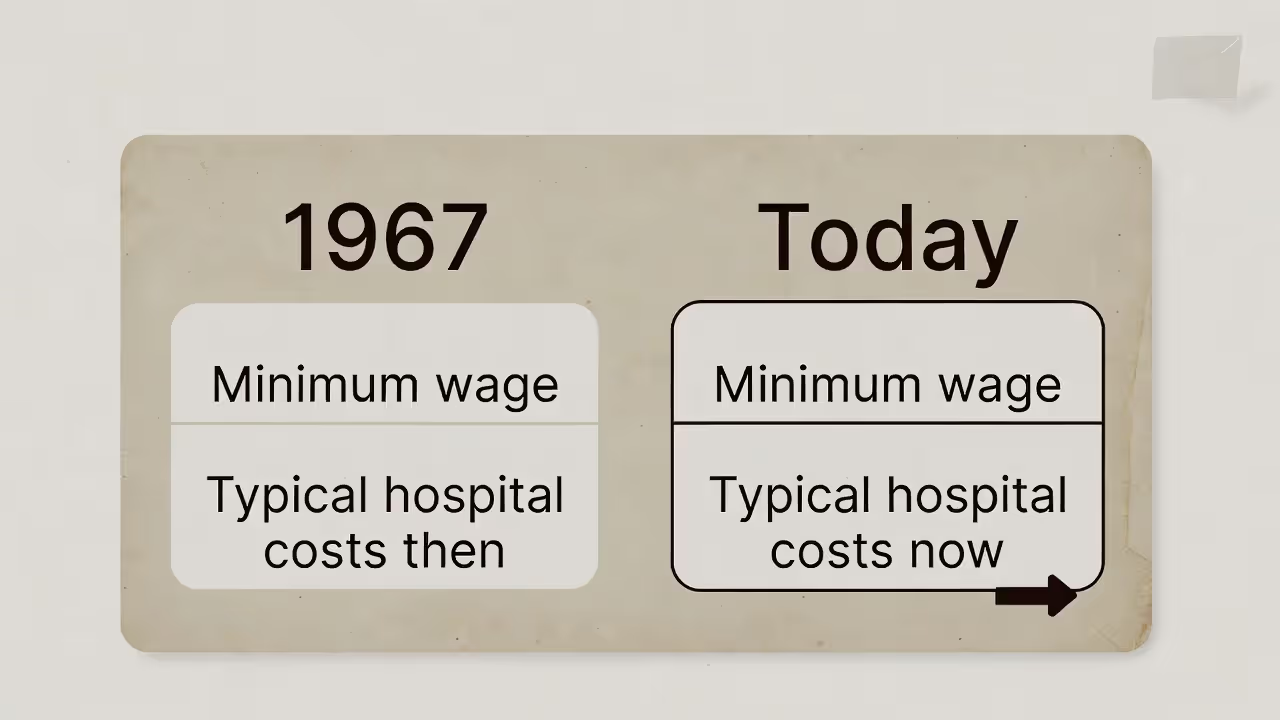

Buying state-minimum liability coverage might satisfy the law, but it rarely protects you from financial ruin. Medical costs have skyrocketed over recent decades while many state minimums haven't budged. California's 15/30/5 requirement hasn't changed since 1967, when the average hospital stay cost $500.

Consider a common scenario: you cause an accident that sends one person to the hospital with a broken femur. Surgery, hospital stay, physical therapy, and follow-up appointments hit $75,000. You're carrying California's minimum 15/30/5 coverage. Your insurer pays $15,000. You personally owe the remaining $60,000. The victim can sue, get a judgment, and garnish your wages or put liens on your property until the debt is paid.

Multiple victims multiply the problem. You injure three people in one crash and each racks up $40,000 in medical bills ($120,000 total). Your 15/30 bodily injury limit caps your insurer's payout at $30,000. You're personally liable for $90,000.

Property damage gaps create similar risks. Total a $60,000 Tesla while carrying only $5,000 in property damage coverage? You owe $55,000. Hit both a luxury sedan and a pickup truck, causing $80,000 in combined damage? Your $25,000 property damage limit leaves you exposed for $55,000.

Lawsuits add another risk layer. Even when your coverage handles immediate bills, victims can sue for pain and suffering, emotional distress, and future lost earnings. These non-economic damages aren't capped in many states, and juries can award amounts far exceeding your policy limits. Once a judgment exceeds your coverage, your personal assets—bank accounts, investment portfolios, home equity—become fair game for collection.

Insurance experts typically recommend liability limits of at least 100/300/100 ($100,000 per person, $300,000 per accident for bodily injury, $100,000 for property damage). Drivers with significant assets should consider 250/500/100 or higher, plus an umbrella policy providing an additional $1 million–$5 million in liability coverage across all your insurance policies.

Higher limits cost less than you'd think. Upgrading from state minimums to 100/300/100 often adds just $200–$400 per year—a small price for protection against six-figure judgments.

How State Liability Laws Affect Your Premiums and Legal Risk

Author: Tara Livingston;

Source: trialstribulations.net

Where you live dramatically impacts both your insurance costs and your legal exposure after accidents. State liability laws determine whether people can sue you, how damages are calculated, and what penalties you face for driving uninsured.

In tort states, the at-fault driver bears full responsibility for all damages. Victims can sue for economic damages (medical bills, lost wages, property damage) and non-economic damages (pain and suffering, emotional distress). Some tort states cap non-economic damages, others allow unlimited awards. This legal environment drives premiums higher in states with generous jury awards and aggressive plaintiff attorneys.

No-fault states require drivers to carry personal injury protection (PIP), which pays their own medical bills regardless of fault. In exchange, drivers give up the right to sue except in serious injury cases—typically defined by dollar thresholds (medical costs exceeding set amounts) or verbal thresholds (permanent injury, disfigurement, or death). No-fault systems aim to reduce litigation and speed up claims, but they often result in higher premiums because everyone's policy must include PIP.

Michigan, for instance, runs a pure no-fault system with unlimited lifetime medical benefits, producing some of the nation's highest auto insurance premiums. Florida's no-fault system requires only $10,000 in PIP, keeping premiums lower but leaving drivers underprotected for catastrophic injuries.

Driving without liability insurance triggers severe penalties in virtually every state. Consequences include:

- License suspension until you provide proof of insurance and pay reinstatement fees ($100–$500)

- Vehicle registration suspension or vehicle impoundment

- Fines ranging from $500–$5,000 for first offenses

- SR-22 or FR-44 filing requirements, forcing you to carry higher liability limits and notify the state if your policy lapses

- Jail time for repeat offenses or accidents causing injury while uninsured

Even brief coverage lapses can haunt you. Insurers view coverage gaps as high-risk behavior and charge substantially higher premiums when you reapply. A 30-day lapse can spike your rates 30%–50% for the next three to five years.

Your driving record also affects your liability premiums. At-fault accidents, speeding tickets, DUIs, and other violations signal higher risk, prompting insurers to raise your rates or cancel your coverage entirely. After one at-fault accident, expect your premiums to jump 20%–40%. Multiple accidents or serious violations can force you into the high-risk market, where policies cost two or three times standard rates.

Common Mistakes When Buying Liability Coverage

Author: Tara Livingston;

Source: trialstribulations.net

The biggest mistake drivers make? Choosing state-minimum coverage purely to save money. Sure, minimum policies are cheap, but they shift catastrophic financial risk onto your personal assets. Saving $300 a year on premiums seems insignificant when you're facing a $200,000 judgment after a serious accident.

Many drivers don't understand split limits. They see "25/50/25" and assume they have $100,000 in total coverage. Actually, the per-person and per-accident caps create significant gaps. When you seriously injure one person, your per-person limit applies; when you injure multiple people, your per-accident limit applies, but no single person gets more than the per-person cap. This structure can leave victims—and you—badly undercompensated.

Another common mistake? Confusing "full coverage" with comprehensive protection. "Full coverage" is insurance industry slang for a policy including liability, collision, and comprehensive. It's not an actual product, and it doesn't mean you're covered for every possible scenario. You can have "full coverage" with 25/50/25 liability limits and still face financial ruin after a serious accident.

Drivers also overlook umbrella policies. An umbrella policy sits on top of your auto and homeowners insurance, providing an additional $1 million–$5 million in liability coverage for relatively little cost—often $200–$400 per year for $1 million in protection. Umbrellas kick in when your underlying liability limits are exhausted, protecting your assets from judgments. If you own a home, have significant savings, or earn a high income, umbrella coverage is essential.

Some drivers assume their employer's commercial auto insurance covers them when they drive a company vehicle for personal errands. Most commercial policies restrict coverage to business use only. Cause an accident while running personal errands in a company car? You might find yourself uninsured and personally liable.

Finally, many drivers forget to review their liability limits after major life changes. Got a promotion? Bought a house? Built up retirement savings? Your liability coverage should grow to match your increasing assets. Otherwise, you're painting a target on your financial resources for any plaintiff attorney looking to maximize a settlement.

Frequently Asked Questions About Liability Insurance

Liability car insurance is the foundation of financial protection for drivers, but it only works when you carry enough coverage to match real-world risks. State minimums are legal requirements, not recommendations—they're outdated floors that leave most drivers dangerously exposed.

Before you renew your policy or shop for new coverage, calculate what you could actually lose in a catastrophic accident. Add up your assets: home equity, retirement accounts, savings, future earnings. Then ask yourself whether your current liability limits would protect those assets if you caused a crash that injured multiple people or destroyed expensive vehicles.

Raising your liability limits from state minimums to 100/300/100 or higher costs far less than you'd expect, often just a few dollars per month. Adding an umbrella policy for an extra $1 million in protection might cost less than your monthly streaming subscriptions. These small investments buy enormous peace of mind and protect everything you've worked to build.

Review your coverage today. If you're carrying minimum limits, you're not just risking a financial setback—you're risking financial catastrophe. Don't wait for an accident to discover your coverage falls short.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.