Driver holding a course certificate beside an insurance page showing a defensive driving discount and lower premium.

How to Get a Defensive Driving Discount on Your Car Insurance

Content

Completing a defensive driving course can slice 5% to 20% off your car insurance premium, but only if you navigate the requirements correctly. Many drivers leave money on the table because they choose the wrong course, miss documentation deadlines, or misunderstand their insurer's specific rules.

The discount works differently depending on where you live, who insures you, and even your age. Some states mandate that insurers offer it; others leave it optional. Some companies apply the savings immediately; others make you wait until renewal. Understanding these variations before you enroll saves time and ensures you actually receive the reduction.

What Qualifies You for a Defensive Driving Discount

Not everyone who completes a defensive driving course automatically qualifies. Insurance companies set specific criteria around age, license status, and driving history. Meeting course eligibility requirements means checking both state regulations and your insurer's internal policies.

Age and license requirements by state

Most states require drivers to be at least 55 years old to qualify for the insurance discount, though some set the threshold at 50. New York allows drivers as young as 18 to receive premium reductions through its Point and Insurance Reduction Program (PIRP). Florida extends eligibility to all licensed drivers regardless of age, while California limits it to drivers 55 and older.

Your license must be active and in good standing. Drivers with suspended or revoked licenses won't qualify, even if they complete an approved course. Some insurers also exclude drivers with recent major violations—DUIs, reckless driving, or at-fault accidents within the past three years often disqualify you.

Commercial driver's license holders face additional restrictions. Many insurance companies won't apply defensive driving discounts to policies covering vehicles used for business purposes. If you drive for rideshare services or make deliveries, confirm whether your insurer distinguishes between personal and commercial use.

First-time vs. renewal course takers

Author: Calvin Prescott;

Source: trialstribulations.net

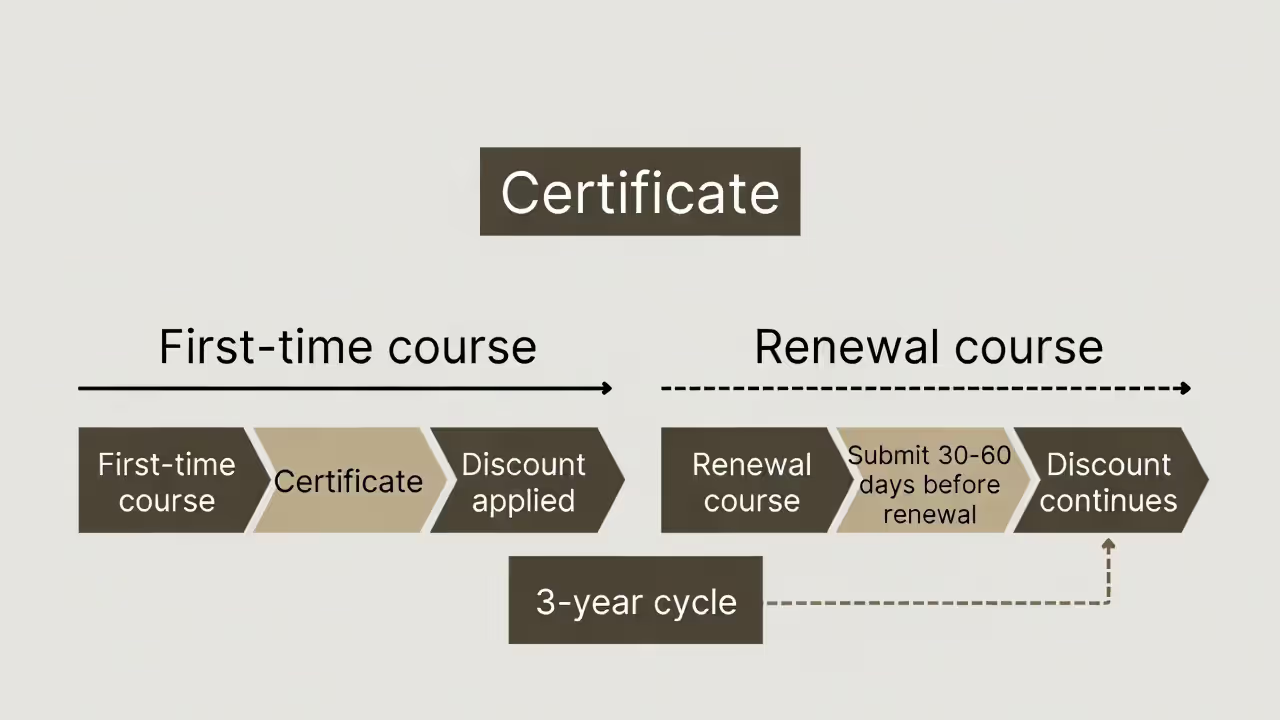

Taking the course for the first time usually triggers a straightforward process: complete the hours, submit your certificate, receive your discount. Renewal course takers face tighter timelines. Most states require recertification every three years, but your insurer might need the updated certificate 30 to 60 days before your policy renews to avoid a lapse in the discount.

First-time takers in states with point reduction systems gain a dual benefit—fewer points on their license and lower premiums. Renewal takers only maintain the insurance discount; they don't receive additional point reductions unless they've accumulated new violations.

Some insurers reward first-time completers with slightly higher initial discounts, then reduce the percentage on renewals. USAA, for example, offers 10% to new course graduates but drops it to 8% after the first renewal period in certain states.

How Much You'll Actually Save on Insurance Premiums

The savings percentage matters less than the dollar amount. A 15% discount on a $1,200 annual premium saves you $180. The same percentage on a $2,400 premium doubles your savings to $360. Younger drivers with higher base rates often see larger absolute savings, even though older drivers typically receive higher percentage discounts.

Most insurers apply the reduction to specific coverage types rather than your entire premium. Liability and collision coverage usually qualify, but comprehensive coverage often doesn't. If you carry minimum liability limits, your discount applies to a smaller base amount than someone with 250/500/100 limits.

State-mandated minimums also affect your savings potential. A driver in Michigan paying $3,000 annually for no-fault coverage will save more in absolute dollars than a driver in Maine paying $900 for the same discount percentage.

Your driving record influences the final number. Drivers with clean records sometimes see smaller percentage discounts because insurers already classify them as low-risk. One speeding ticket can bump you into a higher risk tier, where the defensive driving discount offsets part of the surcharge rather than reducing an already-low premium.

Multi-car households should calculate per-vehicle savings. Some insurers apply the discount only to the vehicle the certified driver primarily operates. Others extend it across all vehicles on the policy if the primary driver completes the course. A family with three cars might save $150 per vehicle annually, totaling $450—enough to justify the course fee and time investment.

Geographic location creates significant variation. Urban drivers in high-premium areas like Detroit, New Orleans, or Miami gain more dollar-value savings than rural drivers in low-cost states. A 10% discount in Louisiana might save you $250, while the same percentage in Vermont saves $80.

Which Insurance Companies Accept Defensive Driving Certificates

Author: Calvin Prescott;

Source: trialstribulations.net

Major carriers handle defensive driving discounts differently, and state regulations add another layer of complexity. What works in Texas might not apply in Pennsylvania.

| Insurance Company | Average Discount % | Course Requirements | Discount Duration | States Available |

| State Farm | 5-15% | State-approved, 6-8 hours | 3 years | 45+ states |

| Geico | 5-10% | Approved providers only | 3 years | 40+ states |

| Progressive | 5-10% | Online or in-person | 3 years | 38+ states |

| Allstate | 5-15% | Varies by state | 3 years | 42+ states |

| USAA | 8-10% | Military-friendly options | 3 years | All 50 states |

| Liberty Mutual | 5-10% | Pre-approval recommended | 3 years | 35+ states |

| Farmers | 5-15% | State-specific requirements | 3 years | 40+ states |

| Nationwide | 5-10% | Must notify before enrollment | 3 years | 38+ states |

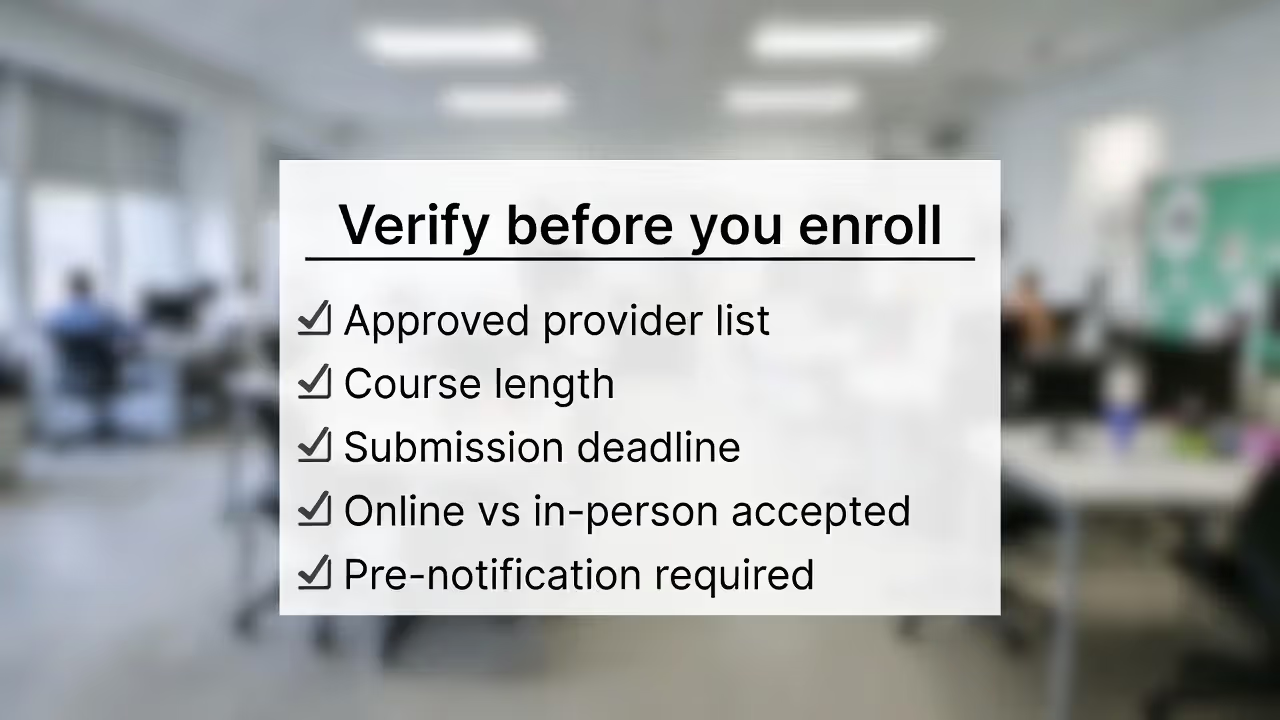

State Farm requires notification before you enroll in some states but not others. Geico maintains a pre-approved provider list and won't accept certificates from unlisted schools. Progressive accepts most state-approved courses but requires you to submit the certificate within 30 days of completion.

Regional insurers sometimes offer better discounts than national carriers. Erie Insurance provides up to 15% in Pennsylvania, while California-based Mercury Insurance caps it at 5%. Checking with local or regional companies can uncover higher savings rates.

Some insurers won't accept online courses even in states where they're legal. Travelers Insurance prefers in-person instruction in certain markets, while The Hartford readily accepts online certificates. Always confirm your insurer's stance on course format before enrolling.

Choosing a Course Your Insurer Will Approve

Picking the wrong course wastes your time and money. Insurance companies reject certificates from unapproved providers, leaving you without the discount despite completing the hours.

Online vs. in-person certification differences

Author: Calvin Prescott;

Source: trialstribulations.net

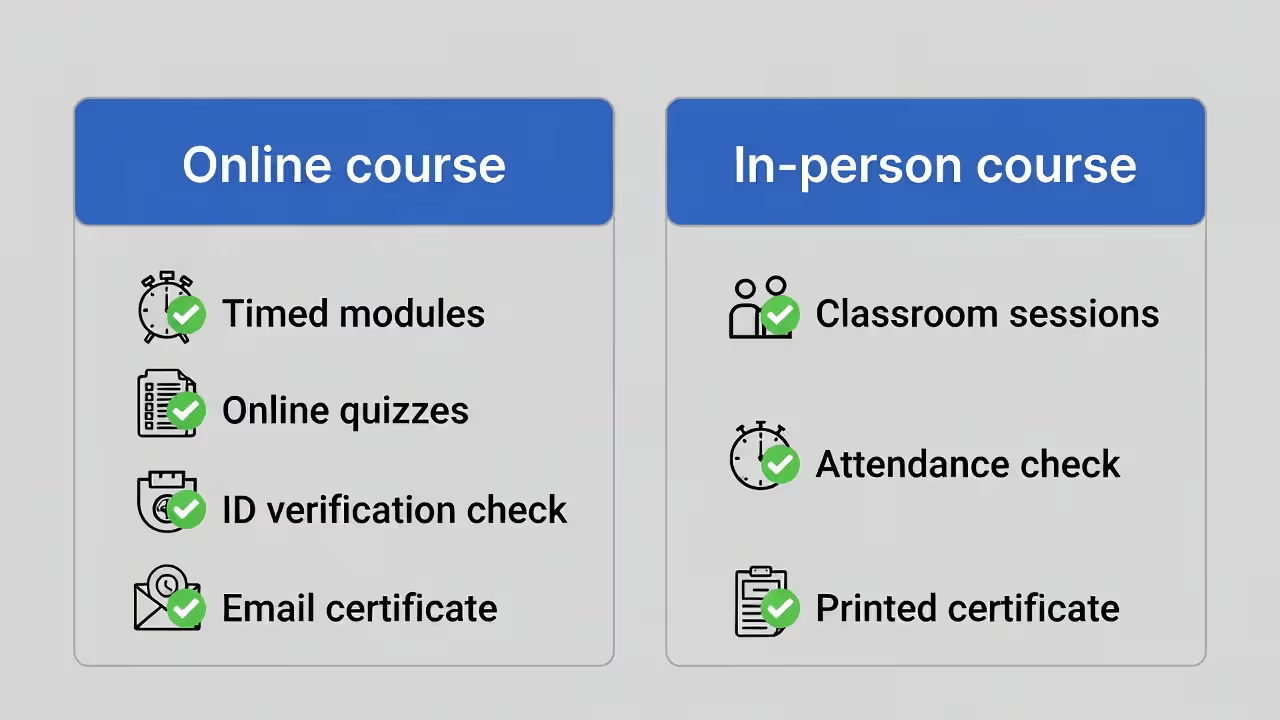

Online courses offer flexibility—complete modules during lunch breaks or late evenings—but they come with verification requirements that in-person classes don't face. Many online platforms use timed modules, periodic quizzes, and identity checks to prevent someone else from completing the course for you.

In-person classes provide immediate certificate issuance and face-to-face confirmation of attendance. You'll spend a full day in a classroom, but you walk out with documentation in hand. Online courses typically email certificates within 24 to 72 hours, creating a documentation gap if you need proof quickly.

State approval matters more than the delivery method. Texas accepts online courses from approved providers, while Oregon requires in-person attendance for drivers seeking insurance discounts. Check your state's Department of Motor Vehicles or Department of Insurance website for the official list of approved providers.

Cost varies significantly. In-person courses run $50 to $100 including materials. Online options range from $15 to $60, with some providers offering money-back guarantees if your insurer rejects the certificate. The cheapest option isn't always the best—some low-cost providers skimp on customer service, leaving you stranded if problems arise.

A defensive driving discount isn’t automatic — it’s earned and maintained through careful compliance with state rules and insurer requirements. Drivers who verify eligibility, choose approved courses, and track renewal deadlines are the ones who consistently turn training into real premium savings.

— Mark Ellison, Auto Insurance Risk Advisor

Accreditation red flags to avoid

Legitimate courses display their state approval number prominently on their website and marketing materials. If you can't find this number within 30 seconds of landing on the homepage, look elsewhere.

Providers promising "instant certificates" or "no exam required" often aren't state-approved. Most states mandate a final exam with a minimum passing score, typically 70% to 80%. Courses that skip this requirement won't satisfy certification rules.

Check the provider's complaint history with your state's Better Business Bureau or consumer protection office. Multiple complaints about rejected certificates, missing documentation, or unresponsive customer service indicate problems.

Beware of courses significantly shorter than your state's minimum hour requirement. If your state mandates eight hours of instruction and a provider advertises a "four-hour defensive driving course," they're either misrepresenting the content or offering a point-reduction course that won't qualify for insurance discounts.

Read the fine print about certificate delivery. Some providers charge extra fees for expedited processing or physical certificates. Others include these in the base price. Factor in the total cost when comparing options.

How Long Your Discount Lasts and Renewal Requirements

Author: Calvin Prescott;

Source: trialstribulations.net

Defensive driving discounts aren't permanent. Most expire after three years, requiring recertification to maintain the savings. Missing the renewal deadline means your premium jumps back to the pre-discount rate at your next policy renewal.

Mark your calendar for 90 days before your discount expires. This buffer gives you time to complete the renewal course, receive your certificate, and submit it to your insurer before the deadline. Waiting until the last minute risks processing delays that could cost you the discount.

Some states allow shorter renewal periods. California permits a new course every 18 months, letting you maintain continuous coverage with more frequent recertification. New York's three-year cycle is standard, but you can't take the course early—completing it more than three years before your current certificate expires won't extend your discount.

Renewal benefits don't stack. Taking the course twice in one year won't double your discount or extend the duration beyond the standard three years. You're paying for redundant certification without additional savings.

Switching insurance companies resets the clock in some cases. If you complete a course with Insurer A, then switch to Insurer B two years later, Insurer B might honor your existing certificate for the remaining year or require a new course immediately. Policies vary—ask before you switch.

Auto-renewal reminders from course providers can help, but don't rely on them exclusively. Companies go out of business, change contact systems, or experience technical glitches. Set your own reminders independent of the provider's system.

Common Mistakes That Disqualify Your Discount

Author: Calvin Prescott;

Source: trialstribulations.net

Small errors in documentation or timing can invalidate your entire effort. Insurance companies reject discount applications for surprisingly minor reasons.

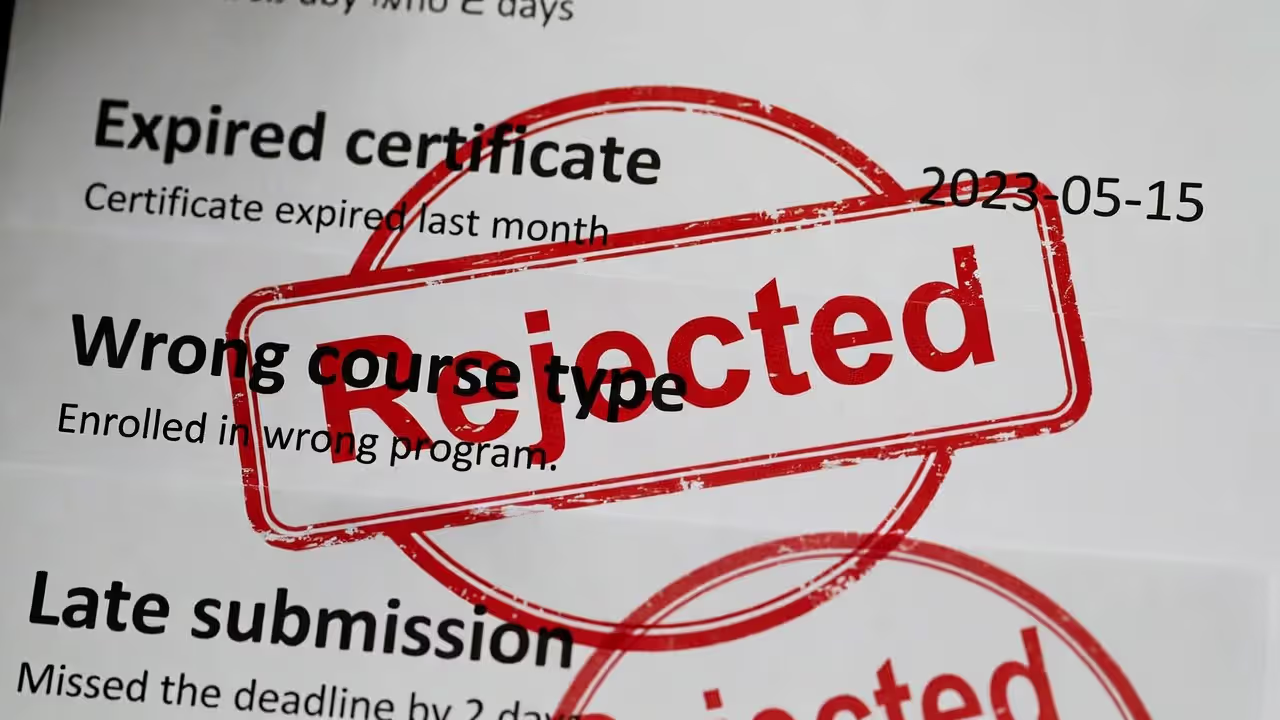

Submitting an expired certificate is the most common mistake. If your course completion date falls outside your insurer's acceptable window—usually within the past three years—they'll deny the discount. Double-check the completion date on your certificate before submitting.

Wrong course type causes frequent rejections. Point-reduction courses, traffic school, and defensive driving courses serve different purposes. Taking a court-ordered traffic school class to dismiss a ticket won't qualify you for an insurance discount, even if the content seems similar.

Missing your insurer's notification deadline creates problems. Some companies require advance notice before you enroll; others want the certificate within 30 days of completion. Submitting your certificate four months after finishing the course might disqualify you, even with a valid certificate.

Incomplete certificates get rejected. Your certificate must include your full legal name exactly as it appears on your driver's license, the course completion date, the provider's approval number, and often an instructor signature or digital verification code. Missing any of these elements gives your insurer grounds for denial.

Assuming your spouse's certificate covers you is a mistake. Each driver needs their own certification. If both you and your spouse want the discount, both must complete separate courses, even if you're on the same policy.

Forgetting to notify your insurer after course completion means you won't receive the discount automatically. Unlike some discounts that insurers apply proactively, defensive driving reductions require you to initiate the request and provide documentation.

FAQ: Defensive Driving Insurance Discounts

Defensive driving discounts reward proactive drivers who invest time in improving their skills. The savings compound over years—$200 annually becomes $600 over the typical three-year discount period, easily justifying the $50 course fee and six to eight hours of instruction.

Start by contacting your insurance agent to confirm your eligibility and identify approved course providers. Don't enroll until you've verified that your insurer will accept the specific course and format you're considering. Set reminders for certificate submission deadlines and renewal dates to avoid losing your discount through administrative oversight.

The discount works best for drivers who already maintain good records and want to maximize their savings. If you're facing surcharges from recent violations, the defensive driving discount helps offset those increases but won't eliminate them entirely. Combine it with other available discounts—bundling, pay-in-full, paperless billing—to drive your premium as low as possible.

Content on trialstribulations.net is provided for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional insurance, financial, legal, or risk-management advice, nor as a substitute for consultation with licensed insurance agents, brokers, or other qualified professionals.

The information provided on this website is for general informational purposes only and may include content related to auto insurance policies, coverage options, premium comparisons, cost-saving strategies, state-specific insurance requirements, and insurance provider reviews. Use of this website does not create a professional, advisory, or client relationship between trialstribulations.net and the user.

While we strive to keep information accurate and up to date, insurance laws, regulations, rates, and policy terms vary by state and may change without notice. Trialstribulations.net is not responsible for any errors or omissions, or for actions taken in reliance on the information contained on this website. Users are encouraged to verify policy details directly with insurance providers and consult licensed professionals before making coverage decisions.