Parent comparing an auto insurance bill with a student report card showing a GPA.

Insurance Discounts for Students: How to Save on Auto Coverage with Good Grades

Content

Your car insurance bill just doubled. Maybe even tripled. You added your teenager to the policy, and now you're staring at an extra $2,400 per year.

Here's something that helps: your kid's report card might be worth real money. Students who keep their grades up can slash those insurance costs—sometimes by hundreds of dollars annually. Insurance companies have been offering these academic discounts for decades, and they're not token gestures. We're talking 10% to 30% off premiums, which adds up fast when you're insuring a 17-year-old.

Why do insurers care about algebra grades? Their actuarial data shows something interesting. Kids who take school seriously tend to take driving seriously. Fewer accidents, fewer claims, lower risk. So they'll actually pay you—through discounts—to keep your student hitting the books.

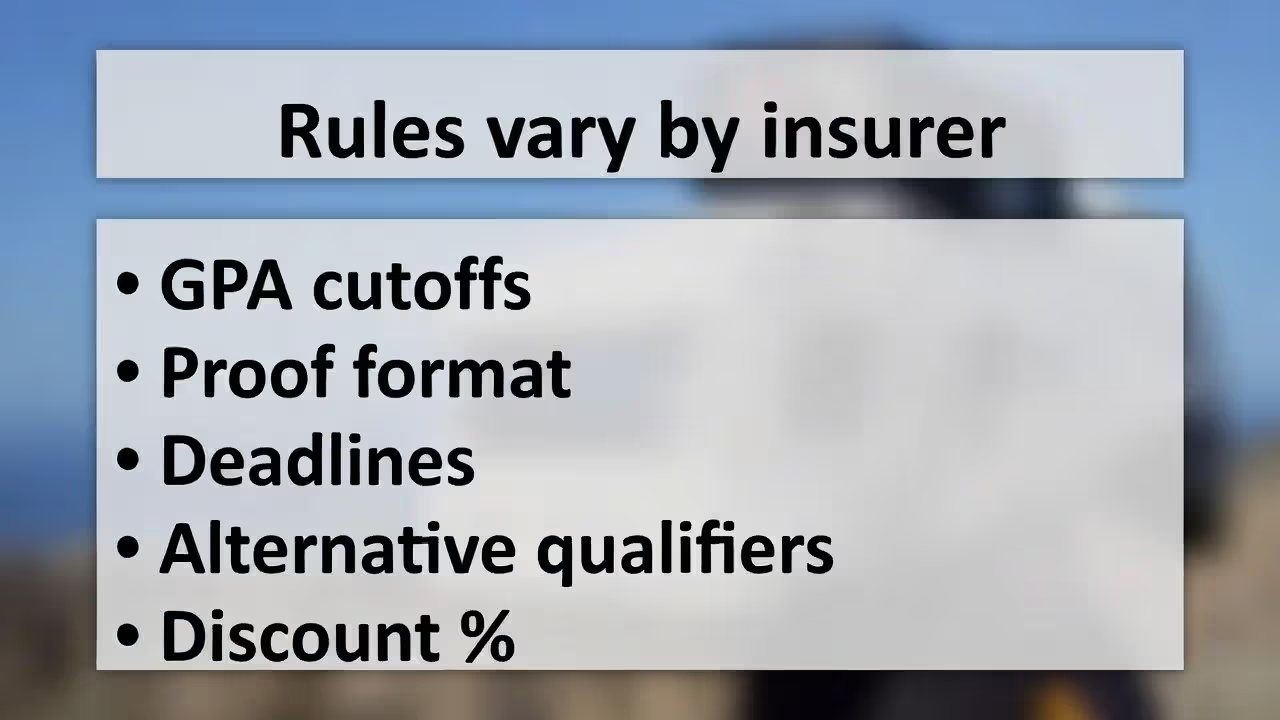

But here's the catch: every insurance company runs this program differently. State Farm wants different proof than GEICO. Progressive has different grade cutoffs than Allstate. Miss one documentation deadline, and you'll pay full freight until you fix it. Let's break down exactly how to grab these savings and keep them.

What Qualifies You for a Good Student Discount

Your student can't just wave a B+ and expect a discount. Insurers want specific proof that meets specific standards.

Age and enrollment requirements

Most companies draw the line at 25. Once your kid hits that birthday, the good student discount evaporates—regardless of whether they're still in school. A handful of insurers stretch to 29, but don't count on it.

The student needs full-time status at a real school. That means high schools, colleges, universities, or vocational programs with proper accreditation. Part-time enrollment usually doesn't cut it, though I've seen a few regional carriers accept nine credit hours minimum. You'll need to ask your specific company.

Here's something many families miss: the student typically must stay on a parent's policy to get the best discount rates. Sure, you can buy your own policy at 19, but the good student discount shrinks compared to what you'd get piggybacking on mom and dad's coverage. Some carriers even require dependent status and won't give the discount to married students.

Distance matters too. When students head off to college more than 100 miles away without taking a car, most insurers stack an additional "away at school" discount on top of the good student benefit. That combination can hit 35% or more off the base premium. But bring the car to campus? You'll need to report that immediately or risk having claims denied.

Author: Brandon Whitaker;

Source: trialstribulations.net

GPA thresholds by insurance company

Here's where things get messy. Every carrier sets its own bar:

| Insurance Company | Minimum GPA | Age Limit | Discount Percentage | Special Notes |

| State Farm | 3.0 (B average) | 25 years | 25% maximum | Class rank in top 20% also works |

| GEICO | 3.0 | 25 years | 15% maximum | Must carry 12+ credit hours |

| Progressive | 3.0 | 25 years | 10-15% range | Honor roll or dean's list substitutes for GPA |

| Allstate | 3.0 | 25 years | 20% maximum | Can combine with SmartRide app monitoring |

| USAA | 3.0 | 25 years | 20% maximum | Military family membership required |

| Farmers | 3.0 | 25 years | 15-25% range | National Honor Society membership counts |

| Nationwide | 3.0 | 25 years | 15% maximum | Driver training course can substitute |

| Liberty Mutual | 3.0 | 25 years | 10-22.5% range | Higher GPAs above 3.5 unlock bigger discounts |

Notice how 3.0 dominates? That's your target GPA at virtually every major carrier. A few will take 2.5 for high school students, but those are outliers.

What if your student struggles with GPA but tests well? Some carriers accept alternatives. Class rank in the top 20% works at State Farm. SAT scores above 1300 or ACT scores above 28 can qualify you at Progressive and Nationwide even with a 2.9 GPA. Honor societies like National Honor Society or Phi Theta Kappa also count at several companies.

How Much Students Actually Save

Percentages sound nice in brochures. Let's talk actual dollars.

Take a 17-year-old guy in Chicago. He's driving a 2019 Honda Civic. His share of the family policy runs about $3,200 yearly before any discounts. Apply a 20% good student discount, and you've just saved $640 for the year. Over four years, that's $2,560—enough for a decent chunk of college expenses.

Now compare that to suburban Kansas City. Base rates run lower there, maybe $2,200 for the same teenage driver. That same 20% discount saves $440 annually. Still worth claiming, but location dramatically changes your actual savings.

Girls pay less from the start. Statistics show teenage girls have fewer accidents than teenage boys, so a 17-year-old female might start at $2,500 instead of $3,200. Her 20% discount saves $500 versus his $640. Same percentage, different dollars.

The real magic happens when you stack discounts. I talked to a family in Columbus whose son qualified for five simultaneous discounts: good student, defensive driving completion, paperless billing, multi-car, and telematics monitoring. His premium dropped from $2,800 to $1,540—a $1,260 annual savings. That's 45% off the original rate.

Want the biggest dollar savings? Live in an expensive insurance state (Michigan, Louisiana, Florida) where base rates run high. A 25% discount on a $4,000 premium saves more than a 25% discount on a $2,000 premium, obviously. But percentage-wise, they're identical.

Proof and Documentation Rules: What Insurers Need to See

Author: Brandon Whitaker;

Source: trialstribulations.net

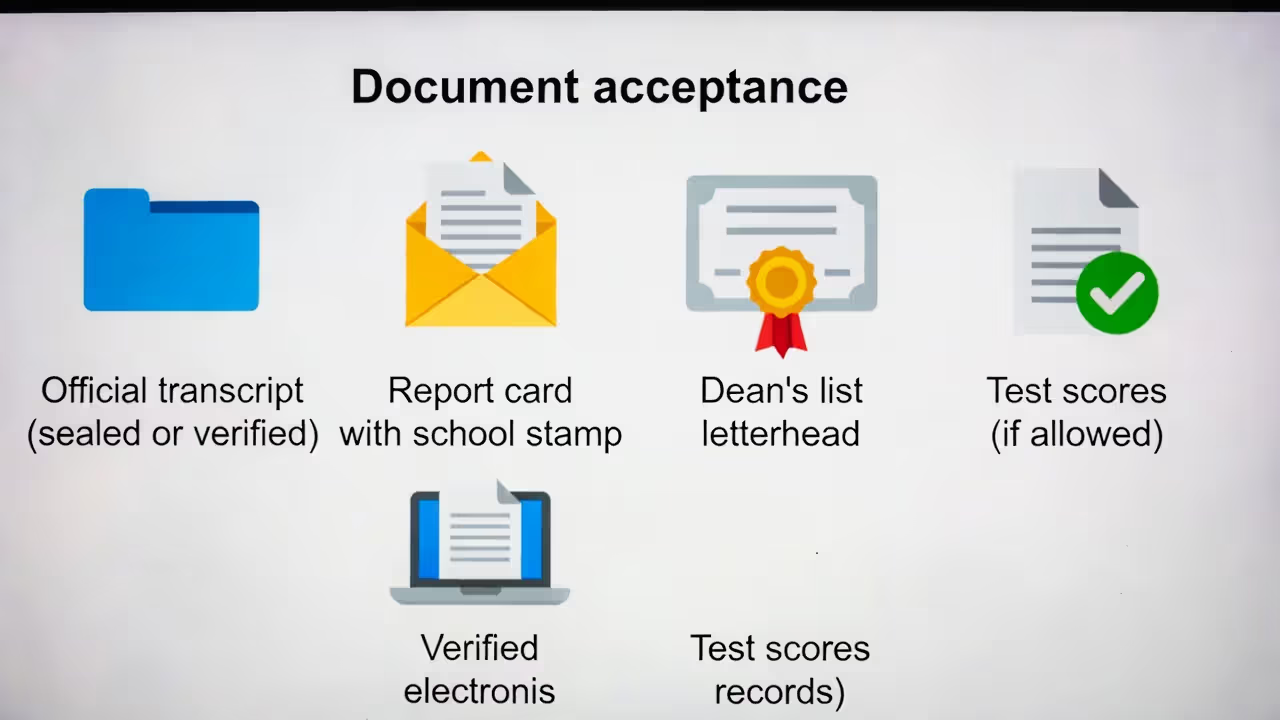

Your insurance company won't just trust you about grades. They want documentation, and they're picky about what they'll accept.

Acceptable forms of academic proof

Official transcripts work everywhere. Contact your school's registrar, pay the $5 to $15 fee, and get a sealed copy mailed directly to your insurance agent. The unofficial transcript you printed from your student portal? Worthless. Too easy to fake.

High school report cards can work if they show cumulative GPA and carry the school's official seal or stamp. A photocopy without authentication gets rejected. One family told me they lost three months of discounts because they submitted an unsigned report card that the insurer wouldn't process.

Letters work too—if they're legitimate. Dean's list notifications on college letterhead qualify. Honor roll certificates with official school stamps qualify. A generic "good standing" letter without specific grades or dates? Denied.

Digital verification has changed the game recently. Services like Parchment or National Student Clearinghouse let your school send verified academic records directly to your insurer electronically. Your agent gives you a release code, you authorize the transfer, and records arrive within two days. No mail delays, no lost envelopes.

Here's something useful: standardized test scores sometimes substitute for GPA. If your daughter scored 1350 on the SAT but her GPA sits at 2.85 due to a brutal AP course load, ask whether test scores qualify her anyway. Progressive and Nationwide both accept this alternative.

Good student discounts aren’t symbolic perks — they’re actuarially driven incentives based on measurable risk patterns. Families who understand the eligibility rules, documentation timelines, and stacking opportunities can reduce the true cost of insuring a teen driver by thousands over the high-risk years.

— Daniel Harper, Auto Insurance Risk Analyst

Verification timelines and renewal requirements

You can't submit proof once and forget about it. Insurance companies want fresh documentation regularly—usually every six to twelve months.

State Farm typically asks for updates at each policy renewal. GEICO wants annual verification. Some regional carriers demand new transcripts every semester. Miss the deadline, and the discount vanishes from your next bill automatically. No grace period, no reminder notice, just higher premiums.

I recommend calendar alerts set two weeks before your renewal date. Schools take 7 to 10 business days processing transcript requests during busy periods like December and May. Request early or you'll miss the deadline.

What happens if grades slip for one semester? Depends on the insurer's calculation method. Many average your most recent two semesters or use cumulative GPA across all years. A rough fall semester that drops you to 2.8 won't necessarily kill your discount if spring semester brings your cumulative back above 3.0. Call your agent to confirm how they calculate it.

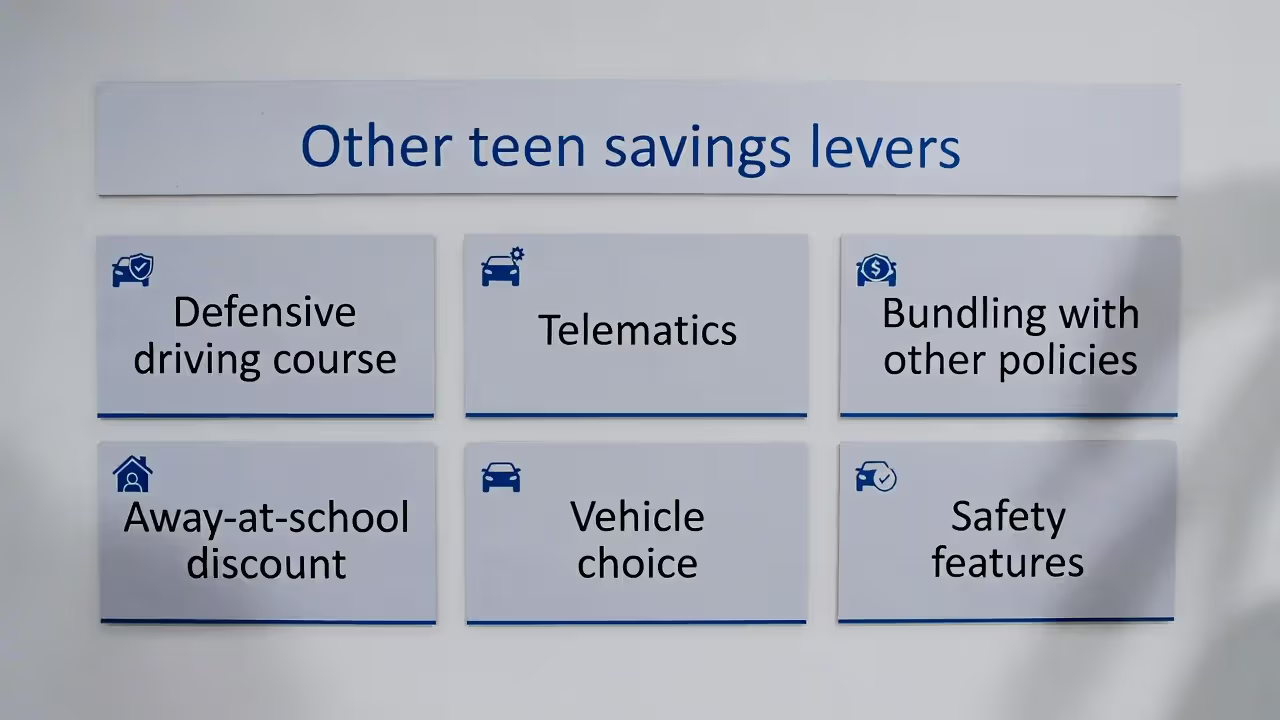

Young Driver Savings Beyond the Good Student Discount

Author: Brandon Whitaker;

Source: trialstribulations.net

Academic performance represents just one way to cut youth insurance costs. Smart families combine multiple strategies.

Defensive driving courses knock 5% to 15% off premiums at most carriers. These courses run six to eight hours, cost $30 to $75, and you can complete them online. They teach crash avoidance, hazard recognition, and weather-related driving skills. States usually require repeating the course every three years to maintain the discount, but you'll recover the course fee within a few months of insurance savings.

Telematics programs track your actual driving through a smartphone app or device plugged into your car's diagnostic port. Drive safely—no hard braking, no speeding, limited nighttime trips—and earn 10% to 30% discounts. Allstate's Drivewise, Progressive's Snapshot, and State Farm's monitoring program all work this way. The downside? Your insurer knows where you drive, when you drive, and how fast you go. Privacy-conscious families skip these despite the savings.

Bundling policies creates automatic savings. Families who already bundle home and auto insurance typically save 15% to 25% on the auto portion. When you add a student driver, they inherit the bundle discount automatically—no separate action required.

Away-at-school discounts apply when your college student attends school beyond 100 miles from home without bringing a vehicle to campus. The car stays home, the student only drives during breaks, so exposure drops dramatically. Insurers respond with 10% to 40% discounts depending on the distance. You'll need to prove enrollment and campus location. One warning: if your student decides to bring the car to campus in January, report it immediately. Getting caught with unreported vehicle location can result in claim denials.

Vehicle selection matters more than most families realize. Put your student in a 2015 Honda Accord versus a 2022 Dodge Charger, and premiums shift by 40% or more. Cars with advanced safety features—automatic emergency braking, lane departure alerts, blind spot monitoring—qualify for additional 5% to 10% discounts. Sometimes an older car with high safety ratings costs less to insure than a new car without modern safety technology.

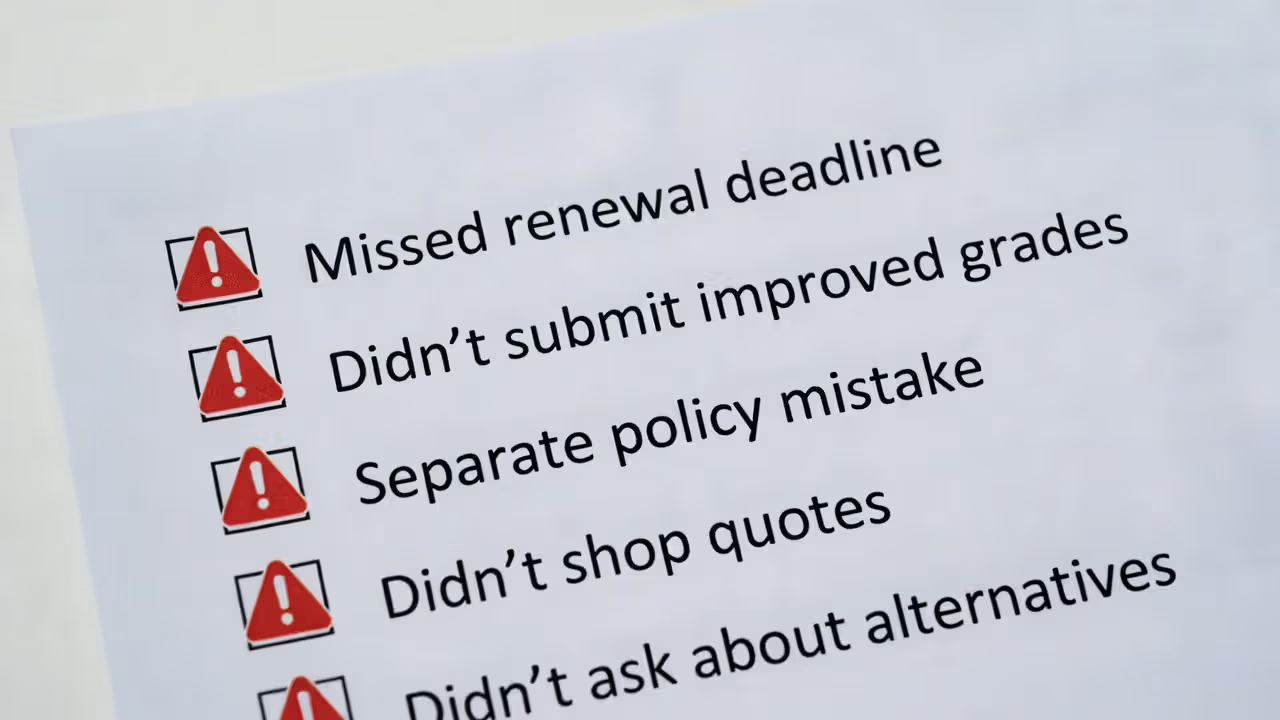

Common Eligibility Mistakes That Cost Students Money

Author: Brandon Whitaker;

Source: trialstribulations.net

Even families who understand these programs make errors that drain their bank accounts unnecessarily.

Missing renewal deadlines tops the list. Your insurance company won't call reminding you to submit transcripts. When the deadline passes, the discount disappears silently. You might not notice until you review next month's bill, and by then you've already paid the inflated premium. Reinstating the discount requires submitting current proof and waiting 30 days for processing. You've lost at least a month of savings.

Failing to report improved grades wastes money. Let's say your son's GPA jumps from 3.1 to 3.7. Liberty Mutual and Farmers both offer tiered discounts where higher GPAs unlock larger percentage reductions. If you never submit the updated transcript, you're leaving enhanced savings unclaimed. Check whether your insurer offers graduation tiers.

Putting students on separate policies often backfires financially. Some families think purchasing a standalone policy helps the student "build insurance history." True, but you sacrifice multi-car discounts, bundle discounts, and often get a weaker good student discount on the standalone policy. The $200 you save annually building independence might cost you $800 in lost household discounts.

Not shopping around before adding a student driver costs thousands over time. Good student discounts vary wildly by company. One insurer's 10% might save less than a competitor's 25% discount with a different base rate structure. When my neighbor's daughter turned 16, they requested quotes from six companies. The difference between highest and lowest quotes exceeded $1,400 annually—for the same coverage and same good student discount.

Forgetting to ask about alternative qualifications blocks some students unnecessarily. Your daughter has a 2.9 GPA—just under the 3.0 threshold. But her SAT score hit 1320 and she made honor roll last semester. Most agents won't volunteer alternatives unless you specifically ask whether test scores or honor roll status qualify instead of GPA.

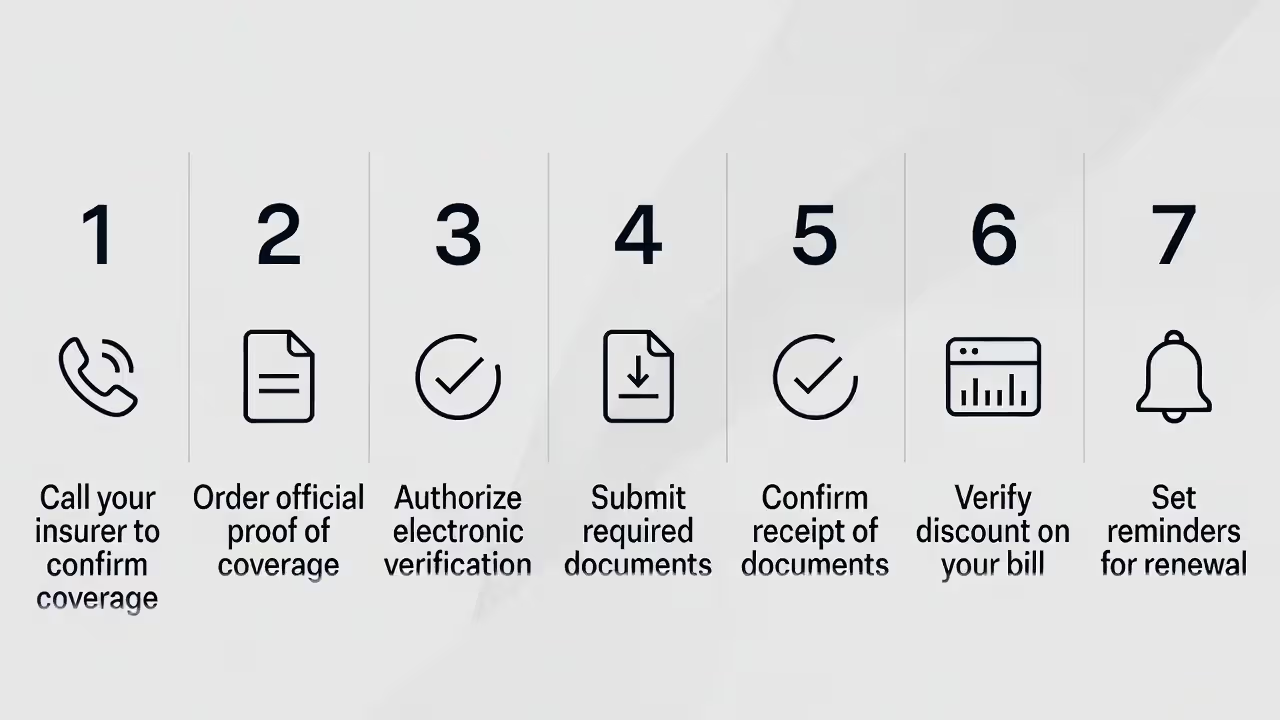

How to Apply for Student Insurance Discounts: Step-by-Step Process

Author: Brandon Whitaker;

Source: trialstribulations.net

Getting your discount requires a methodical approach, not a casual mention during a phone call.

Step 1: Call your agent or company customer service at least 30 days before your policy renews. Ask specific questions: What's your minimum GPA requirement? What age limits apply? Which documents will you accept? When's the submission deadline?

Step 2: Order official transcripts or report cards from your school's administration office. Specify you need official, sealed documents for insurance verification. Many schools charge $5 to $15 per copy. Allow 7 to 10 business days for processing, longer during May or December when schools handle high volumes.

Step 3: If using electronic verification, request the authorization code or link from your insurance company. Complete the digital authorization through the verification service, ensuring your insurer appears as the approved recipient.

Step 4: Submit documentation through whatever method your insurer prefers—postal mail, email attachment, online portal upload, or in-person delivery to your agent's office. Photograph or photocopy everything before sending it. Write down the submission date on your calendar.

Step 5: Call back within one week confirming they received and processed your documents. Ask exactly when the discount will appear on your policy and whether they need anything else.

Step 6: Check your next insurance bill or policy declarations page verifying the discount shows up correctly. Verify the dollar amount matches the promised percentage. Mistakes happen during data entry.

Step 7: Create recurring calendar reminders for future verification deadlines. Most companies want updated proof every 6 to 12 months. Set reminders two weeks ahead of deadlines to avoid last-minute scrambling.

If your insurer denies your discount despite meeting requirements, demand a written explanation citing specific policy language. Documentation glitches, timing confusion, or agent miscommunication cause many denials that can be corrected with follow-up information.

Frequently Asked Questions About Student Auto Insurance Discounts

Making Student Discounts Work for Your Family

Student insurance discounts offer one of the few reliable methods for controlling what adding a young driver does to your insurance budget. Academic performance discounts alone save most families $400 to $800 yearly, with savings continuing up to nine years if students maintain eligibility from age 16 through college graduation at 25.

Success depends on details most families overlook: knowing exactly how your specific insurer calculates GPA, meeting documentation submission deadlines, recognizing non-GPA qualification paths, and stacking multiple discounts for maximum impact. The financial difference between families who actively manage these discounts and families who don't easily exceeds $5,000 over a student's driving years.

Start by calling your current insurer to nail down exact requirements and deadlines. Then request competing quotes to confirm you're getting the best combination of base rates and available discounts. Build a simple management system—calendar alerts, a dedicated folder for insurance paperwork, regular conversations with your student about academic performance—to preserve these savings year after year.

The effort you invest securing and maintaining student insurance discounts delivers returns beyond immediate premium reductions. Students observe firsthand how responsible choices translate to financial rewards, and families redirect hundreds of dollars annually toward other educational costs, emergency savings, or long-term investment goals.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.