Car insurance paperwork with a calculator and a checklist of ways to lower premiums.

How to Lower Car Insurance: 12 Proven Ways to Cut Your Premium

Content

Most Americans overpay for car insurance by hundreds of dollars each year, not because they're bad drivers, but because they're unaware of the levers they can pull to reduce their premiums. Your rate isn't set in stone—it's the product of dozens of variables, many of which you control more than you realize.

The average US household spends roughly $1,700 annually on auto insurance, but that figure varies wildly based on choices you make about your policy structure, the discounts you claim, and how you present yourself as a risk to insurers. What follows are twelve concrete strategies that address the actual mechanics of how insurers price policies, not vague advice to "shop around."

Why Your Car Insurance Costs What It Does

Before adjusting your policy, understanding the pricing engine helps you target the right changes. Insurers calculate your premium by assessing risk across multiple dimensions: your driving history, credit score (in most states), vehicle make and model, annual mileage, ZIP code, age, coverage limits, and deductible choices.

Each factor carries different weight. A single at-fault accident can raise your rate 20-40% for three to five years. Your credit score might account for up to 30% of your premium in states where it's allowed. The car you drive matters enormously—a Honda Accord costs far less to insure than a Dodge Charger because of theft rates, repair costs, and accident statistics.

Location affects rates more than most people assume. Moving from a rural area to a city center can double your premium due to higher theft, vandalism, and accident frequency. Even moving a few miles within the same city can shift your rate if you cross into a different rating territory.

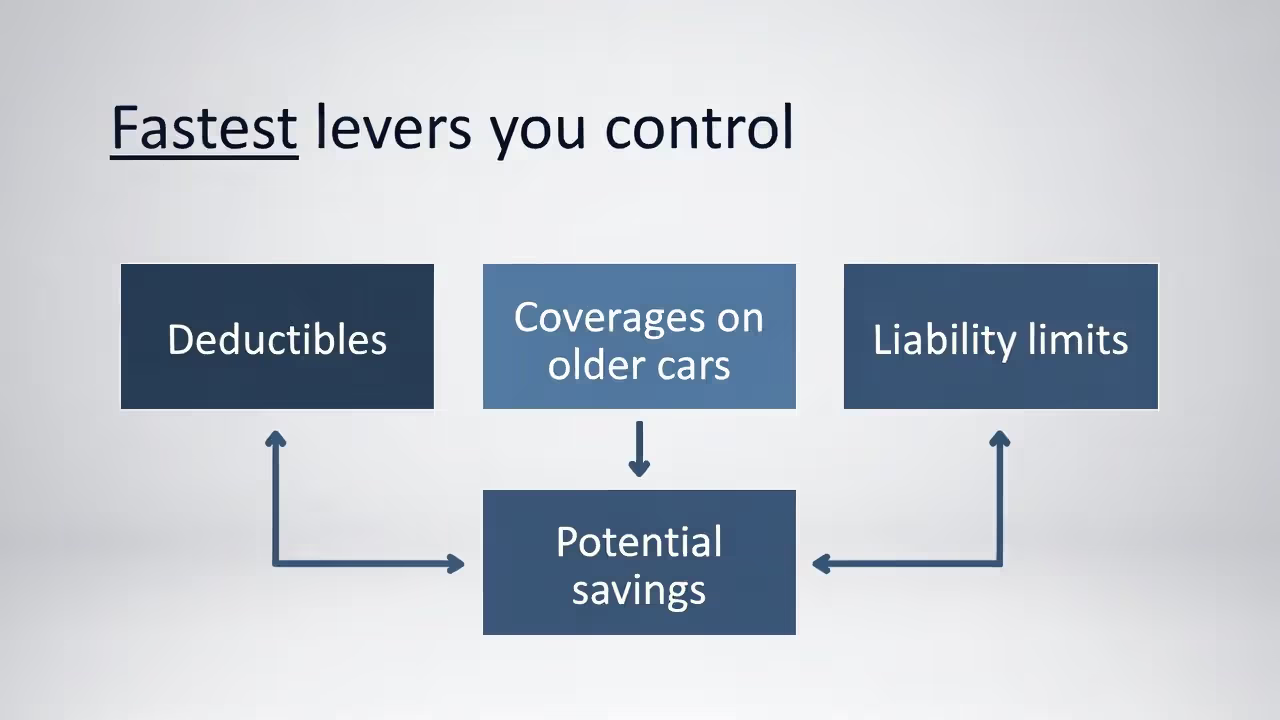

The coverage you select and your deductible create the most immediate opportunity for adjustment because you control them completely, independent of your driving record or credit score.

Author: Tara Livingston;

Source: trialstribulations.net

Adjust Your Policy Structure for Immediate Savings

Raising Your Deductible: When It Makes Financial Sense

Your deductible—the amount you pay out-of-pocket before insurance kicks in—inversely affects your premium. Higher deductible equals lower premium, but the trade-off requires math, not guesswork.

| Deductible Amount | Typical Annual Savings vs. $250 Deductible | Out-of-Pocket Risk Increase | Break-Even Point (Years) |

| $250 | Baseline ($0) | Baseline | N/A |

| $500 | $100–$150 | +$250 | 1.7–2.5 |

| $1,000 | $200–$350 | +$750 | 2.1–3.8 |

| $2,000 | $300–$500 | +$1,750 | 3.5–5.8 |

The decision hinges on your emergency fund and claim frequency. If you have $2,000 in accessible savings and haven't filed a claim in five years, jumping to a $1,000 deductible makes sense. You'll pocket $200-$350 annually, and over three years without a claim, you've saved enough to cover the higher deductible if you do need to file.

Bad fit: You live paycheck-to-paycheck and couldn't cover a $1,000 repair without hardship. Stick with $500 or even $250—the premium difference isn't worth the financial stress of a surprise expense.

One overlooked detail: comprehensive and collision deductibles can be set independently. If you're more concerned about theft or hail damage (comprehensive) than accidents (collision), set a lower comprehensive deductible and higher collision deductible, or vice versa based on your risk profile.

Dropping Unnecessary Coverage on Older Vehicles

Collision and comprehensive coverage become poor value propositions once your car's actual cash value drops below a certain threshold. The rule of thumb: if your car is worth less than ten times your annual premium for those coverages, consider dropping them.

Example: Your 2012 sedan is worth $3,500. Collision and comprehensive together cost $600 per year with a $500 deductible. Maximum payout after a total loss: $3,000 ($3,500 minus deductible). Over five years, you'd pay $3,000 in premiums for coverage on an asset declining in value. The math doesn't work.

Keep liability coverage regardless of your car's age—that protects your assets from lawsuits, not your vehicle's value.

Right-Sizing Your Liability Limits

While raising liability limits costs less than most people expect, carrying more than you need wastes money. The standard advice to carry 100/300/100 ($100,000 per person, $300,000 per accident, $100,000 property damage) makes sense for people with assets to protect.

If you're 24, rent an apartment, and have $8,000 in total assets, state minimum liability might suffice. If you own a home with $200,000 in equity, 100/300/100 is inadequate—you need 250/500/100 or an umbrella policy.

Increasing from 50/100/50 to 100/300/100 typically adds $100-$200 annually. Dropping from 250/500/100 to 100/300/100 saves about the same. Assess your actual asset exposure and adjust accordingly.

Stack Every Discount Your Insurer Offers

Author: Tara Livingston;

Source: trialstribulations.net

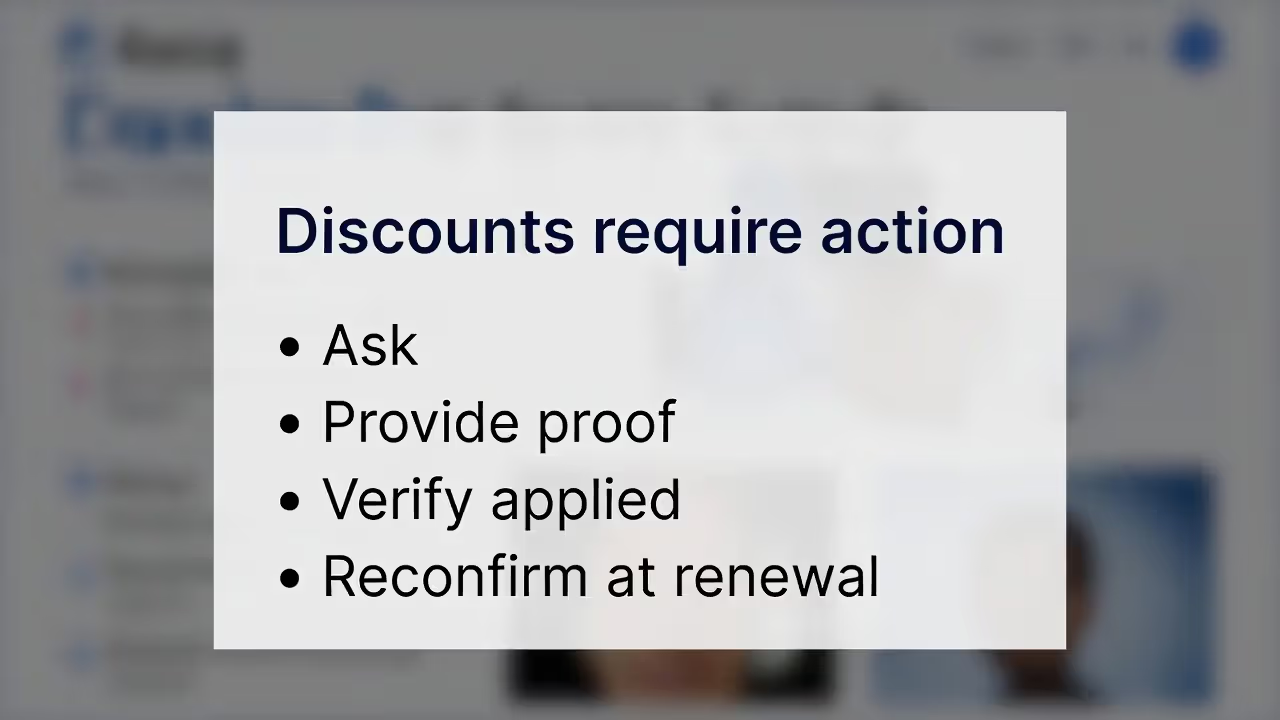

Discounts aren't automatically applied. You must ask, provide documentation, and sometimes push back when eligibility isn't recognized. Insurers offer 20+ discount categories, and most policyholders claim fewer than three.

| Discount Type | Typical Savings | Eligibility Requirements |

| Multi-policy (bundling) | 15-25% | Home/renters + auto with same insurer |

| Multi-vehicle | 10-20% | Two or more vehicles on same policy |

| Good driver | 10-20% | No at-fault accidents/violations 3-5 years |

| Low mileage | 5-15% | Under 7,500-10,000 miles/year (varies by insurer) |

| Paid-in-full | 5-10% | Annual payment vs. monthly installments |

| Paperless/auto-pay | 2-5% | Electronic documents and automatic payments |

| Good student | 8-15% | Full-time student under 25 with B average or better |

| Defensive driving course | 5-10% | State-approved course completion (check frequency requirements) |

| Safety features | 5-15% | Anti-lock brakes, airbags, anti-theft systems |

| Affinity/professional | 5-10% | Alumni associations, professional organizations, employers |

| Telematics/usage-based | 10-30% | Monitored safe driving via app or device |

| Loyalty | 5-10% | Years with same insurer (though shopping often saves more) |

The bundling discount alone can cut your auto premium by 20%. If you're renting and paying $18 monthly ($216/year) for renters insurance, bundling saves you $300+ on auto insurance—a net gain of $84 plus simplified billing.

Good student discounts apply until age 25 in most cases. If your college-age child maintains a 3.0 GPA, submit transcripts each semester. One parent saved $420 annually by remembering to send updated grades twice a year.

Low mileage discounts require documentation. If you work from home and drive 6,000 miles annually instead of 12,000, tell your insurer and provide odometer photos. The discount applies retroactively once verified.

Professional and affinity discounts hide in plain sight. Check if your employer, university alumni association, or professional organization (engineers, teachers, military) has negotiated group rates. These partnerships can save 5-10% before other discounts apply.

Car insurance premiums aren’t random — they’re the result of specific rating factors that drivers can actively influence. Those who understand how deductibles, discounts, credit, and driving behavior interact within pricing models can consistently reduce their costs without sacrificing meaningful protection.

— Rachel Donovan, Auto Insurance Pricing Analyst

How Your Driving Behavior Directly Impacts Your Rate

Telematics Programs and Usage-Based Insurance

Telematics programs (Progressive Snapshot, State Farm Drive Safe & Save, Allstate Drivewise) monitor your actual driving via smartphone app or plug-in device. They track hard braking, rapid acceleration, speed, mileage, and time of day you drive.

Initial discounts of 5-10% apply just for enrolling. If you're genuinely a safe driver—minimal hard braking, no late-night driving, staying within speed limits—you can earn 20-30% off your premium after the monitoring period.

The catch: poor driving habits can reduce or eliminate the discount, though most insurers promise rates won't increase beyond what you'd pay without the program. If you regularly drive aggressively or commute at 2 AM, skip telematics.

Best candidates: people with short commutes, daytime schedules, and smooth driving habits. Worst candidates: urban drivers navigating stop-and-go traffic (triggers hard braking events) or shift workers driving late nights.

Maintaining a Clean Driving Record

A single speeding ticket raises your premium 20-30% on average, costing $300-$500 extra per year for three years—$900-$1,500 total. An at-fault accident costs even more, with increases of 30-50% lasting three to five years.

The financial case for defensive driving: if a ticket would cost you $1,200 over three years, paying $400 for a lawyer to negotiate it down to a non-moving violation saves $800 net. Traffic school to keep a ticket off your record costs $50-$150 and saves multiples of that in premium increases.

After a ticket or accident, ask your insurer about accident forgiveness programs. Some forgive the first incident if you've been claim-free for a certain period, preventing the rate increase entirely.

Reducing Annual Mileage

Every 5,000 miles you cut from your annual driving reduces your premium 5-10%. Insurers price on exposure—fewer miles means fewer opportunities for accidents.

Practical ways to cut mileage: carpool three days per week (saves 6,000+ miles annually), use public transit for commuting, combine errands into single trips, or bike for local errands. If you dropped from 15,000 to 9,000 miles yearly, you'd save $100-$200 on insurance while also cutting fuel costs by $400+.

Report mileage changes to your insurer. They won't proactively lower your rate if you start working from home—you must notify them and request a policy adjustment.

Shopping Strategies That Actually Lower Your Premium

Author: Tara Livingston;

Source: trialstribulations.net

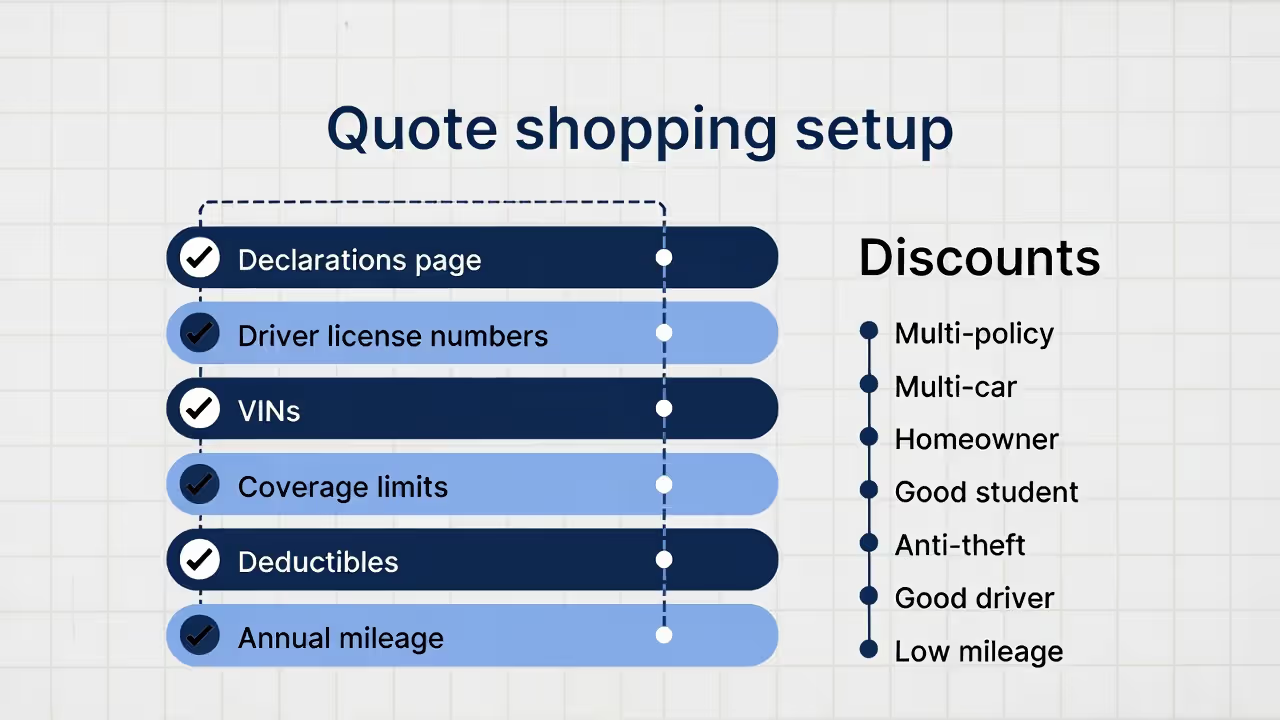

Comparing quotes every 12-18 months is the single highest-return activity for reducing premiums. Rates shift constantly as insurers adjust their risk models, enter or exit markets, and compete for specific customer profiles.

You might be a preferred customer for one insurer (married, homeowner, excellent credit, 15+ years driving experience) and a higher-risk profile for another. The same coverage can vary by $800-$1,500 between insurers for identical drivers.

Get quotes from at least five companies: three national carriers (State Farm, Geico, Progressive), one regional insurer strong in your state, and one independent agent representing multiple companies. Independent agents access carriers that don't sell direct and can compare options in one conversation.

Have this information ready: current policy declarations page, driver's license numbers for all household drivers, VIN numbers for all vehicles, current coverage limits and deductibles, annual mileage estimates, and a list of potential discounts you qualify for.

Timing matters. Shop 30-45 days before your renewal date. This gives you time to compare without a coverage gap and leverage competing quotes when negotiating with your current insurer.

Negotiation works more often than people expect. Call your current insurer with a lower competing quote and ask, "I've been with you for six years without a claim. Can you match this rate or get close?" Retention departments have authority to apply additional discounts or adjust pricing to keep long-term customers.

One caution: don't let your current policy lapse before new coverage starts. A gap of even one day can classify you as a higher-risk driver and increase rates 20-40% across all insurers for the next three years.

Credit Score, Location, and Other Hidden Rate Factors You Can Control

Author: Tara Livingston;

Source: trialstribulations.net

In 47 states, insurers use credit-based insurance scores to price policies. The correlation between credit behavior and claim frequency is statistically significant, so improving your credit score from "fair" to "good" can cut your premium 20-30%.

Concrete steps: pay down credit card balances below 30% utilization, set up automatic payments to avoid missed due dates, dispute errors on your credit report, and avoid opening multiple new accounts in short periods. A 100-point credit score improvement (e.g., 620 to 720) can save $400-$700 annually on car insurance.

Your garaging address—where your car is parked overnight—significantly impacts rates. If you're moving, get insurance quotes for your new address before signing a lease. A ZIP code change might raise or lower your rate 15-30% based on local theft, accident, and claim patterns.

College students: if your school is 100+ miles from home and you don't take your car to campus, you may qualify for a distant student discount. Your parents' policy covers you as a listed driver, but the car's garaging address stays at their lower-rate location.

Vehicle choice for your next purchase matters enormously. Before buying, get insurance quotes on your top three vehicle choices. A $3,000 price difference between two cars might come with a $600 annual insurance difference, making the cheaper car $9,000 more expensive over five years of ownership.

Vehicles with high theft rates (certain Honda and Hyundai models), powerful engines (sports cars), or expensive repair costs (luxury brands, electric vehicles with specialized parts) cost significantly more to insure. A Toyota Camry costs 30-40% less to insure than a similar-year BMW 3 Series.

Common Mistakes That Keep Your Premium Higher Than Necessary

Loyalty costs money in insurance. Staying with the same insurer for 5+ years without shopping often means you're overpaying by $300-$600 annually. Insurers raise rates gradually on existing customers while offering aggressive pricing to new customers. The "loyalty penalty" is real and substantial.

Failing to update your policy when circumstances change leaves money on the table. You got married, moved to a safer neighborhood, started working from home, paid off your car, or your teenager moved out—all rate-reducing events that require you to contact your insurer.

Letting coverage lapse, even for non-payment, marks you as high-risk for three years. A single missed payment that results in cancellation can increase your rate 30-50% across all insurers. Set up automatic payments or calendar reminders to avoid this expensive mistake.

Filing small claims costs more than paying out-of-pocket. If your repair costs $800 and your deductible is $500, you'll pay $500 plus suffer a 20-30% rate increase for three years. That $300 insurance payout costs you $900+ in higher premiums. The break-even point: file claims only when the payout exceeds 3-4 times your deductible.

Assuming all discounts apply automatically means you're missing savings. Insurers don't audit your life for new discount opportunities—you must ask. Completed a defensive driving course? Notify your insurer. Installed a dashcam? Ask if that qualifies for a discount. Joined a professional organization? Check for affinity pricing.

Your Car Insurance Savings Checklist

Author: Tara Livingston;

Source: trialstribulations.net

Use this checklist to systematically reduce your premium:

Policy Structure -Raise deductible to $1,000 if you have emergency savings - Drop collision/comprehensive on vehicles worth less than $4,000 - Review liability limits against your actual assets - Set different deductibles for comprehensive vs. collision based on your risk

Discounts - Bundle home/renters insurance with auto policy - Add all household vehicles to one policy - Submit proof of good student status (if applicable) - Enroll in low mileage program with odometer verification - Complete defensive driving course - Set up paperless billing and auto-pay - Check for affinity discounts (employer, alumni, professional groups) - Consider telematics program if you're a safe driver

Driving Behavior - Maintain clean driving record (fight tickets, use traffic school) - Reduce annual mileage through carpooling or transit - Drive during lower-risk hours when possible - Avoid small claims; pay minor repairs out-of-pocket

Shopping & Optimization - Get quotes from 5+ insurers every 12-18 months - Negotiate with current insurer using competing quotes - Review and update policy annually for life changes - Improve credit score to "good" or better - Research insurance costs before buying your next vehicle

Hidden Factors - Check if garaging address change could lower rate - Apply for distant student discount if child attends college without car - Install anti-theft devices and notify insurer - Pay annually instead of monthly to avoid installment fees

Frequently Asked Questions About Lowering Car Insurance Costs

Reducing your car insurance premium isn't about finding one magic trick—it's about systematically addressing the dozen factors that determine your rate. The strategies outlined here can collectively cut your premium 20-40%, saving the average household $400-$700 annually without reducing coverage quality.

Start with the quick wins: raise your deductible if you have savings, claim every discount you're eligible for, and get competing quotes. Then address longer-term factors like improving your credit score and adjusting your driving habits. The combination creates compound savings that grow year after year.

Your insurance company won't proactively lower your rate. You have to ask, document, compare, and sometimes switch. Treat your annual policy review like any other financial optimization—because that's exactly what it is.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.